The discrepancy is most apparent in the United States but also in the rest of the global markets, Perpetual head of investment research Matt Sherwood said.

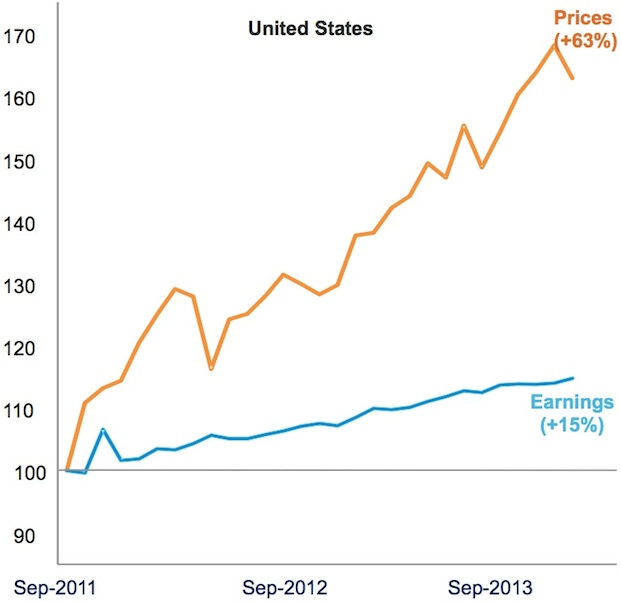

“Since September 2011 the US market has risen 63 per cent, but earnings has risen only 15 per cent,” Mr Sherwood said.

“We are not only seeing this in the United States, where the performance difference is 48 per cent, but also in the rest of the global economy, where markets have risen 43 per cent but earnings are down 4 per cent,” he said.

“Normally, you get that type of outperformance at the start of an economic recovery because the markets run ahead of earnings and the economy.

“But we are not at the first year of recovery. We are actually five years into it.”

Speaking at an industry lunch on Tuesday, Mr Sherwood said that “while things have stabilised and are looking much better at the moment”, the improvements in the global economy are of a cyclical nature and that “all of the structural issues that were amplified during the GFC and the European debt crisis still remain unresolved”.

“Most of these are about the state of global balance sheets, particularly in Europe and also in various parts of Asia,” he said.

“I tend to think the US balance sheet repair is pretty much well advanced, and that’s why the US economy is certainly looking like it has a better outlook than Australia.”

Interestingly, advanced economies outperformed emerging markets in every single asset class last year, Mr Sherwood said.

“That is pretty rare because, of course, it is the emerging markets that are seen as the biggest beneficiary to improvements in the global economy,” he said.

“The big weakness in the market rise is that is wasn’t backed by earnings.

“Earnings growth outside the United States and Japan particularly remains pretty much elusive.”

The chart below shows the significant gap between earnings growth and share price growth since September 2011.

Source: UBS Australia Limited

Perpetual’s economic outlook for 2014 is the same as the International Monetary Fund’s, which gives reason for Perpetual to believe earnings growth should grow by six per cent globally.

“But if the global economy can grow at 3.4 per cent – which is their central outlook – that does provide a very good backdrop for global earnings, and earnings have been the missing variable to date in the global recovery.”