Promoted by

Why do you find mid-small caps stocks in most Australian equity portfolios, but not in global equity portfolios?

More and more advisers are starting to ask that question as they seek to optimize clients’ global equity portfolios. It is a good question, given that global mid-small caps can offer enhanced alpha opportunity and greater levels of diversification benefits, just like Australian mid-small caps, but with the added benefit of a bigger universe.

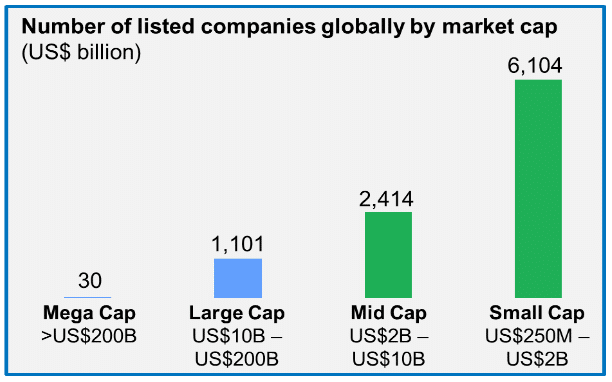

With the current weighted average market cap of the MSCI World index standing at an enormous $136 billion, the majority of investors only hold mega and large cap global companies without realizing it. But think of the potential impact on your client’s portfolios if you could give them access to companies with a market cap up to US$10 billion. According to Ellerston Capital Portfolio Manager Arik Star, “The global mid-small cap investment opportunity set is 5 times larger than global mega-large cap within developed markets. The opportunity is staggering.” The numbers speak for themselves:

Source: Bloomberg – 23 developed markets as at 28 February 2018.

How can you access this opportunity set? By purchasing a single security on the ASX – Ellerston Global Investments (ASX:EGI) – you can provide your clients with a global mid-small cap focused, 20-40 stock portfolio that uses a benchmark agnostic, best ideas investment approach.

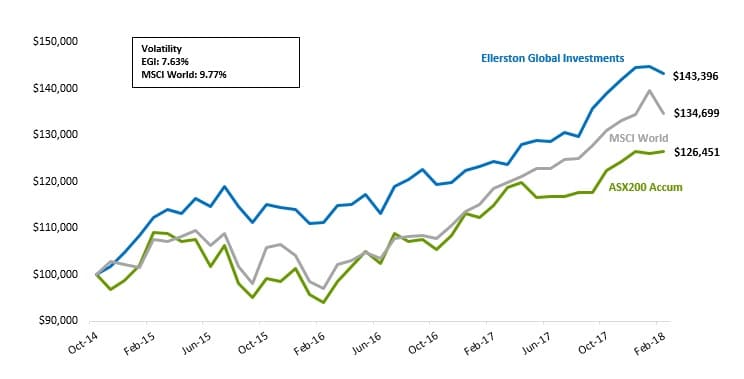

Since inception in November 2014, EGI has outperformed the MSCI World Index by over 2.1% p.a. with lower volatility of 7.6%p.a. versus the MSCI World’s volatility of 9.8%p.a., clearly showing the potential power of mid-small cap diversification on risk adjusted returns.

Ellerston Global Investments (EGI) performance versus major indices to 28 February 2018

^ Inception date 1 November 2014 (fully invested basis). * Before tax. Source: Ellerston Capital and Bloomberg as at 28 February 2018.

Ellerston Capital, a Sydney based fund manager, currently manages $5.8 billion. Arik Star (Portfolio Manager) has 23 years industry experience managing money for numerous Family offices prior to joining Ellerston Capital in 2014. For more information visit our website www.ellerstoncapital.com or email info@ellerstoncapital.com