Leverage is a core part of contract for difference (CFD) trading. It increases your market exposure, and magnifies even the smallest price movements. In fact, you will always be using at least some leverage whenever you place a CFD trade.

But increased market exposure also brings risk. The more leverage you apply, the higher this risk gets.

So, how do you use leverage as a beginner CFD trader, and how do you keep risk to a minimum while targeting optimal profits?

What is CFD Trading?

CFD trading is just trading on a contract for difference. You will be predicting whether the price of an asset will rise or fall. The profits or losses are based on the difference between the opening and closing prices.

CompareForexBrokers co-founder Justin Grossbard explains more about how CFDs work.

“CFDs are derivatives,” Justin says. “So they take their value from an underlying asset, but you never actually take ownership of that asset.”

“You’ll trade CFDs through a broker, who is your connection to the market. As brokers are businesses, you’ll pay a fee for either a separate commission or a cost built into the price of the trade.”

What is Leverage?

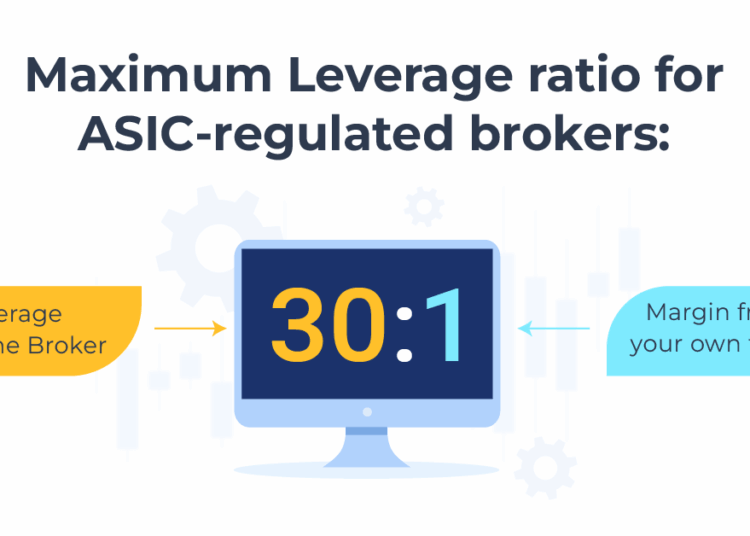

Trading on leverage means borrowing money from the broker to increase the size of your position. Leverage is expressed as a ratio. The maximum leverage the Australian Securities and Investments Commission (ASIC) allows is 30:1.

So for every dollar you put up of your own capital, you’ll get $30 from the broker. Your trade becomes thirty times bigger than if you were just using your own money. And your profits and losses are thirty times greater too.

The “1” in the “30:1” is your margin. This is the level of your own capital you’ll need to provide to open the trade.

Managing Risk when Trading With Leverage

Leverage trading maximises your profit potential, which also maximises your loss potential. In other words, more leverage equals more risk. So how do you manage this risk?

Trade with Well-regulated Brokers

Only trade with well-regulated brokers. In Australia, the ASIC provides regulation, so look for licenses from this body.

If you want to access higher leverage than 30:1, you can look for offshore brokers regulated in other countries. Brokers regulated in multiple global jurisdictions tend to be reliable, but only the ASIC can protect you in Australia.

Use the Right Strategy

Leverage is most effective with short-term scalping strategies. The price movements on these strategies are so small that you’ll need leverage to achieve any meaningful profit. At the same time, you won’t lose too much money if the trade goes wrong.

High leverage isn’t so proper on longer-term trades, where the price movements tend to be bigger. You are also at risk of losing money quickly.

Practice with a Demo Account

All the best forex brokers in Australia offer a demo account – a risk-free simulation where you can practice with virtual money.

Make sure you’re comfortable with the trading platform and the market by practicing on a demo account. But don’t assume that demo success will automatically translate to live market success.

Build Leverage Slowly

You don’t need to jump to 1:30 leverage immediately. In fact, you shouldn’t.

Instead, increase your leverage rate methodically, in line with your own experience. The chance of big profits can make traders greedy, and cause them to forget about the potential big losses.

Use Risk Management Tools

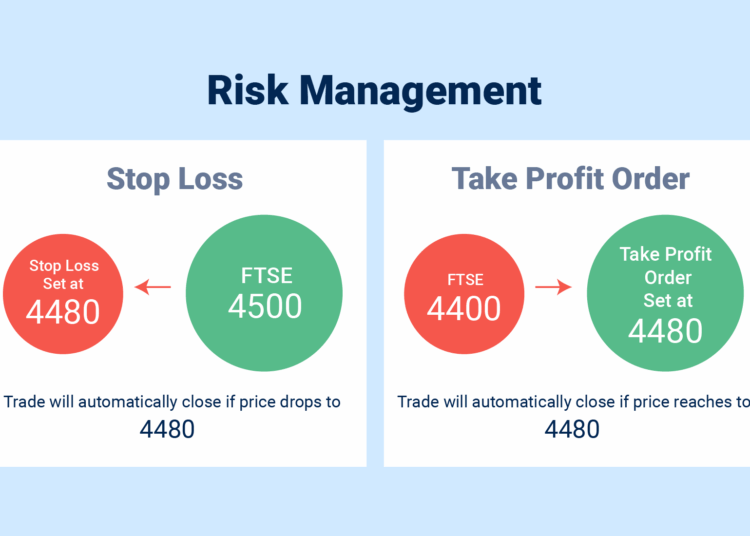

Use risk management tools, whether you’re trading with high leverage or not. A stop-loss tool will close out your trade automatically when it falls to a certain point, while a take-profit does the same when it rises to a preset level. Both help to keep your trades within sustainable parameters.

ASIC-regulated brokers must also provide negative balance protection. This is great for leveraged trading, as it means you can only lose what’s in your trading account and you’ll never owe money to the broker.

Increase Leverage on Familiar Markets

When you increase your leverage, choose markets you are familiar with. There is always risk involved with CFD trading, but trading on markets you know well will help you predict movements and make informed decisions.

Proceeding with Caution and Trading Sustainably

The best way to trade on leverage is to proceed cautiously, whether you’re a beginner or otherwise. Target sustainable trading, and work to minimise the risks.

“Some of the biggest dangers I see in the CFD market are over-leverage and over-confidence,” Justin Grossbard says.

“Traders get excited by big potential returns, and end up wiping out. I advise setting a sustainable strategy early on, and sticking to this strategy long-term. Building leverage slowly and cautiously is the best way to go.”