Two key features of infrastructure are compelling right now.

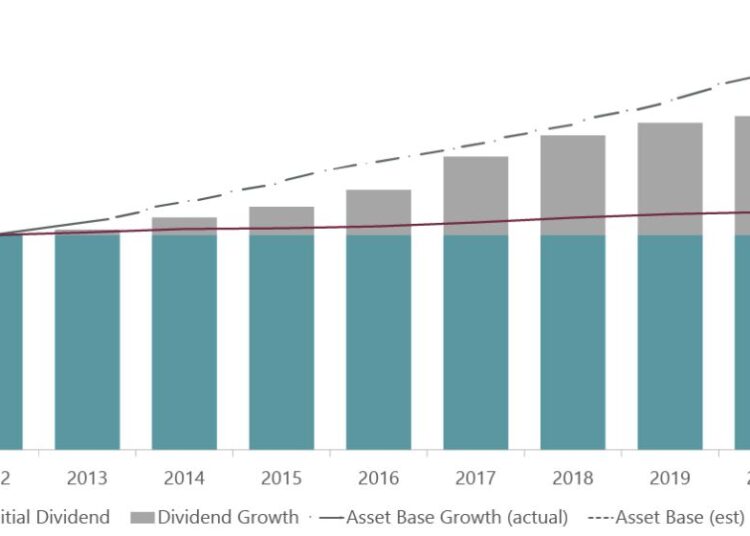

First, its power as an inflation hedge. Broadly, infrastructure can adjust to inflationary environments due to the pre-programmed way it builds inflation into regulation and contracts. This applies to both regulated utilities, which adjust their allowed returns with regulators to account for inflationary cost increases, and user-pays assets, such as toll roads or rail, as both types of infrastructure generate inflation-linked revenues. As a result, dividend yields are attractive and, in our portfolios, have grown above inflation, closely tracking the asset growth of the underlying companies (Exhibit 1).

Exhibit 1: Infrastructure Dividends, Above Inflation, Linked to a Growing Asset Base

As of March 31, 2022. Source: ClearBridge Investments. ClearBridge Global Infrastructure Income Strategy.

Infrastructure’s pricing power comes from the essential nature of its assets: even at times of economic weakness, consumers continue to use water, electricity, and gas; drive cars on toll roads, and use other essential infrastructure services. The income we look for from infrastructure is underpinned by long-term contracts, which ensure a steady flow of revenue over an extended period.

The second key feature driving interest in infrastructure is its vital role in decarbonisation.

Infrastructure and utilities are at the forefront of this effort and can offer investors a stable return on equity without taking technology risk. Annual power sector capital spending is expected to increase from US$760 billion in 2019 to US$2.5 trillion (in 2019 dollars) by 2030, mostly on solar, wind and other renewable energy generation and on modernizing and extending electricity networks. Electric vehicles have also been gaining more consumer acceptance. In some estimates, 20 per cent of vehicles sold annually today are electric, but by 2030, that is expected to increase to 60 per cent, although figures differ from country to country.

In our estimation, this spending will flow through to asset base growth for regulated utilities globally, driving strong return outcomes.

Other consumer transportation changes might result from global decarbonisation. Rising fuel prices and rising emissions also affect air travel. Airlines could be taxed if flights are too short, making rail and public transit look more appealing to some consumers.

And while energy infrastructure pipelines have seen renewed interest as energy security has become a strategic priority (in Europe, for example), midstream pipelines are also beginning to facilitate an energy transition through hydrogen or carbon capture and storage, developing technologies that will only have an increasing role in net zero efforts.

So, there are several areas of infrastructure benefiting from decarbonisation tailwinds, not to mention other secular trends like 5G driving investment in communication towers, and with its ability to pass-through inflation as well as provide current income, infrastructure’s attractiveness now is no surprise.

We believe the opportunity set for infrastructure investors is only set to grow, with a number of powerful drivers, as well as attractive valuations and potential dividends that income-seekers should find appealing.

Charles Hamieh, portfolio manager, ClearBridge Investments