Data spanning the past two decades confirms the benefit to portfolios of consistent exposure to broad, diverse areas of the stock market over the long term. On the other hand, being exposed to just a few big stocks raises the risk that when they go down, so will portfolio returns.

Already, rising US Treasury yields and other factors have combined to dent the run of some of the big seven. Apple shares, for example, have significantly underperformed the overall US stock market and that trend of underperformance could extend to the other six of the Magnificent Seven. While the S&P 500 has gained 27 per cent over the 12 months to 3 April 2024, Apple shares are up just 2 per cent. That compares to a gain of 224 per cent for Nvidia, Meta’s rise of 136 per cent, a 75 per cent gain for Amazon, 82 per cent return for Netflix, a 46 per cent gain for Microsoft while Alphabet has gained 48 per cent.

The sheer scope of the Magnificent Seven’s dominance in the US stock market arguably sets a new standard for “narrow leadership”.

Investors would be wise to keep diversified as history shows too that when large-cap companies have posted significant outperformance, they underperform in subsequent years.

So, it may be time for global investors to reassess their allocations and exposure to these big seven stocks should their magnificence begin to diminish, as Apple’s already has. Long-term exposure to diverse areas of the market may have the potential to produce superior investment performance.

Magnificent Seven set new standard for concentration

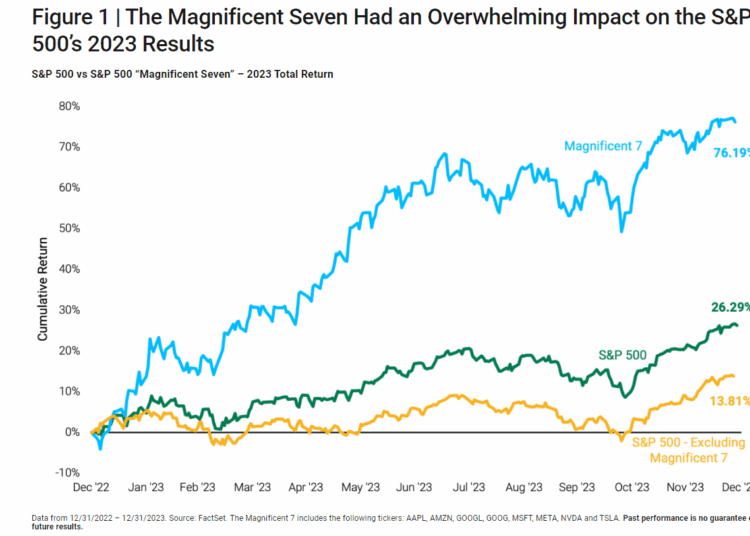

What happened in the US stock market last year deserves closer attention. While the S&P 500 gained more than 26 per cent, if we exclude the Magnificent Seven, the remaining index constituents rose just under 14 per cent. The Magnificent Seven, on the other hand, jumped more than 76 per cent, as the chart below shows.

As a result of their gain, the Magnificent Seven now account for around one-third of the S&P 500’s market weight – an all-time high – and 17 per cent of the MSCI All Country World Index’s (ACWI) total market capitalisation. Their combined weighting in that index now surpasses stocks from Japan, France, the UK and China combined. As a result, investors using the index as a proxy for a global investment portfolio now have more exposure to the Magnificent Seven than they do to three leading developed markets and the world’s second-largest economy.

That is a risky position to take as their prices can fall, as well as rise.

Indeed, in prior times, the Magnificent Seven have been volatile. Their 2023 rally followed 2022 in which they lost a combined 41 per cent of their value, compared with a 12 per cent decline for the rest of the S&P 500. That is a significant underperformance and, as Apple’s recent underperformance highlights, the tide can turn at any time for any one of these big technology companies.

Of course, the Magnificent Seven have far more established revenue and earnings streams than many of the dot.com stocks that inflated the 1990s stock market bubble. Powerful innovative forces have helped turn the Magnificent Seven into economic engines with the potential to shape society for decades to come. Nonetheless, their recent leadership dominance raises the spectre of concentration risk.

As such, holding a portfolio that tracks the US market index or is heavy with the big seven technology stocks is risky from an investor’s point of view. Some investors now may have considerably more exposure to narrow portions of the technology sector than they did just six or 12 months ago. That’s particularly true for investors who rely on exchange-traded and index funds tracking market weights of popular global indices. Such concentrated exposure may compromise their portfolios in terms of risk management and potential returns.

Time to reweigh away from tech mega caps

Over the long term, a well-diversified portfolio of shares rather than concentration in just a few stocks offers clear benefits to investors in terms of risk management and returns.

Indeed, a key advantage of actively managed portfolios compared with their passive, index-replicating counterparts, is that actively managed portfolios can guard against such unintended risks through broader security selection and asset allocation. However, it also makes active managers vulnerable to short-term underperformance during periods of narrow market leadership, as we have seen.

But the benefits of diversification are clear. Data show that, over time, investors in global portfolios benefit from a consistent allocation to diverse areas of the market. Those benefits accrue from both risk and return perspectives. That’s why investors in global portfolios maintaining a more diversified approach should consider remaining patient, particularly given the world’s precarious economic position and geopolitical uncertainty. Furthermore, we believe that investors who haven’t already incorporated an active approach may want to consider spreading their risks.