Nationwide, we see housing values are still rising – with CoreLogic’s National Home Value Index (HVI) for April recording 0.6 per cent growth, albeit the lowest since October 2020.

What we are seeing though, is a “three-speed” housing market challenging both buyers and sellers, with:

-

Sydney, Melbourne and Hobart in decline on the back of affordability constraints;

-

higher rates – with further cash rate rises on the horizon, a rise in listing numbers and lower consumer sentiment on the back of cost of living and inflationary pressures;

-

Adelaide, Brisbane, Perth and Darwin are holding up on the back of the rebound in migration and relatively lower stock, with growth rates over 1 per cent. Regional markets also seem somewhat insulated with a 1.4 per cent increase in April across the regions – mainly on the back of an imbalance between advertised stock levels, which are 42 per cent below the average five-year rolling index, and demand up 20 per cent.

Investor perspective

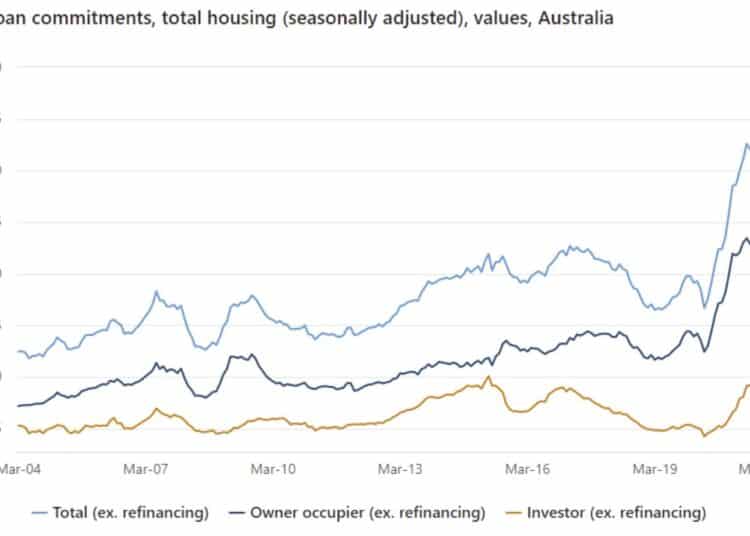

The market surge over the last two years was driven predominately by owner-occupiers. In fact, many investors either sat on the sidelines and took the opportunity to lock in and access capital – to position themselves to re-enter the market when the right asset comes up and as stock levels rise, or in fact, they took advantage of the surge and left the market “cashing in” through 2020 and 2021 making a tidy capital gain.

Investors are now returning to the market after this hiatus, with recent ABS data showing investors loan commitments up 48.4 per cent and owner-occupier down 2.2 per cent compared to a year ago.

Why the surge in investor opportunities?

Long-term investors have an eye on a rebound in 2024-25, and are assessing a market that is losing momentum. With increased stock levels, they see it very differently to owner-occupiers where the mortgage is non-discretionary, and many who have never seen a rate rise and where rising inflation directly cuts into consumer spending. For investors, the effective value of the loan is shrinking.

Additionally with rising rents, where vacancy rates are as tight as anyone in the market can remember – (remembering some investors left the market adding to low rental stock), investors are somewhat insulated from the inflationary pressures, as the risk of their property making no income is minimal. On top of this, rental yields are on the up with CoreLogic’s National Home Value Index (HVI) recording rents up 2.7 per cent over the three months to April, with the annual change in houses at 9.1 per cent and units catching up quickly at 8.7 per cent – as affordability constraints start hitting renters.

Additionally, we are in an environment of rising rates – with a series of rate hikes on the horizon. Albeit for an investor money is still relatively “cheap” with gross rental yields on the up as the market for rentals heats up. These higher yields and the longer-term capital growth prospect is seeing investor credit growth the highest level since 2015, surpassing owner-occupier credit for the first time since 2016.

How long-term “wealth creation” investors are approaching the market

-

Work out the strategy, be well informed and focus on quality assets.

-

Understand the investment strategy – whether it be to live off the income, maximise equity and build a portfolio, or a combination.

-

Do the homework on a good investment property including:

-

Does the property have strong capital growth potential?

-

Understand the region, its infrastructure and economy – will it be easy to find tenants, what rental income can be expected and what are comparative prices?

-

What infrastructure developments may be on the horizon, and how might they impact the property

Analyse the cash flow and the potential income and costs to hold the property.

And lastly, not every property makes a good investment! Successful property investors are doing their homework and never stop researching the market to capitalise on the best opportunities across all of Australia’s property markets and not just their local market, in order to find the best investment.

And finally, as with investing in any asset class, critical for property investors is to remain disciplined and keep emotion to one side – a quality asset will stand the test of time and for most, property is a long-term investment, not bound by the short-term sentiment of market emotion.

Anthony Landahl, managing director, Equilibria Finance