We have seen some superannuation funds have also become more comfortable with deviating from the property benchmark used in the Your Future, Your Super regime, which is heavily weighted towards local office and retail assets.

Investors need to have strong conviction to take an intentional tracking error from a benchmark, including investing in property sectors and geographies that deviate from that benchmark.

In terms of portfolio diversification, many local institutional investors have a preference to add exposure to private real estate property sectors in which tenant demand doesn’t necessarily move in lockstep with the economy. Data centre demand, for example, has proved resilient in both downturns and periods of economic expansion.

The amount of digital data expected to be created over the next five years will be more than double the amount of data created since digital storage was first invented in 1956.

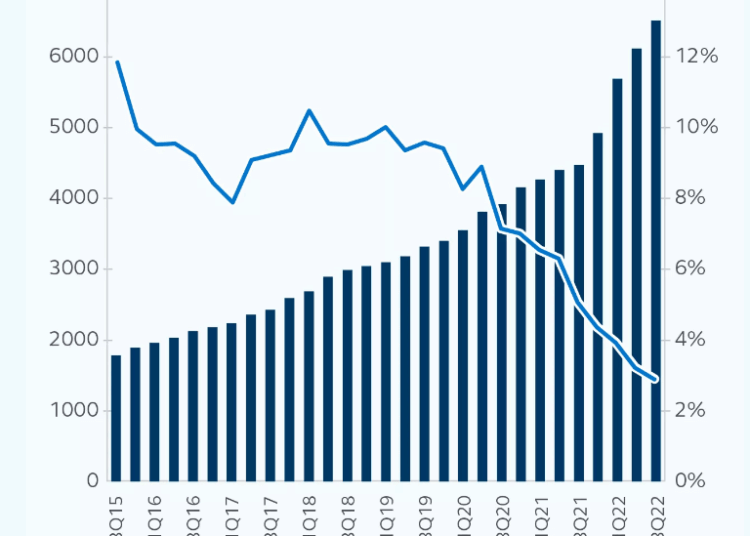

Processing and securing this data have led to rapidly increasing demand for data centres, and even though leased data centre capacity has more than tripled since 2015, vacancy is at an all-time low.

The unique characteristics of data centres mean that a handful of markets have emerged as more dominant than others. US locations in this category include Northern Virginia, Dallas, Chicago, Phoenix, Northern California, and Portland.

Low correlations to other assets, a favourable risk/return profile, and strong interest from institutional capital make data centres a portfolio component with strong appeal. Longer leases, many times in excess of 10 years, also make data centres attractive, giving investors exposure to cash flows from high-quality credit tenants at higher yields than many other property types.

Demand is far outpacing supply

Growing demand for data centres has not been satisfied by the supply side, in part due to power grid limits imposed by local governments. Record low vacancy rates in key markets and accelerating demand have shifted the balance of pricing power toward landlords. This has resulted in higher lease rates and contract rent escalations. This is important as data centre tenants are not immune to concerns such as rising energy prices, supply chain issues, and labour shortages that are prevalent in other property sectors.

Exhibit 1: Market size and vacancy rate

For long-term investors, particularly those aiming to fund obligations by matching income and liabilities, stabilised data centres may offer some inflation.

Further, while sourcing opportunities in growth sectors during economic uncertainty is challenging, data centres are among the few areas where the structural growth story is intact. We see this as an attractive sector as the options to gain investment exposure to the data centre sector are scarce due to limited offerings — core investments rarely trade and the pool of highly-technical developers who have capacity to build hyperscale data centres is thin.

John Berg, senior managing director, head of private equity portfolio management, Principal Asset Management