Within all this, there are a few important factors that drive returns. These factors are driven by different economic fundamentals and tend to outperform at different times. Therefore, it’s important to consider maintaining exposure to those factors that offer complementary outcomes.

Momentum and quality are two such factors.

Momentum investing refers to buying companies with strong performance trends. Quality can be defined in many ways, but a common component typically includes companies with healthy balance sheets or operating profitability. Both momentum and quality have individually generated positive excess returns across most market caps and geographies, however, their performance patterns are differentiated.

After examining returns from each factor in global stock markets in a new research paper by EAM Investors, Momentum and Quality, momentum was found to be the best-performing factor in global equity markets for small-cap, mid-cap and large-cap stocks. Quality outperforms the market, as well, everywhere except for in emerging markets small cap. However, quality tends to exhibit lower volatility than momentum.

The research examined the relationship between momentum and quality across different subsegments of global equity markets.

In global small caps, both momentum and quality outperformed the market return over the entire sample period from July 1991 to April 2024. However, momentum outperformed quality by nearly 300 basis points on an annualised basis in the period. Quality displays a much lower tracking error to the market and lower volatility than momentum. Still, momentum exhibited superior risk-adjusted returns in the period as measured by higher Sharpe and information ratios.

For emerging market small caps, for the same time period, quality underperformed the market return by 149 basis points annualised, while momentum strongly outperformed the market by 531 basis points annualised. Momentum outperformed quality with a lower tracking error with about the same volatility.

The relationship between momentum and quality has fluctuated significantly over time. Correlations have trended increasingly negative in recent periods, particularly in US small cap and emerging markets. Generally, the varying degrees of relationship between momentum and quality result in a beneficial pairing particularly in periods of major market regime shifts.

For investors looking to maintain a balanced portfolio, having exposure to the right factors is key.

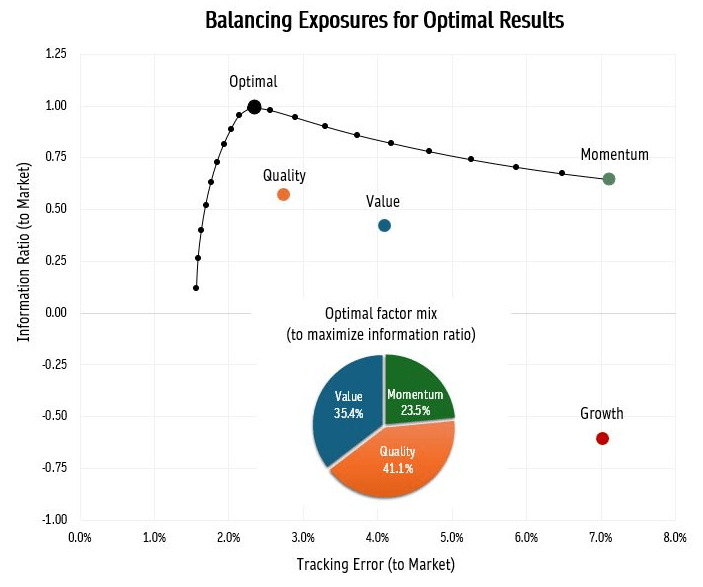

So, what is the optimal mix of strategies? Having examined momentum and quality along with other prominent style factors, including value and growth, to determine what an optimal mix of strategies might look like, this analysis points to an optimal blend of strategies through maximising the information ratio, by combining momentum and quality in a diversified portfolio, or using momentum as a stand-alone satellite due to its leading risk/return characteristics.

Results in global small cap show that a blend of quality, momentum and value yields the highest information ratio. Growth is noticeably absent due to its inferior risk/returns characteristics in the global small cap universe.

Momentum is often misunderstood and under-utilised due to its perceived risks and implementation challenges; however, research points towards including the factor as part of an optimised and diversified portfolio in global equity markets, especially in the case for global small caps. By incorporating momentum within this small cap universe, investors can potentially unlock a more reliable and persistent source of alpha. At EAM Investors, we have included momentum into our proprietary investment approach Informed Momentum. By incorporating momentum with stock selection, tailored risk management and efficient implementation, we aim to maximise alpha for investors.

With an evolving investment landscape, we believe that leveraging momentum strategies may prove instrumental in navigating the shifting tides of financial markets and achieving sustained outperformance.

Travis Prentice, co-founder and chief executive, EAM Investors