According to survey results in a bi-yearly research report compiled by Willis Towers Watson, social media has become one of the top ways in which super funds are choosing to engage with their members.

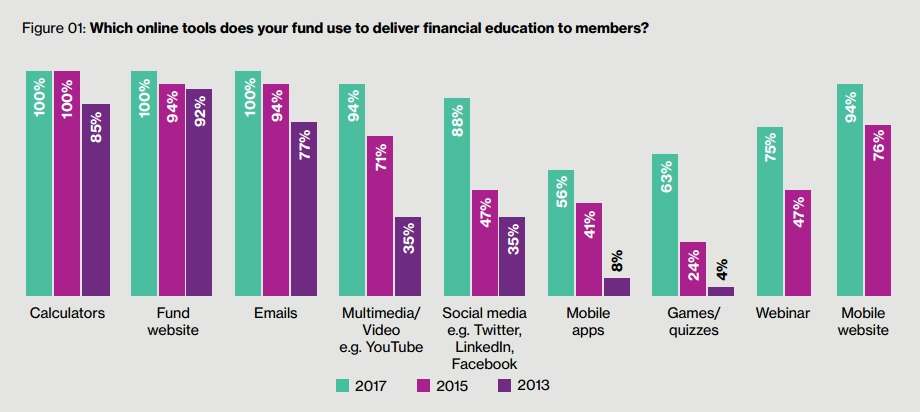

While websites, calculators and emails all scored over 90 per cent as top online engagement and education tools in 2015, new digital channels such as the use of multimedia/video and social media platforms have gained increasing adoption in 2017.

Social media nearly doubled in usage as an engagement tool, jumping from 47 per cent in 2015 to 88 per cent, while the use of multimedia/video soared 23 per cent.

Commenting on the results, Willis Towers Watson Australasia and Asia head of digital solutions Richard Body said “strong growth in funds’ use of social media, games and quizzes and webinars” was “one of the most interesting results” to emerge from the research.

“Super funds are following their members’ lead in terms of the types of channels that are trending,” Mr Body said.

“Social media was considered less important two years ago, but given that’s where members spend so much of their time, having a presence in that space is a priority.

“And funds continue to watch their members’ behaviours to trial new technologies and inform their own future direction.”

The interactive platforms of games and quizzes showed the most growth, with 63 per cent of respondents utilising this channel compared to 24 per cent two years ago.

The report also revealed super funds had ramped up their use of webinars (47 per cent in 2015 to 75 per cent in 2017) and mobile websites (76 per cent in 2015 to 94 per cent in 2017) to connect with members.

Super funds were also demonstrating use of newer digital channels such as SMS, online statements and employer/member portals.

Regarding data, however, though 77 per cent of funds considered data analytics to be highly important, only 31 per cent of funds were actually using data analytics for the range of online channels.

“In the short term, funds continue to explore digital tools, including technologies such as chat-bots and artificial intelligence, but there is a realisation that technology for its own sake is not the goal,” Mr Body said.

“Given the limited resources, only those technologies that drive member engagement and contribute to a fund’s overall strategy will survive.”