Historically, Australian investors have been underweight fixed income. Years of low yields and historically low interest rates have not helped its reputation, as investors flocked towards higher yield-producing assets, such as equities and hybrids – bank issued convertible preference shares that convert to stock. Since late 2016, developed market yields have started to pick up from their historic lows, and it may be time for investors to take another good look at fixed income and the important role it can play regardless of the interest rate environment.

Fixed income has the ability to play numerous important roles in a portfolio. It is intended to do well when the rest of the market isn’t. It allows for capital preservation and provides a predictable income. Whilst cash offers capital protection too, returns may be lower, and in periods of inflation, it could erode in value. Whilst hybrids provide a regular income stream in the form of coupon payments, they have been shown to move in the same direction as equities. Bonds, on the other hand, typically move opposite to equities and thus, work well as a portfolio diversifier.

Australian investors looking to create a new fixed income portfolio or increase exposure to the asset class don’t have to look far. Domestic bonds can offer attractive benefits as other developed market bonds. The Australian 10-year government bond, for instance, offers the highest yield among G-7 government bonds at 2.70%.[1] In addition, the domestic debt market continues to deepen. Last year, the Australian government issued its first 30-year bond, the longest maturity to date.

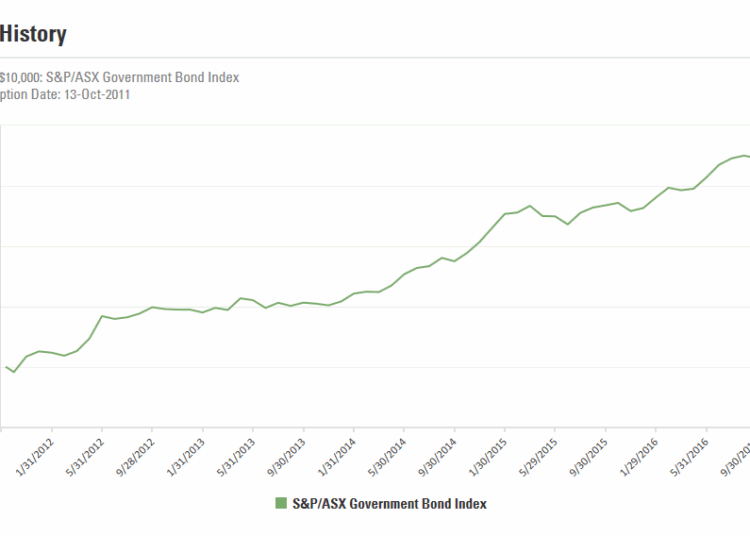

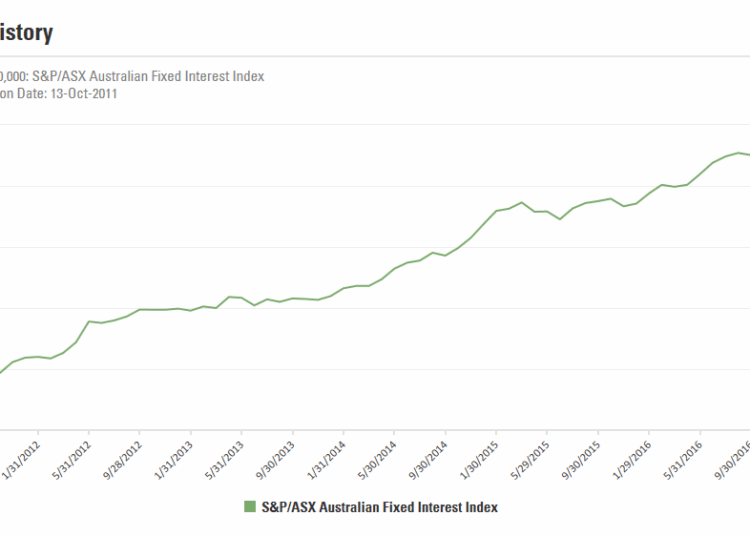

The charts below show the performance of a $10,000 invested in a basket of Australian government bonds and Australian bonds (including corporates, supranationals, etc.) based on the S&P/ASX Government Bond Index and the S&P/ASX Australian Fixed Interest Index, respectively.

Source: SSGA, as of 31 January 2017

Index returns reflect capital gains and losses, income, and the reinvestment of dividends.

Source: SSGA, as of 31 January 2017

Performance quoted represents past performance, which is no guarantee of future results.

Index returns reflect capital gains and losses, income, and the reinvestment of dividends.

A Ballast during Volatile Times

In a shifting landscape with questions over interest rates and economic growth, investors need to consider carefully how they construct their fixed income portfolios, thinking beyond a broad fixed income benchmark to more deliberately chosen exposures.

For many investors, the role of fixed income is to dampen overall risk, not to increase it. This allows the asset class to act as ballast during times of heightened market volatility. Thus, investors should aim to build a robust portfolio with the following in mind:

Diversification

With uncertainty over the path of interest rates remaining high and difficult for investors to predict, a well-thought out core fixed income strategy may play a critical role in a portfolio by seeking to provide stability, diversification and income.

To create a truly diversified core fixed income portfolio, investors should have exposures to a wide variety of issuer types and maturities. Aside from big banks and the government, which dominate the domestic debt market, consider including bonds issued by corporations, state governments, supranationals and foreign institutions as well as Australian government-backed corporate debt and kangaroo bond issues.

One way of accessing this universe easily and cost efficiently is by investing in an exchange traded fund (ETF) whose underlying index reflects these characteristics, for example, the S&P/ASX Australian Fixed Interest Index, which has more than 450 constituents[2].

For those with an existing fixed income portfolio currently geared towards higher risk bonds, adding exposures to highly secure Australian government and state government bonds potentially reduces overall portfolio risk. The S&P/ASX Government Bond Index, for example, includes over 80 Australian government and state government bonds.

Quality

The risk of default is always an investor concern, but it can be mitigated by focusing on investment grade-rated bonds, which tend to have stronger balance sheets and are able to withstand economic downturns. The S&P/ASX Australian Fixed Interest Index and S&P/ASX Government Bond IndexS&P/ASX Government Bond Index include only issuers with a minimum BBB rating. The indices also only include bonds that have maturity of longer than or equal to one year and pay a fixed rate. Bonds secured by mortgages, with the exception of covered bonds, are excluded. This deliberate screening methodology helps reduce the risk of default and enable the portfolio to deliver a steady income stream for investors.

Cost Efficiency

Debt markets have typically been expensive and hard to access for retail investors, requiring a high minimum investment. Investors will find fixed income ETFs as convenient investment vehicles, offering easy execution at a fraction of the cost of fixed income managed funds. Traded on the ASX like a share and with a transparent investment process, investors know exactly what they hold and can choose ETFs that align closely with their risk/return profile.

Index methodologies, as mentioned above, can screen for high quality issuers so investors don’t have to do it on their own. ETFs also further narrow down the index holdings to a manageable number of holdings to keep costs under control. For example, the SPDR® Australian Bond Fund, which tracks the 450+-constituent S&P/ASX Australian Fixed Interest Index, only holds 86 constituents. Moreover, fixed income ETFs offer liquidity that may be hard to come by when directly investing in bonds or managed funds — ETF investors can sell or buy shares on the ASX at any time during the trading day, with price certainty.

In the rush towards higher yields, bonds have somehow been left behind. The concept of “fixed income” has mistakenly expanded to include hybrids, cash and high yield equities. To genuinely reap the benefits of this asset class in your portfolio, we believe fixed income should strictly include only bonds. Investors should reassess their portfolios and rethink the role of true fixed income securities. They’re like the boring friends you’ve long ignored for cooler mates, but who always had your back.

Gain direct exposure to the local fixed income market with SPDR S&P/ASX Australian Bond Fund and SPDR S&P/ASX Australian Government Fund (GOVT).

Issued by State Street Global Advisors, Australia Services Limited (AFSL Number 274900, ABN 16 108 671 441) (“SSGA, ASL”) www.ssga.com. This material is of a general nature only and does not constitute personal advice. It does not constitute investment advice and it should not be relied on as such. It does not take into account any investor’s objectives, financial situation or needs and you should consider whether it is appropriate for you. You should consult your tax and financial adviser.©2017 State Street Corporation —All Rights Reserved. AUSMKT -3370 | Expiry date: 30 April 2017.

[1] As of 10 February 2017

[2] As of 31 January 2017