The Story of 2016

The past year was one of the most extreme environments investors have experienced for some time. Generally poor macroeconomic data and political events dominated markets, yet the statistics will show that global equity markets performed well.1 A year that started with a crisis of confidence surrounding growth reversed 180 degrees, firmly consigning those early fears to history.

What has driven this change? Markets had steadily recovered from concerns over China, oil, and fears over the U.S. credit cycle as better economic data began to flow (with even Brexit forgotten as quickly as it came to pass), but it was November 8 that marked the real turning point. Almost overnight, the surprise victory of President Donald Trump did what U.S. Federal Reserve Chairman Janet Yellen had struggled to do for years—change expectations around the prospects for higher U.S. growth, as well as inflation and interest rates.

Trump Tantrum—Making Value Stocks Great Again

While Donald Trump has naturally stolen the headlines, it is equally important to note that the Republicans won both the House and the Senate in the U.S. election. This relates to the policy implications for a Congress that has been gridlocked for much of the past eight years. However, regardless of the detail, equity markets have rallied strongly, with cyclical stocks at the forefront of that, as investors have reassessed global growth prospects in the wake of the election.

Why have growth expectations been changing, and what does it mean for markets? Part of the shift in sentiment witnessed in the mid-part of 2016 was an expression of relief that many depressed data points became “less worse” than feared. Certainly, corporate profits have been gradually improving, which is an important fundamental change we have sought to capture.

However, the really significant change followed the U.S. election. While fear reigned in advance of the result, optimism quickly took over, with opinion centering on the prospect of Republican policies of the past being brought to bear in the future. Front and center to expectations are not only tax cuts, but also deregulation, the repatriation of foreign cash on U.S. corporate balance sheets, and finally, the potential for U.S. fiscal stimulus.

While uncertainty reigns on any specifics, markets have voted quickly and aggressively that growth, inflation, and U.S. interest rates will rise, giving a shot in the arm to some deep cyclical segments of the market. This is evidenced by calendar year returns for the MSCI ACWI energy (29%), materials (24%), financials (13%) and industrials (13%) sectors.2 In effect, the market has quickly shifted toward the view that we have entered a new regime, and that requires a repositioning of portfolios toward economically sensitive stocks.

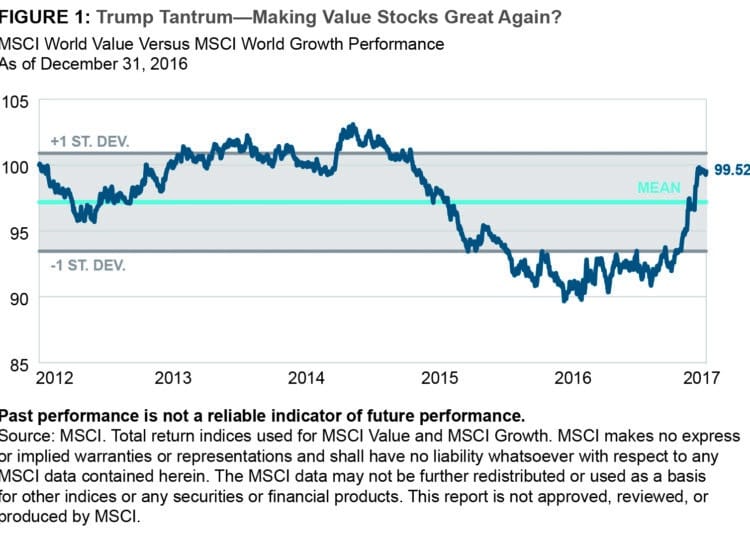

Given the nature of these sectors, this shift has led to broad-based and significant outperformance of Value over Growth.3 Indeed, the relative strength of global Value stocks versus Growth equivalents in 2016 is such that the trailing five-year picture now resides in a neutral position (Figure 1). This obviously caused a significant headwind to growth-oriented investors, and we were not spared in this respect.

However, we believe less has actually changed fundamentally than is currently being priced into the markets and would caution against chasing a cyclical bounce to avoid disappointment. Given this, we are focusing intensely on stocks we own and those stocks we would seek to own on any weakness. For us, it is important to distinguish between meaningful change and market noise.

Emerging Markets—Ups and Downs

The year 2016 was a roller coaster year for emerging markets equities. It began with strong outperformance as economic growth indicators showed improvement in tandem with a backdrop of slowing inflation. This lasted through to the end of October, but then reversed with real force after the U.S. election.

The prospect of higher U.S. interest rates and the subsequent knock-on impact of funding costs for emerging countries caused a sharp pullback. Countries with higher levels of debt such as Indonesia were particularly impacted, as was the case during 2013’s “taper tantrum,” despite the reality that the debt structure of most countries has changed materially over the course of the past two decades. Donald Trump’s rhetoric around trade was also perceived as a negative for Asia-based economies.

Stay selective and don’t chase the sentiment

Key to our bottom-up and top-down view is the need to believe in durable earnings improvement following a clear and significant improvement in macroeconomic sentiment. In many stock-specific cases, we do not see this fundamental change at present.

We have been underweight energy and materials and remain so despite the position being a headwind to performance near term. We believe the world remains oversupplied with oil in the medium term, and if the U.S. is successful at extracting more of its reserves as per early rhetoric around energy independence, this should ultimately put a ceiling on oil prices and the earnings power of much of the energy complex. Even near term, with oil pushing into a U.S. $50 to $60 per barrel range, we are likely to see more mothballed U.S. drilling sites coming back online. In our opinion, the nature of technological change makes supply growth more likely and involves a magnitude of near-term supply change that the market is currently underestimating.

Materials stocks having rallied from a deep trough is perhaps understandable, given low expectations set in late 2015. However, into late 2016, the market has begun to price the reality of fiscal stimulus before any policy has been formed. While the probability of an improving economic environment is higher, a package of U.S. fiscal stimulus via infrastructure spending is unlikely to move the needle as much as many investors are anticipating. The potential impact will not succeed in offsetting the structural declines in China’s demand for base commodities. Even if we see the details of stimulus agreed and passed, the earnings impact is unlikely to be seen until 2018–2020. The battle between hope and reality means a bumpy ride ahead for commodity-oriented sectors.

We have also seen significant movement in industrials stocks, and we continue to focus on high-quality and unique companies within the sector. Today we are neutrally weighted versus the index, in part because valuations look expensive in the near term. With much of the earnings impact of any improving growth a medium-term story, and with low year-on-year earnings comparisons fading in the next few months, selectivity and patience will be essential. While it might be tempting to follow the momentum, we are focused on stocks that can generate visible and durable profitability without needing to bet on fiscal policy, or the politicians behind fiscal policy shifts.

While we are cautious on the commodity complex and stocks solely reliant on meaningful and near-term macro improvement, we have been active in financials, maintaining or increasing our positions in U.S. banks and U.S. capital markets. Our view of developed world growth and inflation going into 2017 was, and remains, one of modest improvement from a low base. We already believed before the election that some magnitude of interest rate rise cycle was likely and that inflation was on the rise—partly given the bounce in oil prices, but also given the modest wage inflation cycle that has been building over the last year. We also continue to hold, and are incremental buyers of, stocks that are likely to benefit most from a higher inflation and steepening yield curve environment. Economic and employment data in the second half of 2016 have increased that possibility.

While we have been active in the U.S., we would reiterate that we continue to favor emerging market banks in domestically driven growing economies over many developed market counterparts. This is especially true when considering the fundamentals of banks in Japan and Europe, where we remain skeptical on earnings power as well as balance sheet quality.

Meanwhile, while the market focuses on the procyclical theme, we have been actively adding to stocks in the technology sector. We have targeted companies that have long-term and standalone earnings power in a modest growth world. But we have also added to stocks that could benefit from a growth surprise if we see an acceleration in consumer spending or U.S. corporate tax harmonization. What remains certain (in an uncertain world) is that innovation, disruption, and the growing use of technology has not stopped as a result of political events in 2016. We continue to like e-commerce, social media, and cloud software companies over the long term as a result.

We have also been adding to, and defending, our positions in the consumer sector. Many of the consumer discretionary stocks we own are disruptive share gainers as a result of their products and services. We have also increased our exposure to U.S.-listed leisure and retail stocks in recent months. Similarly, we have defended our highest-conviction earnings growth stories in the consumer staples sector and remain overweight, given the big rotation out of the sector since the U.S. election. We believe that little has changed with regard to the compounded earnings power of the stocks that we own.

Emerging Markets—Keeping the Faith

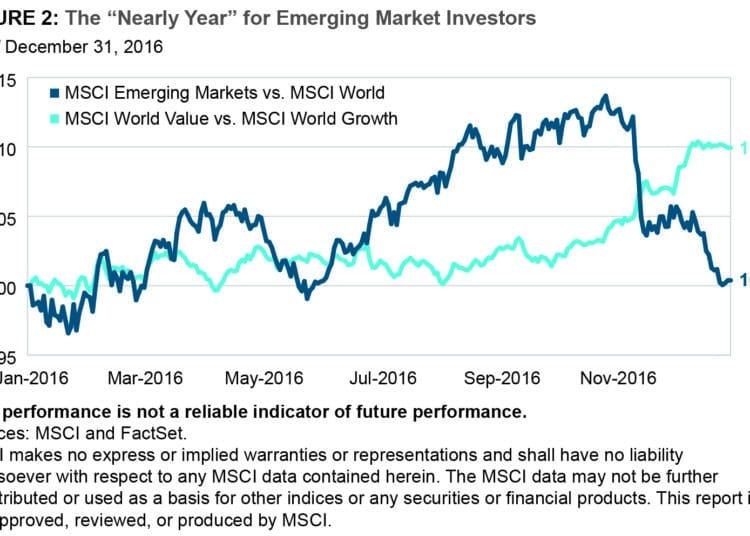

Returning to emerging markets, the market seemed to punish all emerging countries indiscriminately post-Trump, whether export oriented or domestically driven. The MSCI Emerging Markets Index eventually finished the year flat relative to developed markets. This end-of-year pullback added further performance pressure onto our strategy, especially when taken in tandem with the significant outperformance of Value versus Growth indices (Figure 2).

In many ways, this sums up the emerging market opportunity for us as long-term, bottom-up investors, especially in periods when the market becomes disproportionately short-term and top-down focused. Importantly, we have historically navigated such periods well (global financial crisis 2008–2009, death of equities 2012, taper tantrum 2013). All of these turned out to be great opportunities, and we do not believe this “Trump tantrum” period is any different.

Ironically, part of the performance pressures within emerging markets toward the end of the year were also self-imposed, but ultimately driven by “good” intentions. Specifically, India announced a continuation of its ambitious structural reform program via its intention to replace existing large-denomination bank notes with new issues in order to tackle counterfeiting and corruption that was threatening the integrity of the monetary base. While this reform and Prime Minister Narendra Modi’s overall objectives are positive long term for India, the practicalities of changing the physical currency for legitimate holders is likely to slow the pace of growth and consumer spending near term. This has negatively impacted Indian stocks, especially financials where we are overweight.

Our holdings in the Philippines also came under pressure on a mixture of political concerns surrounding highly controversial President Rodrigo Duterte, given both his rhetoric and the uncompromising nature of his anticorruption and anti-crime policies. He has also signaled a more open approach to other Asian countries, including China, in tandem with a distancing from the historically tight relationship with the United States. This approach may very well benefit the economy over time, but a change from conventional ties has been negatively viewed by the market and added a measure of political risk. However, we visited the Philippines in the last quarter of 2016 and remain comfortable with the stocks we own and the outlook for the economy, which remains one of the fastest-growing and demographically advantaged countries in the world.

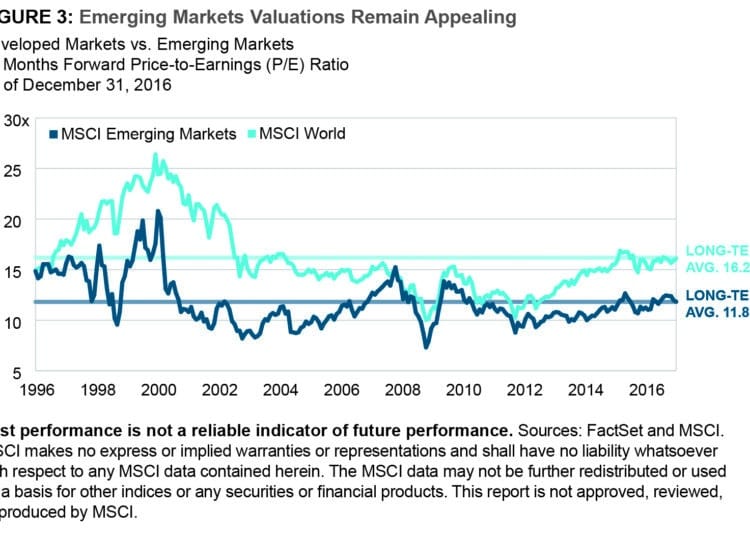

Overall, despite the recent underperformance, the future remains bright for the best of the emerging world. Improving economic growth and the ongoing delivery of superior corporate earnings growth should bode well for the year ahead. We have already witnessed a turnaround in aggregate earnings after a number of years in the doldrums. Some of this improvement is being helped by the revival in commodities, which helped lift our holdings in Peru by over 50% in U.S. dollar terms in 2016, but we have also increasingly seen more examples of self-help within companies. There are a growing number focusing more intensely on cost control, efficient capital expenditure, and improving shareholder returns. Valuations are also still attractive and remain at a discount relative to developed markets when considering near-term earnings multiples (Figure 3), but we continue to focus on the long-term earnings power of specific stocks where this discount becomes even more compelling.

With regards to potential trade sanctions, if President Trump follows through on the most extreme version of his protectionist rhetoric, trade may well be damaged for a number of export-oriented countries. However, while uncertain, our view is that he will be more pragmatic in the policies he pursues, especially as he is forced to prioritize and consider the inflationary and the practical consequences of confrontational trade policies. We expect him to ultimately embrace a more practical, business-friendly stance over time, but this is an area we will be closely monitoring.

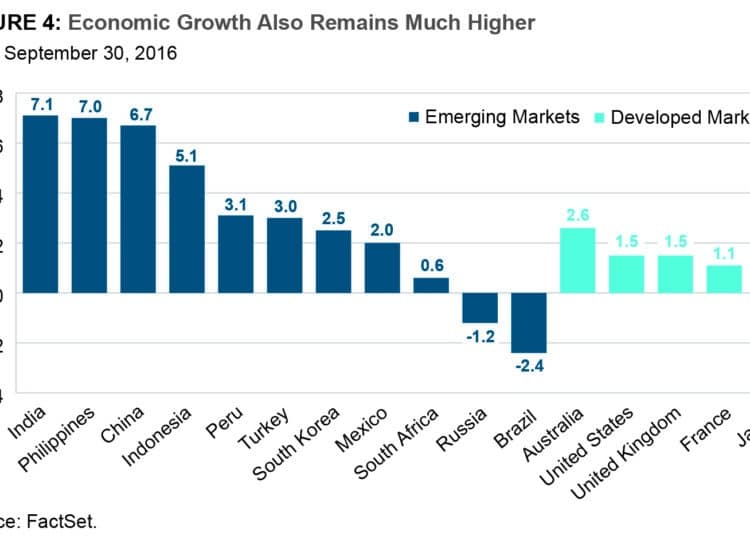

We are therefore maintaining our long-term overweight exposure to emerging market stocks, especially in our preferred emerging Asian economies. Our exposure remains largely concentrated in four countries today: India, Indonesia, the Philippines, and Peru. These countries have strong long-term growth prospects driven by domestic consumption trends (see Figure 4 for current gross domestic product (GDP) growth levels), as well as favorable demographics that can spur ongoing economic growth in what remains a low- to moderate-growth world.

Outlook: Constructive and Maintaining Our Conviction

We remain constructive on markets and, as importantly, on our holdings given the positive building blocks of return that we can see over the course of 2017 and beyond. Led by the U.S., economic growth expectations are rising and industrial production and earnings data have been steady after a period of real weakness. If the future does hold broad-based growth, then some degree of cyclical repricing makes sense. However, there is a level of overexcitement surrounding the policies of Donald Trump playing out in the markets, and we would expect the strong run for deep cyclicals and Value to slow when hope meets reality this year. Earnings delivery is likely to be key over the medium term, and this is an environment where we feel comfortable given our bottom-up, earnings growth focus.

It is crucial, however, that we see an aggregate improvement in earnings and that investors are accurately assessing the long-term earnings power of the stocks they own (for both offensive and defensive reasons). The trend in corporate profits has been poor for some time, and this has dragged out longer than expected. A key question now is whether last summer’s “stop getting worse” trend has stamina to “start getting better,” first from a low base and then through growth driven by something other than “spend today, pay for it later” U.S. fiscal plans.

To illustrate why the change in profits outlook is important for every global investor today, Figure 5 on page 6, and the top-left quadrant in particular, shows the environment we have lived in during much of the equity market rebound years since 2008. An environment of falling interest rates and rising corporate earnings that has made for exceptional equity returns.

However, it is important to note that we left this regime some time around 2014–2015 as earnings stalled and quantitative easing hit its natural limits. This regime change and the market’s natural dislike of change and uncertainty explains the volatility that has been playing out in markets. The path forward is now central to the battle being played out between market bulls and bears today.

While it could be argued that the beginning of 2016 focused on economic collapse and a spike in rates stemming from a “credit crisis II” (bottom-right quadrant), in recent months, the market has effectively shifted toward a scenario in the top-right of the quadrant—where interest rates begin to rise with real intent as the global economy improves significantly and inflation and profits growth trending up meaningfully in tandem. This about-turn in sentiment is part of the reason that 2016 was so challenging to navigate, given the extreme swings we witnessed.

The last potential scenario is that we simply continue with more of the same in terms of increasingly ineffective quantitative easing and further struggles on corporate profitability, essentially a repeat of much of the period since earnings and growth began to slow down in 2014 (bottom-left quadrant). While not a disaster in itself, this was the “new normal” that had concerned investors ever since the consequences and structural shifts stemming from the global financial crisis of 2008 were fully understood.

Our own view is that we are more than likely headed to the top-right quadrant, but at a much more modest and slower pace than the market has bolted toward in the fourth quarter of 2016. This environment should be positive for equities, and especially for companies capable of delivering standalone earnings growth in a modest growth world. This will likely entail a slower path, however, with many bumps in the road. Ultimately, our view of modest growth causes us to settle in a constructive middle ground in terms of how our strategy is positioned.

More importantly, while inherently hard to predict, we do not anticipate an especially defined style environment looking out. Instead, we see strong foundations for the evolution of a stock pickers’ market as we move away from “big macro” being the extreme driver of stock returns. This is especially likely if earnings delivery reasserts itself as a driver of stock returns. Indeed, stock correlations have already fallen, providing more opportunity to benefit from the disparity of company fortunes.

It remains imperative, however, to monitor corporate earnings, both individually as stock pickers and in aggregate as equity investors. We need to see an improvement in global profits, as this will be crucial in supporting equity market valuations which are at, or slightly above, average levels on many measures.

Overall, we remain constructive and believe that global equities can still deliver solid returns over the next 12–24 months. While macro uncertainty will remain part of any environment, over the long term, stocks are driven by valuations, changes in earnings power, and cash flow generation. We believe these fundamental pillars will ultimately hold through any evolution of this current equity cycle and will enable us to continue to deliver on our long-term performance objectives

1MSCI ACWI Index returned 8.5% in U.S. dollars, with U.S. dollar strength providing an additional return boost for many non-U.S. dollar investors. Sources: MSCI and FactSet. As of calendar year 2016.

2Sources: MSCI and FactSet. As of calendar year 2016.

3The MSCI ACWI Value Index outperformed the MSCI ACWI Growth Index by 978bps in 2016. As of calendar year 2016.

Important Information

This material, including any statements, information, data and content contained within it and any materials, information, images, links, graphics or recording provided in conjunction with this material are being furnished by T. Rowe Price for general informational purposes only. The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price. The material does not constitute a distribution, an offer, an invitation, recommendation or solicitation to sell or buy any securities in any jurisdiction. The material has not been reviewed by any regulatory authority in any jurisdiction. The material does not constitute advice of any nature and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The views contained herein are as of January 2017 and may have changed since that time.

Australia—Issued in Australia by T. Rowe Price International Ltd. (ABN 84 104 852 191), Level 50, Governor Phillip Tower, 1 Farrer Place, Suite 50B, Sydney, NSW 2000, Australia. T. Rowe Price International Ltd. is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides in Australia. T. Rowe Price International Ltd. is authorised and regulated by the UK Financial Conduct Authority under UK laws, which differ from Australian laws. For Wholesale Clients only.

Canada—Issued in Canada by T. Rowe Price (Canada), Inc. T. Rowe Price (Canada), Inc.’s investment management services are only available to Accredited Investors as defined under National Instrument 45-106. T. Rowe Price (Canada), Inc. enters into written delegation agreements with affiliates to provide investment management services.

DIFC—Issued in the Dubai International Financial Centre by T. Rowe Price International Ltd. This material is communicated on behalf of

T. Rowe Price International Ltd. by its representative office which is regulated by the Dubai Financial Services Authority. For Professional Clients only.

EEA—Issued in the European Economic Area by T. Rowe Price International Ltd., 60 Queen Victoria Street, London EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

Hong Kong—Issued in Hong Kong by T. Rowe Price Hong Kong Limited, 21/F, Jardine House, 1 Connaught Place, Central, Hong Kong.

T. Rowe Price Hong Kong Limited is licensed and regulated by the Securities & Futures Commission. For Professional Investors only.

Singapore—Issued in Singapore by T. Rowe Price Singapore Private Ltd., No. 501 Orchard Rd, #10-02 Wheelock Place, Singapore 238880. T. Rowe Price Singapore Private Ltd. is licensed and regulated by the Monetary Authority of Singapore. For Institutional and Accredited Investors only.

Switzerland—Issued in Switzerland by T. Rowe Price (Switzerland) GmbH (“TRPSWISS”), Talstrasse 65, 6th Floor, 8001 Zurich, Switzerland. For Qualified Investors only.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

- ROWE PRICE, INVEST WITH CONFIDENCE and the Bighorn Sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc. in the United States, European Union, and other countries. This material is intended for use only in select countries.

2017-GL-5499