In uncertain markets, a solid understanding of contracts for difference (CFDs) becomes essential. These instruments can help you respond strategically when conditions shift — offering flexibility, but not without risk. Knowing how to use CFDs effectively can make all the difference, especially when volatility disrupts traditional strategies.

So, how do CFDs stack up in volatile markets? Let’s weigh the pros and cons..

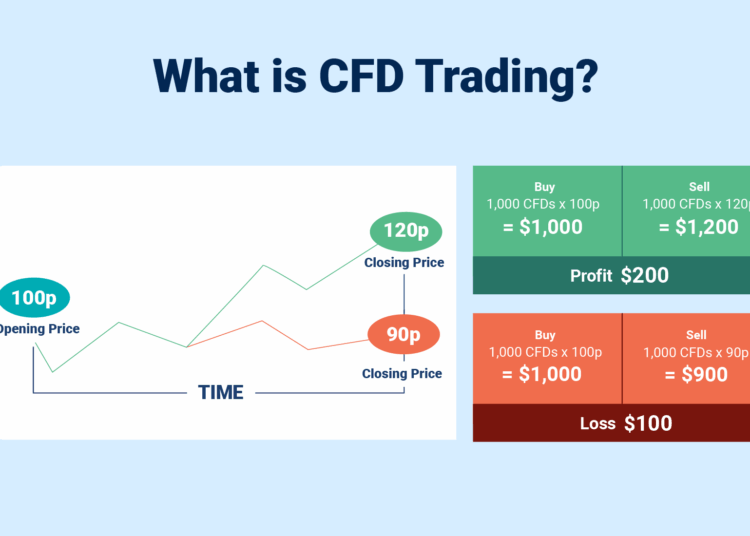

Understanding CFDs

A CFD is a contract for difference – i.e. a contract based on the opening and closing prices of an underlying instrument. This means a CFD is a derivative. You’re not buying, holding, or selling an actual asset. Instead, the value of the contract is derived from that asset.

For CompareForexBrokers founder Justin Grossbard, CFDs are a big part of modern forex trading.

“CFDs are one of the most popular ways to speculate on the forex market,” Justin said.

“Traders like myself really appreciate the potential of this kind of instrument, as you have more flexibility. You can choose to trade with the market or against it, depending on the latest conditions”.

It’s this flexibility that gives CFD trading such potential during less-than-certain economic times.

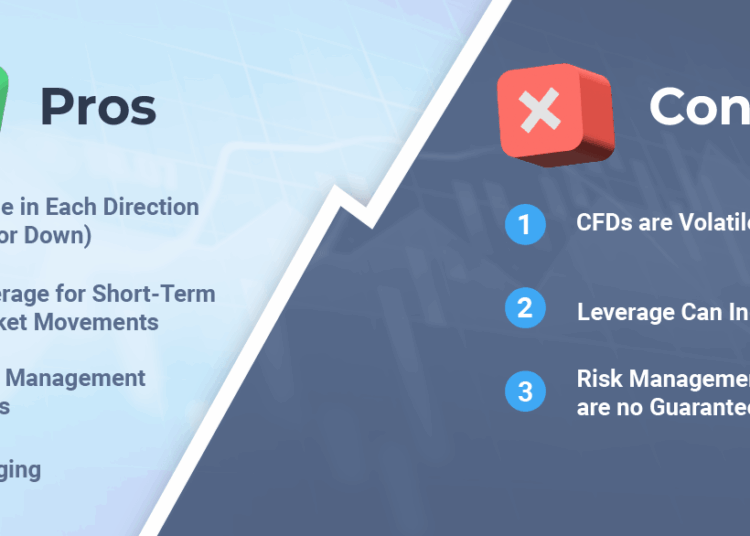

Trading CFDs in Uncertain Economic Times: Potential Advantages

Let’s start with the potential advantages of CFDs. This is what makes these contracts an interesting trading option during stormy economic periods.

- Trading in Each Direction

The biggest advantage of CFDs in uncertain times is the ability to trade in either direction. You’re not simply buying an asset and hoping that it appreciates in value. Instead, you can open a long or a short contract, speculating in either market direction. This gives you more opportunity for potential profit.

- Taking Advantage of Short-Term Market Movements with Leverage

It’s tricky to make longer-term predictions during times of economic uncertainty. However, traders can make small wins by opening and closing short-term positions throughout the trading day. In Australia, the ASIC permits CFD leveraging up to 30:1, so you can multiply these small profits by up to 30 times.

- Protecting Trades with Risk Management Tools

Market risks can be mitigated with risk management tools like stop-loss and take-profit orders. These tools close out your trade automatically once certain preset parameters are reached and help ensure you keep to your trading strategy.

There’s also negative balance protection. All ASIC-regulated brokers have to provide this, and it prevents your losses from exceeding your account balance. So you never owe money to your broker.

- Hedging Trades for Further Protection

Because you can open CFDs in both directions, these instruments are beneficial for hedging. If you want to open a particularly risky trade, you can open a smaller CFD in the opposite direction. This means you can offset some of the losses if price movements don’t move as you expected.

Trading CFDs in Uncertain Economic Times: Potential Disadvantages

While CFDs do offer possible advantages, they are not perfect instruments. It’s a good idea to go into CFD trading with your eyes open, remaining aware of potential disadvantages.

- Predictions Still Need to Be Correct

There’s an important fact to consider here. You’re still speculating on the market, and that speculation still needs to be correct. Yes, you can open positions in either direction, but if you get it wrong, you will still lose out.

- Increased Leverage Brings Increased Risk

You’ll always use leverage when you trade CFDs, and this increases your market exposure. So smaller price movements are magnified, meaning greater leverage brings more risk. The best forex brokers in Australia will cap leverage at 30:1, but traders can reduce this to manage risk.

- CFDs are Far From Guaranteed

There’s never a guarantee when trading CFDs. Even expert traders sometimes make mistakes, which can result in losses. The key is obtaining knowledge with conservative trades and gradually gaining experience over time to optimise your chance of success.

Taking Advantage of Trading Flexibility

Markets rise and fall—that’s the nature of trading. For savvy traders, this constant motion is exactly why flexibility matters.

With CFDs, you can open short positions to potentially profit when prices drop, and switch to long positions when they begin to rise. This ability to move with the market — rather than against it — is what makes CFDs an attractive option for many.

It’s also why traders like Justin Grossbard of CompareForexBrokers regularly turn to CFDs.

“There’s never a guarantee in the markets,” Justin said. “But for me, knowing I can keep trading—and hopefully keep profiting—even when things get tough, is what makes CFDs so appealing.”

CFDs aren’t a one-size-fits-all solution. But with the right strategy and an understanding of the risks, they can offer a flexible approach when navigating uncertain economic conditions.