Private assets were once solely the domain of large investors, be they public or private institutions, superannuation funds or endowments. Developments in holding structures, liquidity optionality, removal of the traditional capital call process, fund accounting and lower entry costs means they can now be accessed by high-net-worth investors (HNWIs), family offices and other sophisticated investors such as SMSFs.

Instos and high net worths led the charge, SMSFs following

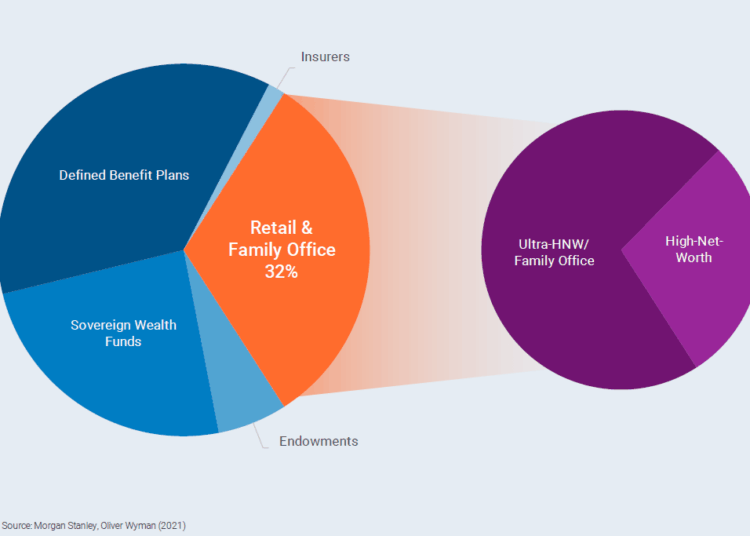

As tracked in the chart below, HNWIs and family offices have led the way in seeking to access this market and continue to remain a large part of the non-institutional investment segment as allocation towards private markets has increased.

These groups have invested nearly $2 trillion in private equity, as at the end of 2021 according to HNWI net asset value data from Morgan Stanley. While only 29 per cent of HNWIs currently allocate to private markets, this is expected to rise significantly to 46 per cent, by 2024.

This is echoed here in Australia — with sophisticated investors such as institutions and HNWIs increasingly adding private markets to their portfolios or expanding their existing allocations in search of potential return drivers, exposure to innovative private companies, and importantly, diversification away from volatile stock markets.

Specialists provide easier access

Specialist private market fund managers recognise this investor demand and have increased focus on bringing better access, not only to HNWIs and family offices, but also to SMSF investors who seek to access a wider source of investment opportunities.

To ensure this happens, enhancements and change at the industry and private capital product levels must continue to occur.

While locking up capital for several years is still common, particularly for institutional investors who have ready access to alternative forms of liquidity to fund longer-term superannuation payments for members, it’s not ideal or realistic for HNWIs, family offices or even SMSFs with sometimes smaller capital sizes and unexpected liquidity needs.

Innovative fund structures and digitisation

The new vanguard of private market funds still invests in illiquid unlisted assets to take advantage of the returns that private markets can provide. However, smaller sophisticated investors are able to access their funds on a more regular basis to not only add to their holdings, but withdraw funds as well due to newer fund structures which allow for the option for liquidity.

But relative liquidity isn’t the only benefit of this trend towards increasing access to this distinct asset class. Minimum investment requirements also play a critical role. For a HNWI, that amount can be quite subjective. There are now minimum entry points ranging from $100,000 to an even lower $25,000 for example.

Additionally, with the advancement of blockchain technology, private market opportunities are becoming more easily accessible through digitising paper processes, providing more creative structures, and enabling fractional ownership via tokenisation for as little as $10,000.

Investment benefits still at the core

It’s not just liquidity, removal of the traditional capital call process and lower investment minimums that are attracting smaller sophisticated investors to these assets. Investors are increasingly understanding the wider range of assets now available to them and how these can assist them in their portfolio construction.

This is in part due to a number of Australian superannuation funds making available their asset allocation public, along with their reasons for investing in various asset classes, including private assets. Investors seek to replicate some of the benefits of these previously difficult and expensive to access assets in their own holdings.

Increasing transparency and information also provide the wider investor market with similar levels of comfort when investing in private markets. But ultimately, it is improved risk management and return characteristics that drive investor interest, in particular during current volatile market conditions.

More private markets subsets

One reason is attributed to the fact that in periods of lower public market returns, private markets’ outperformance has historically widened, offering diversification within portfolios and attractive risk-and-return characteristics.

Then, there are subsets of private markets including venture capital, direct and secondary private equity and credit — all available through a much easier to access, single allocation.

The asset class is not without its additional risks though, and investors’ tolerance for alternative asset-specific risks also need to be considered. Some of these include limited redemption risk, management execution risk and regulatory risk. Having a professional private markets investment manager helps mitigate some of these risks.

Increasing access set to continue

Accordingly, improved understanding of a wider variety of asset classes, coupled with technology that enables a wider number of holdings in fund structures and fund accounting means that more investors can gain access at a cost-effective price to a wider range of assets than ever before.

James Martin, head of international client solutions, Hamilton Lane