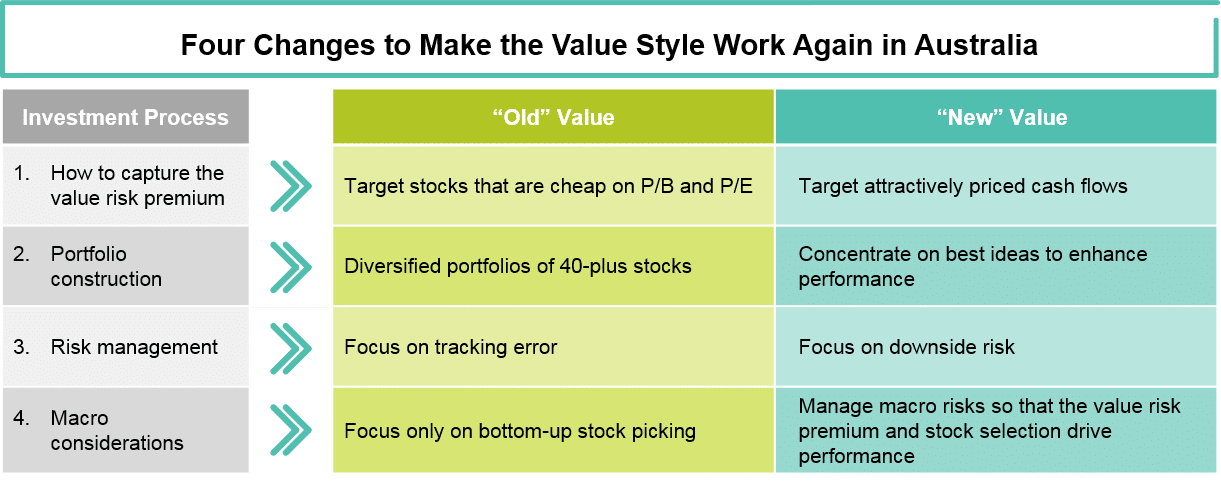

Our research suggests that the value style can indeed become effective again in the Australian market, but that it needs to be rethought in four key areas: capturing the value risk premium, portfolio construction, risk management and stock selection.

The reason that value has performed so poorly over the last decade or so, in our view, is that the style’s traditional approach in these areas has been undermined by market realities which have emerged since the financial crisis.

This is how value traditionally operated in those areas:

- Capture the value risk premium by targeting stocks that are cheap on price-to-book (P/B) and price-to-earnings (P/E)

- Build diversified portfolios of 40-plus stocks

- Measure risk in terms of tracking error

- Focus exclusively on bottom-up stock picking

There are several reasons why P/B and P/E are no longer helpful in targeting value stocks but, in the interests of brevity, we’ll mention just one each. For example, many value investors used to regard buying stocks with a low P/B ratio as the way to access future cash flows at an attractive price.

As they discovered during the financial crisis, however, stocks with low P/Bs can have highly stressed balance sheets, which can work against investors.

P/E was once regarded as a good indicator of a company’s future cash flows, but this is no longer the case for various reasons, including the fact that underlying profits – as distinct from “statutory” profits required for regulatory or accounting purposes – often exclude costs.

Instead of P/B and P/E, our research suggests instead that value investors would do better in today’s market environment to target stocks with low price-to-free cash flow (P/FCF) ratios, for three reasons.

First, cash flows, in our view, ultimately drive the value of companies over time. Second, our empirical research shows that the value risk premium from P/FCF is more attractive than that from P/B and P/E, both in terms of delivering higher returns and mitigating downside risk.

Third, as a tool in the stock selection process, P/FCF can help sharpen the focus on a stock’s fundamental strengths and limit the risk of an investor placing too much hope on a re-rating of the stock’s price-earnings ratio.

Regarding portfolio construction, the conventional proposition that diversified portfolios help to mitigate risk and are positive for investment returns is open to challenge, in our view. Our research indicates that the alpha in an actively managed 40-plus stock portfolio can often be generated entirely by the 20 highest conviction investments.

For this reason, we believe the new approach to value investing should be based on concentrated portfolios.

On risk management, tracking error measures the difference between portfolio and index returns. This makes sense when a portfolio is generating alpha and performing better than the index when the index is falling.

A major issue for value managers in Australia over the last decade, however, has been that value has typically performed poorly when markets have fallen. The answer for value managers, in our view, is to define risk differently – not in terms of tracking error, but how much downside the portfolio suffers relative to the index.

Lastly, the value investment philosophy has traditionally stressed that bottom-up stock pickers should focus on stocks and not allow themselves to be distracted by macro issues. We believe this is wrong, as macro factors can drive market and portfolio returns.

Negative movements in key risk metrics, such as a rise in the Volatility Index, a fall in bond yields or fall in the Australian dollar, have typically been bad for market returns and for the performance of the value style. Rather than leave a portfolio exposed to these factors, we believe that they, and other macro factors, should be evaluated and used to inform portfolio construction.

While these changes might be considered innovative in the context of traditional value investing, we regard them as measured and practical, and based on sound research. Used appropriately, we believe they can help restore the effectiveness of the value style in Australia.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio management teams and are subject to revision over time.

Roy Maslen, chief investment officer―Australian Equities, AllianceBernstein