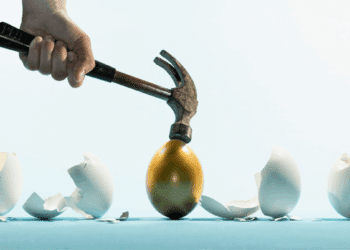

Barely a week goes by without a headline about a builder folding. Despite this, viable construction projects still abound. In this new landscape, it’s crucial for investors to select experienced investment managers with the skills to identify the right projects to fund, and the confidence to manage these successfully.

The factors behind the recent spate of collapses are well-known: fixed price lump sum contracts negotiated before industry-wide issues arising, including escalating costs, supply chain disruptions, labour shortages and rising interest rates.

It’s natural to question whether we are through the worst of it? How can investment managers pre-empt and manage these risks to ensure that funding construction projects remains a viable investment option and that capital preservation remains paramount?

While builders’ balance sheets are still under pressure, there are many quality projects with strong counterparties offering attractive risk-adjusted, non-correlated portfolio returns.

The key for investors is to undertake their due diligence to ensure they select competent investment managers, with the knowledge and skills to navigate through the intensive asset management process required in this environment.

Now, more than ever, experienced teams and deep industry networks matter in the CRED space. Here’s why:

1) CRED investment managers need deep industry networks to extract market intel

Access to detailed information from those participants that fall below Tier 1 is not always readily available.

Like any prudent lender, we undertake intensive due diligence. We stress-test our builders and developers to make sure they have sufficient liquidity to withstand funding requirements to complete a project.

But, for companies that are not required to lodge their financials into the public domain, there is a visibility gap when it comes to determining a builder’s true financial position.

This is where experienced investment managers with deep networks can make a material difference. Those with strong working relationships within the industry can tap into and help determine any potential contagion risk associated with a builder or developer’s position. It’s a powerful way to garnish important information to help manage risks. This is something Zagga does exceptionally well.

One way we achieve this is by being present and visible on construction sites. Our senior decision-makers often visit sites outside the usual cadence of formal meetings. They personally verify the builder’s working relationship with their on-site trades. This information is invaluable. If there are issues, it can act as the canary in the coal mine, allowing the team to pivot early. Or, if all is well, it simply helps to reaffirm that the builder is on track with cost and time budgets.

2) Experienced teams can confidently evolve with changing market dynamics

In response to the string of builders collapsing, subcontractors and suppliers have increased the size of the upfront deposits they require from builders, to protect themselves against any potential further insolvencies.

Meanwhile, on the funding side, some lenders are seeking delayed payment terms and applying large retentions to builders in order to mitigate risk.

Both changes can create a heavy cashflow burden for builders. In our view, it’s important for investment managers to become more collaborative with builders and evolve the way they manage these risks.

For example, if lenders adjust their payments, builders can better manage large upfront deposits, which helps to keep trades on-site. This is crucial, as labour remains tight across the construction industry, and, in many cases, trades prioritise the jobs that pay the fastest. This simple adjustment can help to ensure project completion in a timely manner.

Knowing when to pull the levers to better manage project cash flows comes down to experience. It requires adept teams who have navigated more than one economic cycle.

Given our organisation’s deep experience in development projects and construction funding, we’ve been able to look beyond what independent quantity surveyors present, to identify conservative contingencies to help manage a project seamlessly and successfully through to Practical Completion, and ultimately, loan repayment.

Importantly, we make sure the senior decision-makers at Zagga personally manage relationships with all stakeholders, as this creates fertile ground for a genuinely collaborative approach – a key strength for which we are known.

3) Experienced CRED managers identify the right projects to fund

As we’ve seen from the collapse of Porter Davis, Probuild, Pivotal Homes, and more recently, South Australian builder Qattro, large builders are not immune to changing market dynamics.

In the past, investors often took comfort from the scale and sophistication of tier 1 builders / projects, and for good reason. These projects perform well for investors when all goes to plan.

However, if cracks start to appear, unexpected risks may start to present through.

Tier 1 builders operate on very thin margins (typically 1-3%) with most projects taking several years to complete, potentially spanning several economic cycles.

If they do collapse, getting projects back on track is highly cost and time intensive. It’s quite common to have the involvement of additional parties such as Government and Union representatives as cost escalations become evident.

Above all, there are only a small handful of builders and sub-contractors that can be brought on to recommence the project. The delays and potential losses are significant.

For these reasons, and as part of our risk-mitigation discipline, we strategically work with projects in the $3 million to $50 million range. There is a deeper pool of builders and trades, less regulatory and government intervention and better margins (typically 7-10%). Given our experience and deep networks, we can meaningfully protect investors’ capital in this space. Most importantly, in the event of a stressed or distressed situation, we’re able to get the project moving again at a much faster pace and manage risk much more effectively.

Opportunities in an era of change

As we continue to see ongoing challenges roll through the construction industry, it’s important to recognise that viable construction projects continue to abound.

For wholesale investors, funding construction projects can offer attractive returns and portfolio diversification benefits.

Experienced investment managers are the linchpin to ensuring credible builders and sponsors are involved in transactions, thereby safeguarding capital and preserving the integrity of construction investments.

Authors: Frank Hageali, Director -Investments, Zagga and Tom Cranfield, Director -Investments, Zagga