By Shaun Parkin, Head of SPDR ETFs, State Street Global Advisors Australia

Property has been a cornerstone investment for many Australians. Over recent years, low interest rates have made property even more attractive because of potential income and capital gains, and pushed valuations in Sydney and Melbourne to skyrocket. Last year, the average annual capital gain for Australian capital cities was 10.9%; the highest growth rate for a calendar year since 2009.[1]

However, as property valuations rise, rental yields are falling, and may continue to remain weak.[2] In addition, rising mortgage rates could weaken demand. All of this is prompting some investors to reconsider their focus on the local market.

We believe the case for real estate investing remains strong:

- Real estate plays several meaningful roles in an Australian investor’s portfolio — as a source of potential income, capital appreciation and diversification to a domestic-focused portfolio.

- In a world that’s starting to reflate, real estate acts as an inflation hedge in your portfolio.

- Emerging macro trends, particularly in the United States, have potential to bring medium to long term benefits to the sector.

The key is to be selective and cost-efficient when seeking real estate exposures and to look beyond Australia for opportunities.

Why Go Global and Why Now?

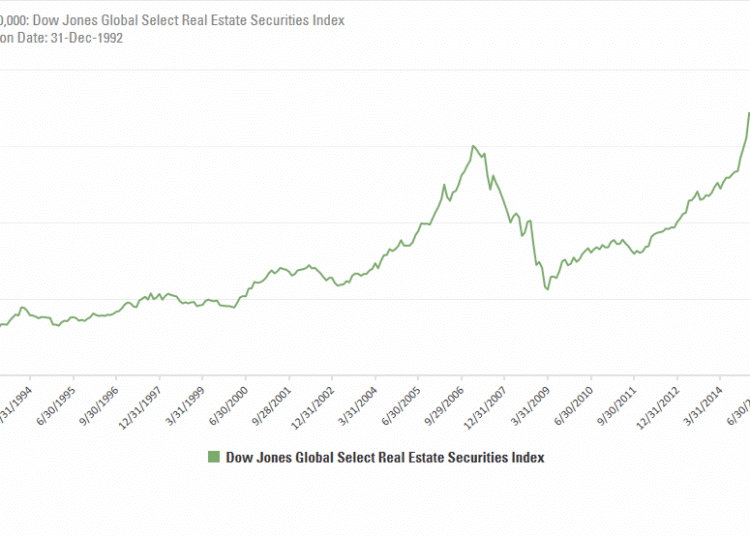

Global real estate recorded a 4.21% return last year, as illustrated by the Dow Jones Global Select Real Estate Securities Index.

Figure 1. Performance chart

| ANNUALISED | ||||||||

| AS OF | 1 MONTH | 3 MONTH | YTD | 1 YEAR | 3 YEAR | 5 YEAR | SINCE INCEPTION 01-NOV-2013 | |

| MONTH END | ||||||||

| Index | 31-Jan-2017 | -4.60% | 1.81% | -4.60% | 0.76% | 12.35% | N/A | 12.81% |

Source: SSGA, as at 31 Jan 2017

Performance quoted represents past performance, which is not a reliable factor of future results. The index returns are unmanaged and do not reflect the deduction of any fees or expenses. The index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

Figure 2 shows the growth of $10,000 in the index since the index’s inception in 1992. Return peaked in mid-2016 and has since come down slightly.

Source: SSGA, as of 31 January 2017

Performance quoted represents past performance, which is not a reliable factor of future results. The index returns are unmanaged and do not reflect the deduction of any fees or expenses. The index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

The US rate hike just before the end of 2016 and prospects for more this year signal the potential emergence of a reflationary environment in the world’s largest economy. While higher mortgage rates could dampen housing demand, property values and rents have tended to increase during inflationary periods, making property investments an inflation hedge.

In addition, a pro-business Trump administration with lower taxes and massive infrastructure spending on the back of a strengthening US economy could produce trickle down benefits for the residential and commercial rental markets. Think of greater consumer spending power from the tax cuts, which could translate to more Americans heading to the malls and more income for retail landlords.

Meanwhile, low growth and low rates continue to be the theme in Europe. Despite the political and economic uncertainties surrounding the EU, the real estate industry seems positive about most of its major markets, especially German cities that could benefit from Brexit, according to a recent survey by Pwc[3]. In Asia, rental growth prospects in key markets are expected to be weak, but emerging markets offer better capital appreciation prospects.[4]

With a global property ETF, an investor can take advantage of the momentum in the US, while balancing those exposures with assets in Europe and Asia that offer good valuations.

What Investors Should Look For

To add a meaningful global real estate exposure to your portfolio, investors should consider three things: diversification, transparency and quality.

Investing directly in overseas real estate can pose challenges for investors such as unfamiliarity of the market, regulations and taxation. Offering a broad exposure to a range of real estate assets, a global property ETF is an easy, cost-efficient and transparent way for Australian investors to gain exposure to an asset class that they would typically have difficulty accessing directly. Unlike direct property ownership, which exposes investors to liquidity risk, investing in an ETF means investors can buy or sell shares throughout the trading day.

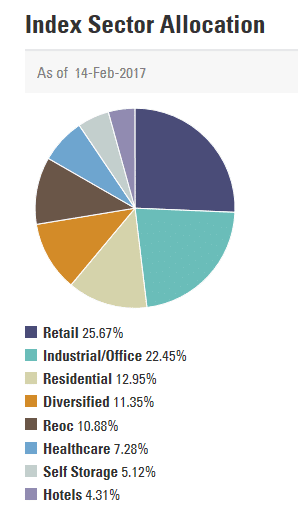

A well-diversified portfolio helps cushion any weakness in one property market from impacting the rest of the portfolio. In addition, it offers a healthy balance of sector exposures (retail, industrial, residential, healthcare real estate assets, etc.) to avoid concentration risk. In Australia, global property ETFs investing in listed property companies and real estate investment trusts (REITs) include the SPDR® Dow Jones Global Real Estate Fund (DJRE), which tracks the Dow Jones Global Select Real Estate Securities Index.

The transparency that ETFs offer is especially important for investors who are conscious of the risks they’re adding to their portfolio. The underlying indices of global ETFs are not created equal, so investors need to be mindful of what companies those indices comprise. How diversified are its holdings in terms of sectors and geographical markets? How are they screened?

The Dow Jones Global Select Real Estate Securities Index, for instance, is a portfolio made up of over 200 publicly traded real estate-related companies, in more than 20 developed and emerging economies including the US, UK, Japan and Hong Kong, and in sectors such as retail, industrial/office, self-storage, healthcare, and residential.

Source: SSGA, as of 14 February 2017

Allocations are as of the date indicated, are subject to change, and should not be relied upon as current thereafter.

Quality and sustainability of earnings and dividends should also be prime considerations for investors. The selection methodology of the underlying assets matter and should be in line with investors’ risk and return profile.

The Dow Jones Global Select Real Estate Securities Index, for instance, ensures that the companies in the index truly offer quality real estate exposures. To be included in the index, companies must derive at least 75% of their revenues from the ownership and operation of real estate assets and have a market cap of at least US$200 million at the time of inclusion. Aside from focusing on income generation potential, the index also limits exposure to significantly leveraged companies by screening out those that have more than 25% of their assets in direct mortgage investments. Property financing companies, mortgage and real estate brokers, home builders, lager landowners and subdividers of unimproved land, timber REITS (among others) are also excluded from the index.

As you can see below, the index’s largest five holdings are US-based companies operating in retail, storage, industrial, residential and senior/assisted living housing. The names may be unfamiliar to Australian investors, but the top 10 holdings is an example of the index’s robust quality screening criteria.

Index Top 10 Holdings (as of 31 January 2017)

Boston Properties Inc

1.99

|

Name |

Weight (%) |

|

Simon Property Group |

5.71 |

|

Public Storage |

3.17 |

|

Prologis |

2.56 |

|

Welltower, Inc. |

2.38 |

|

Avalonbay Communities |

2.36 |

|

Mitsui Fudosan |

2.28 |

|

Unibail-Rodamco |

2.26 |

|

Equity Residential |

2.20 |

|

Ventas Inc |

2.16 |

Source: S&P Dow Jones Indices

Index holdings are as of the date indicated, are subject to change, and should not be relied upon as current thereafter.

Seize the Opportunity

While it remains to be seen how much more interest rates will go up and how much it would impact the global real estate sector, investors cannot ignore the potential of adding the sector into their portfolio. A global REIT that offers significant exposure to the US real estate sector, balanced by exposures in Europe and Asia, allows investors to seize emerging opportunities and potentially boost income, capital growth and diversification to a domestic-focused portfolio.

Learn more about SPDR Dow Jones Global Real Estate Fund (DJRE).

Issued by State Street Global Advisors, Australia Services Limited (AFSL Number 274900, ABN 16 108 671 441) (“SSGA, ASL”) www.ssga.com. This material is of a general nature only and does not constitute personal advice. It does not constitute investment advice and it should not be relied on as such. It does not take into account any investor’s objectives, financial situation or needs and you should consider whether it is appropriate for you. You should consult your tax and financial adviser.© 2017 State Street Corporation —All Rights Reserved. AUSMKT -3326 | Expiry date: 30 April 2017.

[1] http://www.corelogic.com.au/news/capital-city-dwelling-values-surge-10-9-higher-over-the-2016-calendar-year

[2] http://www.news.com.au/finance/real-estate/buying/declining-rental-yields-give-global-property-a-new-appeal/news-story/63c428ba539184d21bbbae93b490c489

[3] PwC “Emerging Trends in Real Estate: Europe 2017” http://www.pwc.com/gx/en/industries/financial-services/asset-management/emerging-trends-real-estate/europe-2017.html

[4] PwC “Emerging Trends in Real Estate: Asia Pacific 2017” http://www.pwc.com/sg/en/publications/assets/aprealestemerging_2017.pdf