The consensus expectation early on was that global growth would rebound strongly after a weak Q1. This was consistent with ongoing PRoC guidance for a V-shaped recovery and expectations of a supportive stance from global central banks. We also suspect that investors were anchoring their expectations for coronavirus around SARS’ muted impact on the global economy roughly 17 years ago.

However, this episode underscored the risks of over-generalising from one particular past event in setting expectations regarding a circumstance like the present one.

Relative to SARS, we have murkier understanding of coronavirus’ trajectory owing to in part a lack of clarity around even rudimentary terms such as case identification, which has led to repeated revisions of case counts. In addition, coronavirus’ particular epidemiological characteristics, including its contagiousness without symptoms and uncertain and possibly extended incubation period, are also likely contributing to unreliable case identification.

How individuals and governments react to the epidemic’s progression will have a material impact on global economic activity particularly with respect to services, consumer discretionary, travel and transportation.

We would strongly encourage investors to avoid overreacting to emotionally evocative headlines in the face of the heightened uncertainty.

Putting recent moves into context, although a single-day drop of more than 3 per cent is uncommon for major equity indexes, such events do happen on average about one to two times a year. Over the short term, information out of China and other regions could continue to add to uncertainty and, hence, contribute to further volatility, as we’ve seen as the week has evolved. In addition.

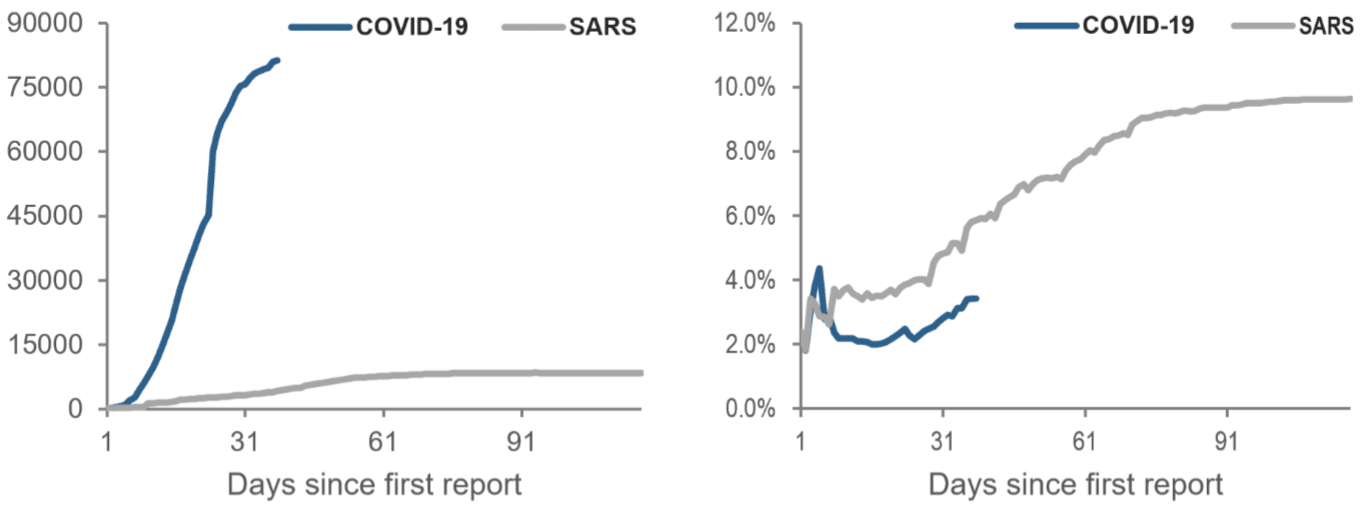

Cumulative reported cases (left) and mortality rates (right): Coronavirus versus SARS

Cumulative reported cases (left) and mortality rates (right) as of 02/26/2020. Sources: Acadian calculations based on World Health Organization (SARS), Bloomberg (COVID-19). For illustrative purposes only.

Looking forward, earnings pre-announcements point to a global slowdown.

We are monitoring the situation and portfolio exposures closely. We have not intervened in our systematic process at this time, consistent with its underlying premise that discretionary management is prone to judgmental error.

The dominant themes driving markets at the beginning of the year were reflation and global growth. Markets had bid up equities with strong earnings prospects resulting in more optimistic earnings expectations as observed in multiple expansion across global regions.

As markets now price in greater likelihood of a protracted earnings slowdown, they quickly reversed part of this multiple expansion.

Unbalanced portfolios that are overexposed to cyclical global growth could continue to be challenged as the full extent of the economic damage is revealed.

While it is too early to predict if, when, and how markets will recover, we would encourage investors to do their best to remain dispassionate in their investing activities and focus on distinguishing signal from the considerable noise related to this rapidly evolving story.

Ram Thirukkonda, vice-president and senior investment strategist; Clifton Hill, vice-president and portfolio manager and Charles Johnson; and vice-president and associate portfolio manager at Acadian Asset Management