While equities are set to post their worst year since the 2007–2008 global financial crisis and bond market returns are their weakest in a much longer period, private credit funds are targeting returns of 9 to 12 per cent in these market conditions. Even better, expected returns from private credit funds have generally increased as official interest rates and inflation have moved upward as the year has progressed.

This is because private credit structures generally have interest rates based on a floating ‘base rate’ benchmark overlaid by a healthy margin meaning that investor income rises alongside interest rate increases. In addition, innovative private credit managers have come up with equity-like instruments that can be used to improve returns more, making private credit a truly defensive asset class, but more about that later.

While this positive correlation to a rising interest rate environment and low correlation to traditional fixed interest securities is the key attraction for many advisers we partner with, others are attracted by the way the illiquidity premium of credit provides higher returns. Some advisers are also drawn to the asset class’s lower volatility because private credit managers are not forced to mark-to-market their assets daily as they would in tradeable public markets.

Private credit is a broad church covering syndicated corporate loans, securitisation, property debt and infrastructure lending, as well as other more esoteric segments. In Australia, private credit is estimated to be 10 per cent of the corporate loan market but is steadily heading towards the 40 to 50 per cent share of non-bank lending now seen in Europe.

It is a historical anomaly of Australian investment portfolios that they have generally been underweight fixed income at both institutional and individual investor levels compared to global investors. Australian portfolios have a 14 per cent allocation to fixed income which decreases further when analysing Australian Self-Managed Super Funds’ 2 per cent allocation to fixed income. This compares to 36 per cent in the United Kingdom, 22 per cent in the United States and 28 per cent across the world.

Within this underweight fixed income allocation, private credit has also been underrepresented in Australian portfolios, but this has started to change over the past three or four years, particularly with more high-net-wealth investors, and family offices becoming convinced of the case for private credit.

As one seasoned investor noted earlier this year, “at the moment, you can get a net return in private credit of about 8.5 per cent when long-term equity return is 9 per cent to 10 per cent. In other words, you can get about the same return as equities with hypothetically one-tenth of the risk”.

Looking across the $10 billion of portfolios that we administer for private client businesses and family offices, approximately 15 per cent is allocated to fixed interest. Of this, around 23 per cent is allocated to private credit and this allocation is increasing steadily. Our client’s exposure to private credit is spread across various types of credit mandates such as those that focus on property lending (commercial or residential), corporate lending (large, mid-market or SME), thematic-driven, sector-specific or diversified and a range of direct securities.

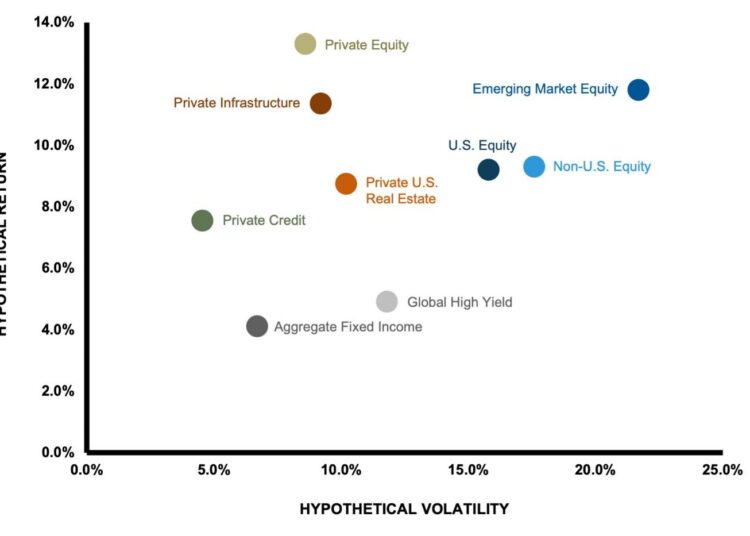

Comparing forecasted risk and return across asset classes: Russell Investments Strategic Planning Forecasts, March 2022

Australia, like the rest of the western world, has seen a significant decline in bank lending to the Small and Medium Enterprise (SME) market and when coupled with a domestic debt capital market that lacks the scale and depth compared to overseas counterparts there is an SME funding gap here.

This funding gap provides private credit investors with opportunities to deploy capital into the sector through structures that protect capital while exhibiting excellent risk-return profiles and has been increasingly embraced by non-bank lenders eager to serve SMEs.

Innovative and successful managers often approach credit opportunities through a private equity lens prior to moving to credit assessment. They will take the time to have a deep understanding of every investment they make, including the borrower’s key drivers, asset position and funding requirements. As opposed to a traditional credit due diligence process involving a quite passive backward-looking view of historical financials, this new wave of SME lenders aims to fundamentally understand the key growth drivers of the business, its competitive moat, management strength, and whether its industry faces structural or macroeconomic tailwinds.

One of these innovators, Ben Harrison, CIO of Altor Capital said, “given that we are doing equity-level due diligence, it makes sense to have our typical loan structures include warrants or other equity-like instruments, which provide the potential to enhance return through the success of the borrower. Just as any increase in interest rates generally flows directly through to the investor in terms of returns, if the company we lend to prospers as a result of our support, we also get to enjoy a share of the spoils. Given the lower potential losses in an event of default, returns are left skewed towards the ability to generate significant risk-adjusted returns with equity-like instruments.”

This equity-like analysis of the underlying business model of the borrowers can deliver a defensive characteristic to a private debt portfolio. In high inflationary environments, a portfolio of companies that can pass on cost increases to customers and maintain margins can safeguard investors against rising input costs such as wages and raw materials.

Additionally, many managers structure debt instruments that vary from senior secured facilities, equipment financing, acquisition financing, management buyouts or research and development lending. These senior secured loans are rarely a feature in public and government bond markets and offer a new way for investors to diversify.

Mark Papendieck, chief growth officer, Integrated Portfolio Solutions