The warnings of economic fallout have only become more apparent this year. As the unprecedented central bank stimulus reverses direction, is 2022 the year that the crisis finally catches up with the market?

Market disruption and rotation

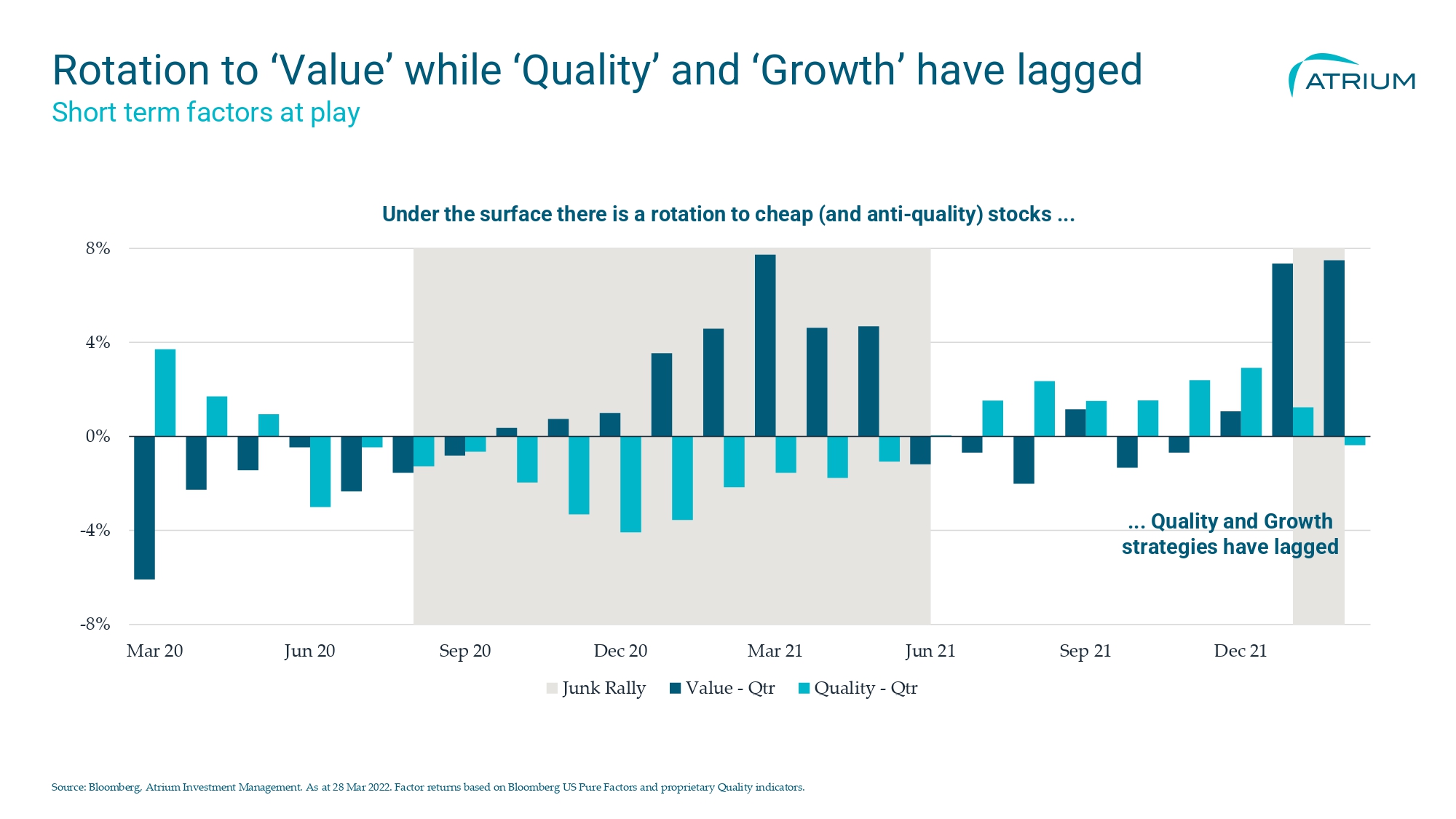

Repetitive and ongoing supply chain disruptions and geopolitical uncertainty have exacerbated already elevated inflation concerns and have resulted in an unusual market environment where lower quality cyclical companies are significantly outperforming higher quality more predictable companies as the risks to growth increase.

Quality stocks are often well-managed companies characterised by predictable and growing earnings, high margins with pricing power, strong balance sheets with low financial or operating leverage, culminating in lower relative stock-specific risk. Lower-quality stocks (sometimes referred to as “junk”) are typically cyclical and unpredictable, unable to maintain margins through higher-input costs, have weaker/less robust balance sheets and consequently have higher stock-specific risks.

Rising interest rates and soaring commodity prices have led investors to rotate their portfolios and chase value offered in these very cyclical low-quality equities as they focus on near-term earnings upside irrespective of longer-term concerns about earnings sustainability. The winners and losers for the financial year reflect the extreme volatility of the markets, with cyclicals and lower quality strongly outperforming quality.

Implications for equities, bonds, and property

Elevated and persistent inflation concerns are the pre-conditions for an environment characterised by increased macroeconomic and asset price volatility and steeper, more prolonged drawdowns in asset prices. These ingredients could prove dangerous for investors if they apply the investing rules of the last decade. The beneficiaries of ever-lower interest rates over the past two decades, including leveraged residential real estate and unprofitable tech companies, will suffer in such an environment as they have done in recent months. In this disrupted market, the Atrium investment team believes the traditional portfolio of a typical SMSF investor, comprising a 60/40 split of equities/bonds, super and investment properties, will not perform as well as it comfortably has over the past decade.

Investors must be especially wary of using bonds as defensive assets in such an environment. Historically, the bond market is sensitive to the predicted path of interest rates and how well the market believes central banks are managing monetary policy. Persistent and rising inflation concerns have seen interest rates rise dramatically this year. This has meant that traditionally classed “safe” assets, such as government-issued bonds, are another loser this financial year – in fact, the Bloomberg AusBond Government Index is undergoing its worst drawdown in 30 years.

Such bond volatility has a material impact on traditional multi-asset portfolios as bonds are traditionally used to diversify portfolios. While the correlation between equities and bonds is commonly thought to be negative, it becomes positive when inflation peaks as it did when inflation last reached similar levels in the 1980s. Over the past decades, monetary policies have acted to keep the correlation negative, but we expect bonds and equities could be positively correlated over coming periods. This is a risk for investors who use only the rules of the past to construct portfolios for the future.

Another typical part of diversified investment portfolios, particularly for SMSFs, the property market, is also likely to be impacted. A 2.5 per cent cash rate implies a 5.5 per cent mortgage rate. The percentage of disposable income to service a mortgage at that rate would reach levels not seen since before the Global Financial Crisis of 2009. Can home owners, squeezed by higher petrol, goods and food costs but stagnant wages growth, absorb rate hikes?

Many think that the RBA will not raise the cash rates beyond 2.5 per cent as resultant mortgage defaults and decreased demand for houses would crash the Australian property market. However, to plan in an uncertain market, all scenarios should be considered, including the worst case, in which ramping inflation would force the RBA to keep on increasing interest rates.

The opportunities: Looking through short-term noise in search of consistent returns

In the short term, various market cycles and factors such as growth or value might dominate performance. More recently, rising interest rates have led to concerns about an imminent recession further complicating the outlook. However, for long-term investors, the goal should be to look through the short-term noise. At Atrium, we focus on maximising returns and minimising risk through true diversification as well as tactically capturing oscillating moves in currencies, commodities and equities to contribute positive absolute returns to our Risk Targeted multi-asset portfolios. Our philosophy is that just investing in bonds and equities is not enough. Just as chasing returns without understanding and managing risks is not enough. Instead, we invest in a broader range of asset classes including liquid alternatives and private markets as genuine portfolio diversifiers to exploit the macroeconomic uncertainty with long and short positions in a variety of markets. By actively managing the risks, keeping a firm eye on valuations, and being flexible in our allocations, we aim to deliver for investors regardless of market conditions.

Tony Edwards, chief investment officer and executive director, Atrium Investment Management