Even if the failure of Silicon Valley Bank (SVB) and the woes at Credit Suisse do not turn into systemic problems, at the very least, they will inhibit activity. Already cautious loan officers are likely to tighten their standards further.

In the face of the headlines that these issues are creating, individuals usually increase saving and cut spending. And corporates will inevitably look even more closely at their liquidity and raise the required return of any potential investments.

And so, the recent collapse of SVB and problems at Credit Suisse create real concern when it comes to the outlook for global equity markets. In fact, we would go as far to say that the outlook for international equities is as bad as we have seen for years with many significant challenges.

However, even with this grim outlook, we still believe there are opportunities, especially for value managers that can find assets trading at a discount.

This kind of value investing relies on understanding numbers and accounting insights and being able to look through overly optimistic estimates, that essentially misrepresent the economic realities.

By incorporating the consideration of items like restructuring charges, stock-based compensation and pension obligations, an estimation of a company’s normalised returns has the best possible chance of reflecting a true rather than a distorted picture.

The outlook

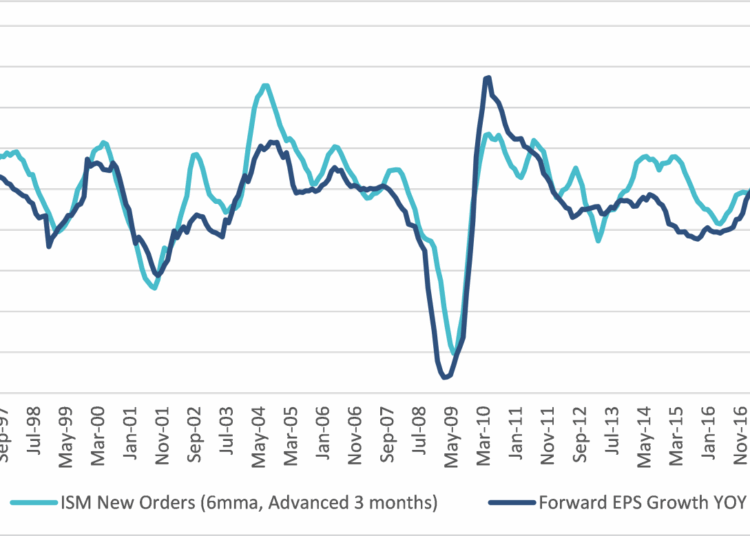

In determining where we are in the economic cycle, we believe one of the most important indicators to follow is the US’ Institute for Supply Management’s (ISM) manufacturing survey, which measures corporate profitability.

A manufacturing ISM above 50 signals the economy is expanding, suggesting an increasing level of future corporate profitability, below 50 suggests a decreasing level.

With the manufacturing ISM in the US below 50 and trending downward since June 2022, and with interest rate increases yet to work their way through the system, we are currently in the risk-averse stage of the cycle. The balance of probabilities therefore is heavily weighted towards falling indices and negative returns.

Source: Bloomberg

More challenges

There is a raft of potential challenges supporting our not so positive outlook for the US economy and therefore equities. Here are five we would like to highlight.

1. Government deficit and household savings

More deficit and less savings have been positives for corporate profitability. After pandemic-induced increases in the deficit, it is currently set to remain at between 5 to 6 per cent of US GDP, providing no further sugar rush to business profits. The savings rate has also fallen to 4.7 per cent from 33.8 per cent during the beginning of the pandemic and provides no reason to expect corporate profitability to continue to benefit from its reduction.

2. Unit labour costs rising

The US Bureau of Labor Statistics shows there are currently twice as many job openings as unemployed persons, which is about as high as it has been since the global financial crisis (GFC). The consequences of worker shortages are showing up in median wage growth which has accelerated since the start of 2021.

3. Interest rates rising

Before central banks started increasing rates last year, the falling cost of corporate debt played an important role in boosting business’ margins. But with interest costs now rising, it is hard to imagine an imminent and indiscriminate income hunting environment that will again push interest costs to all-time low levels.

4. Taxation rates rising

Under the current administration, business taxation is yet one more recent tailwind in the United States that is set to subside or, more likely, reverse as the administration considers raising the marginal tax rate on US derived profits.

5. The impact on earnings per share (EPS)

According to Bloomberg, current year S&P 500 EPS estimates peaked in June last year at $248 with the latest at $220. EPS could easily fall to below $200, perhaps materially below. If that seems unlikely, don’t forget the 2019 pre-pandemic peak high was just $164. Reversion to that level would put an S&P 500 index at 4,000 on a PE of 24 times.

A value playbook

In this kind of environment, equity investors need to prize income, good value, short duration, and rapid payback periods. They should avoid high beta shares, those with prices that can be largely or more than fully explained by overall market moves, and they should avoid financial leverage. Our key message for the equity investor would be defence, defence, defence!!

Hugh Selby-Smith, co-chief investment officer, Talaria Asset Management