Providing similar ballast in a diversified portfolio is the fixed-interest allocation. Like the winged keel on Australia II, bonds may not garner much of the attention, particularly in relation to the billowing sails of one’s equity allocation, but they are just as vital.

This remains true whether interest rates are at 10 per cent or closer to zero, as has been the case in recent years. Equities provide the growth, but bonds provide the stability. Without them, it will be a very choppy voyage indeed.

Of course, that might not matter much earlier in a lifetime’s investing journey. In our 20s and 30s, our financial capital tends to be dwarfed by our human capital. We have decades to retirement and can afford to face the full brunt of the storm.

But as we age and there is more financial capital at risk, our portfolios may not have the time to recover from a 30 per cent or 40 per cent drawdown. That’s when the stability offered by the fixed-income allocation – the winged keel of investment – becomes so important.

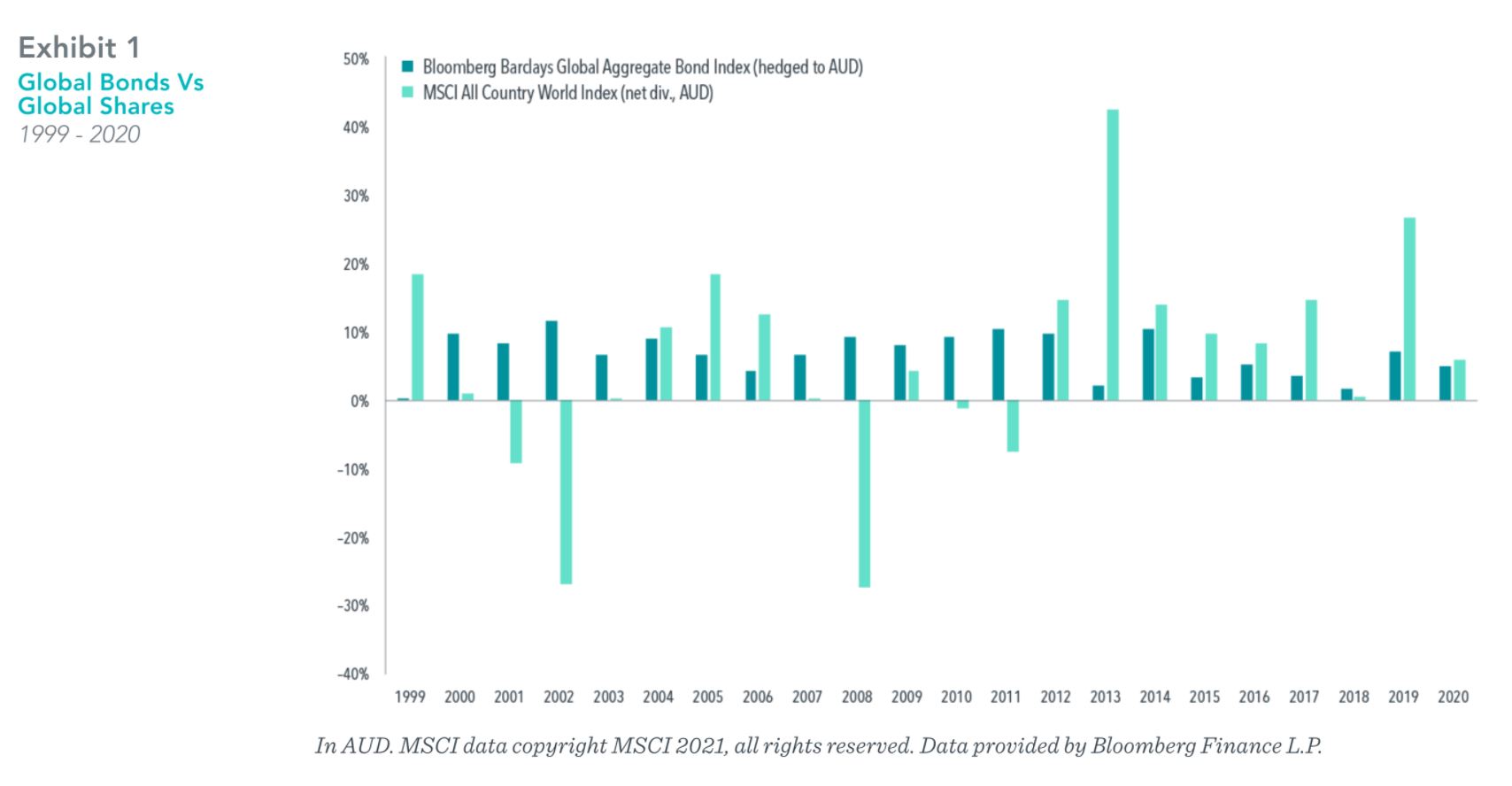

Exhibit 1 below shows the calendar year movements of the global share market, as represented by MSCI All Country World Index, against the movements of the global bond market, as represented by the Bloomberg Barclays Global Aggregate Bond Index.

You can see in the years in which the equity market experienced a decline – in 2002, 2008, 2010 and 2011 in this 22-year sample period – global bonds steadied the ship with positive performances and offering stability and confidence for investors.

This relationship, where bonds zig as shares zag is also seen in much longer periods, highlighting the role that bonds play in tempering the volatility of an overall portfolio.

While there are claims in the media that bonds no longer succeed in playing that stabilising role, we only have to go back to the first quarter of 2020 during the initial shock of the COVID-19 pandemic to see what a difference bonds made when equity markets sank 30-40 per cent in five weeks.

This doesn’t mean it will work every time. In 1994, for instance, both bonds and equities experienced declines in the same year when market interest rates rose sharply and suddenly across the developed world as economies climbed out of recession.

Despite their reputation for relative stability, bonds nevertheless are still risky assets. As with equities, the premiums they offer – term and credit – are not constant. They vary based on market expectations and the information available.

But with their known fixed income, their lower volatility, and the fact they often move differently to shares bonds can offer varied roles, allowing individual investors to tailor their respective portfolios to their own goals and risk appetites.

Alongside their use as a volatility dampener, bonds can also be a source of liquidity, a protection against inflation and a source of returns. For younger investors and those with a large equity allocation, it might make sense to take additional term and credit risk in their bond allocation. For older or more risk-averse investors, it might pay to stay in shorter-term, higher credit quality bonds.

As for zero or even negative interest rate environment, it is also worth reflecting on the fact that the return on a bond is more than just its known income component. It is also made up of the expected capital gain for holding the bond for a set period based on the shape of today’s yield curve. This curve is the line drawn by bonds of the same credit quality but of different maturities.

Using the information in today’s prices, we can build portfolios to meet different investor needs. As interest rates vary around the world and yield curves are shaped differently, it gives us a larger hunting ground for expected returns while reducing volatility.

Given we want to reduce volatility, we can take exchange rate movements out of the equation by hedging the currency exposure from these overseas bonds back to the same starting point in Australian and New Zealand dollars (see Exhibit 2).

The upshot is that this global approach to bond investing allows for more diversified portfolios that can more reliably deliver investment outcomes. And this is without having to try to forecast interest rates or spend a lot of time worrying what central banks will do.

In summary, bonds still can play an important role in your portfolio – as a diversifier and source of stability, as a source of liquidity, as a hedge against inflation and as a source of returns, even in zero rate environments.

But like any voyage at sea, it all starts with your goal.

Jim Parker, vice-president, Dimensional Funds Advisors