Year to date defensives have outperformed value, growth and cyclical stocks, doing what they are supposed to do in uncertain times: offer equity investors a shield against the onslaught of valuation pressures, slowing earnings growth and increased uncertainty. As we continue to brace ourselves for ongoing volatility in equity markets, we prefer to maintain exposure to selective stocks with defensive characteristics – those that are winning by not losing.

The big de-rating might not be over

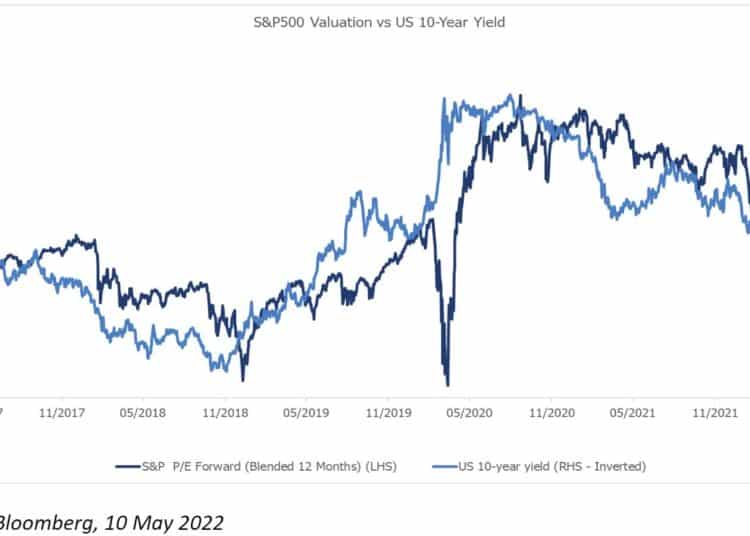

Global equity markets have de-rated since the recent peak in September 2020, with a sharper deceleration in 2022 driven by rising inflation fears as reflected in higher 10-year bond yields. In fact, most major market indices are now trading below their pre-COVID valuation levels. The derating has been particularly evident in the more expensive parts of the market, such as Technology stocks. For example, the Nasdaq Composite Index has fallen by -25 per cent so far this year, with most of this occurring through forward PE multiples contracting from ~32 to ~23x currently. In comparison, the S&P 500 has fallen 16 per cent and contracted from ~22x to ~17x over the same time frame.

Despite this overall market de-rating, most major indices are still trading in line or above their 20-year averages and remain relatively high when considering the sharp rise in 10-year yields (see chart below). The Russia Ukraine War has also recently pushed commodity prices to new highs, raising inflation risks and potentially placing further pressure on market valuations.

Valuations may be at more risk as bond yields continue to surge

Investors’ fears are shifting from inflation to growth

US GDP has surged past prior cycle peaks but is now decelerating sharply. Similarly, while 1Q22 earnings were modestly ahead of expectations on average, management commentary and guidance about the outlook has been increasingly cautious, prompting analysts to downgrade earnings forecasts for both 2022 and 2023. In fact, earnings revisions breath has been declining since August 2021 and has recently moved outright negative. Given the wide range of headwinds companies currently face, which include cost pressures, supply chain constraints, inventory build ups and potentially weaker demand from higher prices and lower global growth, it’s likely that earnings revisions will remain negative for the foreseeable future. This has historically been associated with weak overall market performance (see below).

Earnings revisions and price are highly correlated

Earnings leadership has taken another step to being more defensive

At a sector level, we have however seen a sharp contrast with the classic defensive sectors, such as Utilities and Consumer Staples outperforming the overall market year to date, driven by a superior ratings performance as well as better earnings revisions versus their cyclical peers and the broader market (excluding the Energy and Materials). Defensives have a strong track record of outperforming during slowing growth/recessionary periods, a relative safe-haven within periods of market stress. With a broad range of defensives already reflecting these benefits in relatively high valuations, active investors need to remain nimble and look for new opportunities. Some of these might not be seen as typical defensive plays, but they offer defensive characteristics that should bode well in a volatile environment.

Elfreda Jonker, client portfolio manager, Alphinity Investment Management