How, it was asked, can it be that public markets are down 20 per cent and private markets are only down around 5 per cent? Surely, private market valuations had fallen harder and just weren’t being reported as such.

Tempting as this narrative is, the hard facts are against it. According to Hamilton Lane data from our 2023 Market Overview, in fact, valuations are pretty accurate across most private market sectors. How can that be, given the overriding narrative to the contrary? Again, we’ll turn to the data.

In sum, private markets started off 2022 generally priced at a discount to their public sector equivalents; also, private markets had more exposure, relatively speaking, to better performing sectors; private companies held in private market portfolios had, on average, stronger operational performance than did their public market equivalents, and to cap it all, prices at exit show that GPs on the whole do value their portfolio companies in a conservative fashion.

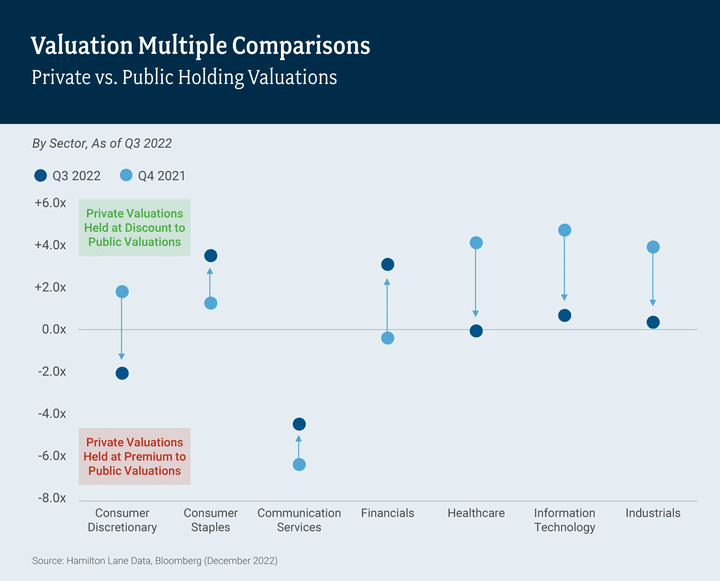

First, at the outset of 2022, private equity was less expensive compared to public markets, so it’s not a big surprise private valuations didn’t perfectly mirror the declines on the public side: private markets were already valued in a conservative fashion compared to public markets.

Second, while it may have felt that the sky was falling in 2022, it is important to bear in mind that not everything fell in value. About 15 per cent of the component companies of the MSCI World Index were up more than 10 per cent in 2022. Selection certainly mattered and sectors mattered a great deal. Well, overall, better-performing sectors had greater weightings generally in private portfolios while poorer-performing sectors had smaller weightings. So the data shows that some of the outperformance from private markets was the result of strong sector selection by GPs.

A third reason that private valuations held up was because private companies notched up better operational performance than public counterparts. In 2022, private companies subject to buyout deals outperformed companies on the MSCI World Index when it came to revenue growth and EBITDA growth. So all else held equal, these private companies should not suffer to the same extent as their public counterparts due to stronger and more resilient fundamentals.

Our final data-backed reason that valuations in private markets held up last year: The average price at which GPs exited deals. Looking at deals exited over the two years to Q3 2022, the value of a company was on average 21.5 per cent higher at exit compared with its value four quarters prior. The average mark-up was 5.1 per cent and 0.2 per cent compared with valuations two quarters and one quarter prior to exit.

So we can see that exits have historically tended to occur at prices higher than valuations. Furthermore, this is not just true when public markets are strong but was also true in the bearish year 2022.

This doesn’t mean private market valuations couldn’t course-correct this year; they may well do (as they did in 2001 and 2008), though initial data suggests a strong Q1 2023. It only goes to show that previous valuations, throughout 2022, were accurate and generally on the conservative side, and that it is a leap to suggest that valuations in private markets will continue to fall. An assertion along these lines is making an implicit assumption that public markets will also continue to drop.

The chance of the opposite occurring, namely, private valuations falling even if public markets rise, is incredibly slim – it’s only happened in one quarter in the last 30 years.

According to the data, the public-private lag that so many have been talking about (the period when those in private markets will lose money while public markets recover), is the exception and not the rule. Furthermore, where the MSCI World is negative for a quarter, only ~50 per cent of the time are buyouts also negative. Private markets usually perform better, in fact across the 132 quarterly data points shown below, they outperformed 64 per cent of the time.

Conclusion

The intrinsic differences between public and private equities and the way public and private companies have to be valued, means this question about valuation is always going to be asked. The year 2022 only provides a particularly relevant case study because the valuation gap had become extreme.

While it may have looked like private valuations were proving sticky because GPs were lowballing the markdowns, in truth there were a number of overlapping reasons for private valuations to not track the fall in public markets. GP valuation practices were, on the whole, conservative.

John Stake, managing director, co-head of fund investment team, Hamilton Lane