Over consumption of natural resources and the ecological damage this causes, is a sustainability crisis on a par with climate change and one that is closely linked to it.

Without urgent action, we’re heading towards an extinction event – the disappearance of flora and fauna – on a scale not seen since the demise of the dinosaurs some 65 million years ago.

Biodiversity refers to the variety of life on Earth. According to estimates by the World Economic Forum, more than half of the world’s economic output – some US$44 trillion – is moderately, or highly, dependent on nature and healthy ecosystems. So change is desperately required.

This is starting to happen as the world finally wakes up to the urgent need to protect the planet’s life support systems.

Preserving biodiversity is critical to supporting sustainable growth. Investors can make a positive impact on preserving natural capital – stocks of natural assets including geology, soil, air, water and all living things.

The financial sector, and the asset management industry in particular, has a crucial role to play in helping to prevent further biodiversity loss. We need to do more in the following four areas to help halt, and even reverse, current trends:

1. Policy advocacy – help ensure that commitments have teeth

We’ve seen plenty of commitments to protect biodiversity. For example, at last year’s COP26 climate change conference in Glasgow, some 141 countries (accounting for more than 91% of the world’s remaining forests) committed to halt and reverse destruction of forests and land degradation by 2030.

Meanwhile, the European Union (EU) is proposing regulation to curb EU-driven deforestation. It is also expected to amend official classifications to make investors give further consideration to the impact of biodiversity loss.

These are positive steps but they need to be reflected in binding legislation. Through collaboration and policy advocacy, we can lobby for these new rules to have the teeth that will lead to compliance in a meaningful way.

2. Drive appropriate pricing of ecosystem services

Nature needs to be assigned a monetary value in the same way that we use carbon pricing to incentivise decarbonisation. That means, quantifying the economic benefits derived from healthy ecosystems, as well as working out the financial cost when the ecosystem is damaged.

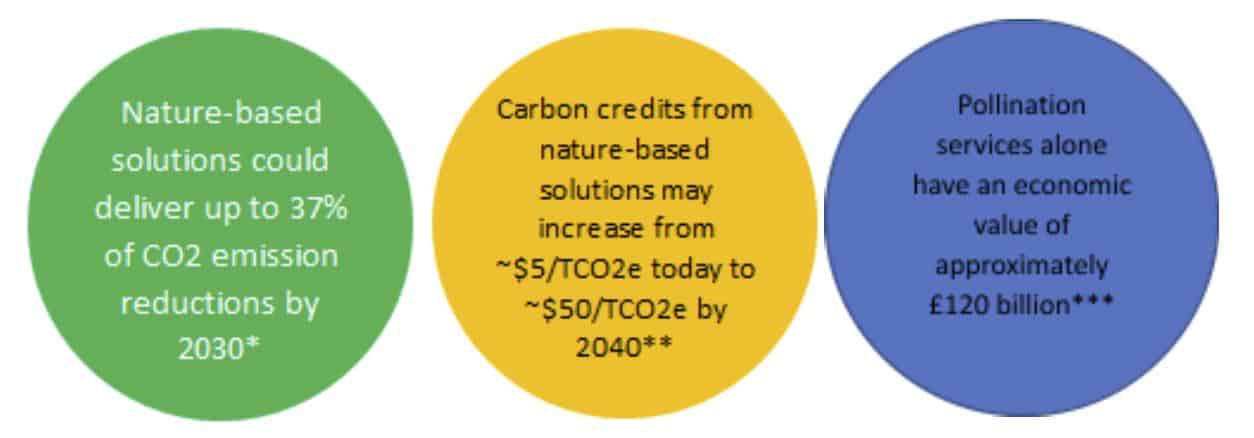

The process is still in its early stages, but right now it’s very much focused on the ability of natural systems such as forests, peatlands and seagrass meadows, to absorb excess carbon from the atmosphere. A monetary value is calculated using carbon credits.

This is a very narrow way of measuring the economic value of these natural habitats. Monetary value should be attributed to other ways in which these natural systems provide economic value. By focusing on carbon alone, other biodiversity benefits are not captured.

We can help champion new ways of pricing the economic value of ecosystems, and to promote these new ideas to policymakers and asset owners.

3. Innovation in key sectors

As investors, we can support – through active engagement and targeted investments – the radical intervention that’s needed to restructure key sectors that can have the biggest impact on the planet’s life support systems. There are three sectors where we see big opportunities for innovation:

-

Food and drink

-

Agriculture

-

Construction

For example, the food industry is the largest driver of biodiversity loss. It is to biodiversity, what fossil fuels are to climate change.

But in order to meet increasing demand to feed a growing population, we need to change the way we grow our food. Key areas of innovation include cultured meat, plant-based proteins, agroforestry, regenerative farming and precision agriculture.

4. Developing investment solutions

We are stewards of our clients’ money, looking to provide a broad range of solutions designed to meet their needs.

New research shows support for sustainable business is growing in both developed and developing economies. The Economist Intelligence Unit, commissioned by the World Wildlife Fund, reported a 71-per cent increase in global online searches for sustainable goods over the past five years. Our own clients are asking increasingly about our approach to biodiversity.

As interest grows, we expect the development of new investment vehicles to accelerate. For example, as part of the growing nature-based solutions market, funds with a focus on investing in biodiversity solution companies will become more prominent.

We have invested in native woodland creation in Scotland to support nature-based solutions as part of our ‘net zero’ strategy. This project, situated in the Cairngorms National Park, covers more than 1,400 hectares and will represent one of the largest afforestation and peatland restoration projects in the UK.

Any biodiversity net gain will be monitored and reported on using a leading science-based approach, conducted by a team of ecologists.

Meanwhile, the New York Stock Exchange (NYSE) and Intrinsic Exchange Group are pioneering a new asset class based on nature and the benefits that nature provides.

The role of financial institutions – we all need to do more

Financial institutions have a big role to play in helping to preserve the planet’s biodiversity.

That’s why biodiversity is an important area of focus for us, one which we examine in our research, in our engagements with companies, and in our proprietary environmental, social, and governance (ESG) house score.

We also support the Taskforce on Nature-related Financial Disclosures (TNFD) to improve the consistency of reporting.

However, we and the wider asset management industry need to do more. These are just the first steps on the start of a long but very important journey.

Ann Meoni, senior responsible investment analyst, ESG investment, abrdn