It is widely accepted that one of the best ways to ensure people have enough saved over the long-term is to invest in the stock market. Yet the stock market experience is not always positive. Markets are unpredictable with their ups and downs, and getting in or out at the wrong time can significantly affect the value of an investor’s portfolio.

During the 2008 financial crisis, investors saw tremendous declines in the values of their portfolios. Diversification, which traditionally had been a solid risk management strategy, proved to be flawed as most asset classes declined at the same time. Although markets have risen considerably since the bottom, uncertainty and volatility remain.

The Sanlam Managed Risk Funds (SMRFunds) are an investment solution that helps manage the risk of investing in equities. It is designed to smooth a client’s investment experience, giving them the confidence to stay invested over the long-term.

How do the Sanlam Managed Risk Funds work?

To achieve a smoother investment experience, equity exposure (for growth) is combined with a risk management strategy designed to reduce volatility and minimise losses in declining markets.

Each Fund in the solution line up consists of two elements:

- An equity tracker fund (i.e. a fund which tracks an index, such as the ASX 200)

- The SMRaccount

The SMRaccount works by investing in assets that are designed to move in the opposite direction to the equity markets (ie short futures positions in an equity index). When markets fall, equity values decline and the value of the short futures positions increases, offsetting some of the equity losses.

What is the intended behaviour of the SMRFunds?

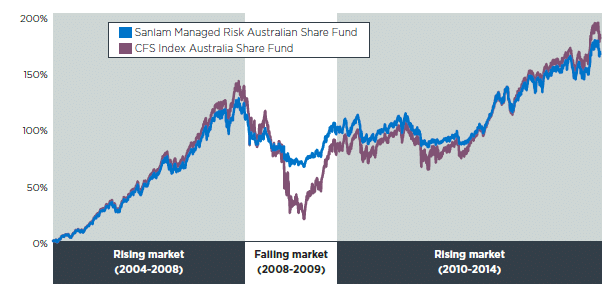

In a rising market

The SMRFunds will rise, albeit not to the same degree as the markets, given that a minimum percentage of the investment must be held in the SMRaccount at all times. The result is that during a rising market, investors are not fully invested in equities and the investment return will be less than having been fully invested. Yet investors still get to participate when markets rise.

In a falling market

The SMRFunds will most likely outperform from a return perspective. As the client’s investment held in the SMRaccount increases, they are cushioned against the market decline. The overall value of their investment is likely to fall, but not by as much as would have been the case without the cushioning effect of the SMRaccount.

In summary

While both lines in this example would have yielded similar results, the SMRFunds investment experience would have been smoother.

About Sanlam

Sanlam is a leading financial services group. Headquartered near Cape Town in South Africa, Sanlam has offices throughout the country and business interests elsewhere in Africa, Europe, India, USA and Australia. Sanlam provides financial solutions to individual and institutional clients.

For more about Sanlam Managed Risk Funds, visit http://www3.colonialfirststate.Ocom.au/adviser/investments/funds/Managed_Risk_Strategies.html

This flyer was designed to provide a brief description of the features of the Sanlam Managed Risk Funds. It does not constitute an offer or solicitation to anyone. It is presented for information purposes only and is not intended for public distribution. The information contained herein may not be reproduced, disclosed or distributed, in whole or in part, unless expressly authorised, in writing, by Sanlam. Products, services and features described herein are subject to change. Neither Sanlam Private Wealth Pty Ltd ABN 18 136 960 775 AFSL 337927 (Sanlam) nor Colonial First State Investments Limited ABN 98 002 348 352 AFSL 232486 (Colonial First State) make any representations that products or services described or referenced herein are suitable or appropriate for an investor. This information is given without any liability whatsoever to Sanlam or Colonial First State or any of their related entities.

Investments in the Sanlam Managed Risk Funds are subject to market risks. Investments can go down as well as up as a result of changes in the value of the investments. There is no assurance or guarantee of capital or performance. Investors may lose money including possible loss of capital. Past performance is not indicative of future performance.

Neither Sanlam nor Milliman make any representations that products or services described or referenced herein are suitable or appropriate for an investor. Many of the products and services described or referenced herein involve significant risks, and an investor should not make any decision or enter into any transaction unless the investor has fully understood all such risks and has independently determined that such decisions or transactions are appropriate for the investor. Any discussion of risks contained herein with respect to any product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved. Investors must make their own independent decisions or seek advice from their financial adviser regarding the suitability and risks of any strategies or financial instruments mentioned herein.

The information contained in this flyer is given without any liability whatsoever to Sanlam or any of its related entities or their respective members or officers, and is not intended to constitute legal, tax or accounting advice or opinion. No representation or warranty, expressed or implied, is made as to the accuracy, completeness or thoroughness of the content of the information. The recipient should consult with its own legal, tax or accounting advisers as to the accuracy and application of the information contained herein and should conduct its own due diligence and other enquiries in relation to such information. Sanlam has not independently verified certain information obtained from third party sources in this flyer. Sanlam disclaims any responsibility for any errors or omissions in such information, including the financial calculations, projections and forecasts set forth herein. No representation or warranty is made by or on behalf of Sanlam that any projection, forecast, calculation, forward-looking statement, assumption or estimate contained in this flyer should or will be achieved. This flyer does not carry any right of publication. This flyer is incomplete without reference to, and should be viewed solely in conjunction with, the Fund documentation.

© 2016 Sanlam Global Investment Solutions. All Rights Reserved.