By investing in infrastructure, one invests in the companies that own and operate the physical assets that provide many essential services to society. These are services we use and interact with every single day. For instance, we use gas, water and electricity to carry out our daily activities. We also use transportation infrastructure, such as rail and roads, to get around and communication infrastructure, such as cellular towers, to connect with each another.

Two buckets

Broadly, infrastructure can be categorised into two key buckets: regulated assets and user-pays assets.

With regulated assets, such as water, electricity and gas transmission and distribution, the regulator determines the revenues that a company should earn on their assets. If an asset earns too much, the company is required to return some of its revenues to its customers by lowering prices. Conversely, if the asset earns too little, the company is allowed to increase its prices. Because demand for these assets is steady and the regulator determines revenue, companies owning and operating regulated assets show a relatively stable cash flow profile over time. Additionally, the regulator periodically accounts for inflation and bond yields, which means price increases are often linked to inflation, and long-term valuations are relatively immune to changes in bond yields.

With user-pays assets, pricing is generally set by contracts, where volume and revenue is determined by how many people use the assets. User-pays assets are usually physical assets, such as rail, airports, roads and telecommunications towers, which move people, goods and services throughout an economy. As an economy grows, develops and prospers, demand for these assets also typically grows. For instance, as more people use, and to some degree, depend on mobile phone data, we see mobile communications operators adding additional capacity to the physical towers to meet this demand.

Infrastructure companies can therefore provide predictable income distributions due to stable earnings derived from underlying assets. For investors, this offers excellent visibility for revenues and dividends.

Infrastructure Vs equities, bonds and property

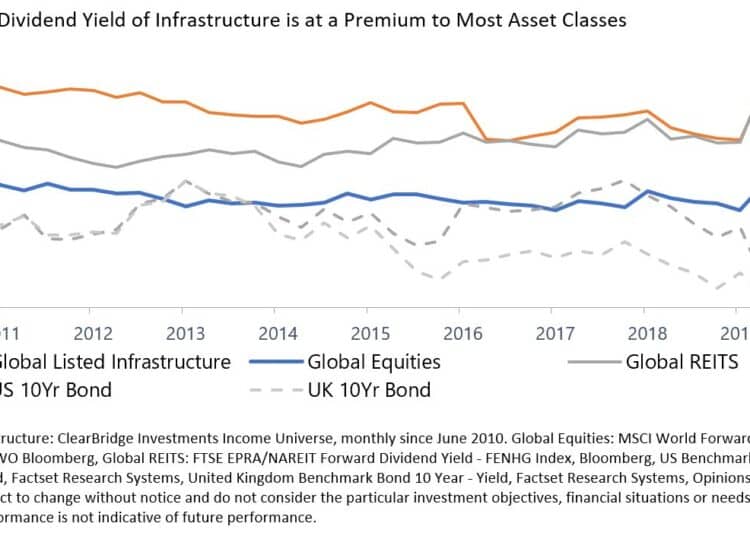

The following chart illustrates that global infrastructure has delivered to investors a significantly higher yield than global equities and global bonds and, over most time frames, a yield greater than global listed property.

In this current environment, investors have had to look beyond traditional sources of income. While both global equities and REITs can provide attractive yields relative to bonds, both have revenues and, ultimately, dividends closely linked to economic activity. In this way, infrastructure has an edge as a long-term income solution, as revenues are generally linked to the asset base of these companies.

A dedicated listed infrastructure allocation provides not only reliable and growing income but also diversification across infrastructure sub-industries as well as political and regulatory regimes, where risks differ. It also offers the ability to invest across the market cap spectrum where specialist sector knowledge can be applied

Net Zero a tailwind

Infrastructure is in a multi-decade secular growth cycle where the assets will play a pivotal role in the path to net-zero emissions. Trillions of investment dollars need to be made over the coming decades, which will underpin the allowed returns, and ultimately dividends. This will likely drive the asset base growth of these companies and provide a tailwind for infrastructure investors seeking income and the potential for capital appreciation.

Shane Hurst, portfolio manager, ClearBridge Investments