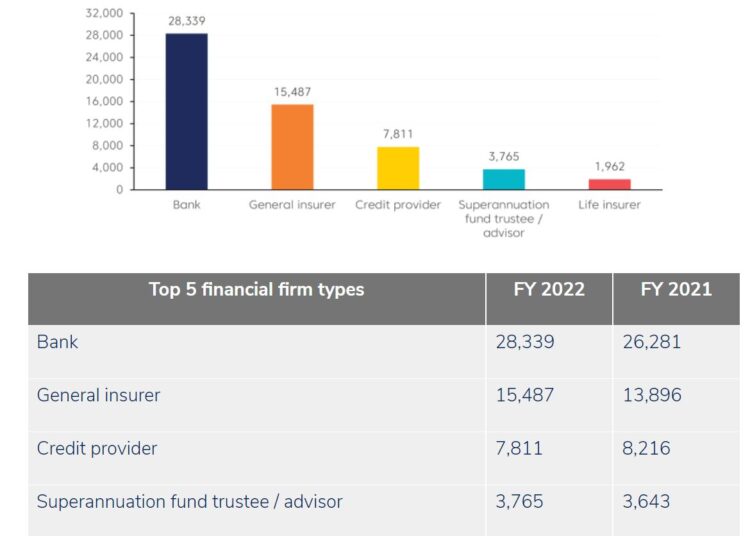

Overall, banks topped the list of the complaints received by the top five financial firm types, with 28,339 complaints in total for FY 2022, increasing from 26,281 complaints in FY 2021.

Disputes with banks, insurers, super funds, investment firms and financial advisers have resulted in a total of 72,358 complaints lodged with the AFCA over the last year, showing a rise of 3 per cent from the previous financial year. However, there was a drop of 5 per cent of lodged complaints against licensed financial firms during that same period.

Complaints brought on by natural disasters such as floods have almost doubled over the last 12 months, rising from 653 to 1,586 complaints.

David Locke, AFCA’s chief ombudsman, said there has been a sharp rise in complaints about general insurance during a period that included an earthquake in Victoria last September, followed by the catastrophic storms and flooding across southern states last October as well as South-East Queensland / Northern NSW at the beginning of 2022.

Home building, home contents and motor vehicle insurance were key issues in regards to delays in claims handling.

“We acknowledge that insurers face challenges as they try to manage claims and get people back on their feet.”

“We know there are significant issues with the supply of things like building materials, parts and labour because of national and global events outside their control,” Mr Locke said.

Mr Locke continued by stating despite the challenges facing insurers, they are still “concerned at the rise in complaints being escalated to AFCA,” and they would like to better understand the cause of complaints in order to resolve disputes quickly and prevent them from happening altogether.

He further remarked that he was “pleased” to see that at least half of the complaints that reached the AFCA were resolved quickly and at the earliest stage of its process, with 67 per cent of complaints being resolved via agreements between the parties.

The 30 June preliminary data “snapshot” revealed that credit cards topped the list of most complained about product in 2021-22, making up 13 per cent of all complaints. However, complaints were down 8 per cent on the pervious year despite topping the list for another year.

NSW had the highest number of complaints lodged, with 23,200 over 2021-22, closely followed by Victoria with 20,988 complaints.

Successful complaints over 2021-22 through the AFCA secured more than $207.73 million in refunds and compensation with an additional $18 million in remediation payments to consumers after the AFCA’s investigations into a range of systemic issues.

Of the 72,358 complaints received, 71,152 were closed.