Following the GFC, the Bank of International Settlements’ Basel Committee boosted universal banking standards to require banks to hold more capital to reduce the likelihood of bail-outs. Basel III, with an implementation deadline of 2019, introduced total loss-absorbing capacity (TLAC) standards requiring an additional layer of bonds that convert into equity capital if an institution’s debt capital reserves are depleted. Tier 2 capital is an example of such debt and it includes subordinated debt.

APRA issued new rules in July requiring banks to double the amount of Tier 2 capital they hold. It is estimated that Australia’s big four banks will need to raise a combined $50 billion of tier 2 capital over the next four years to meet APRA’s demands. This will create a much bigger market for subordinated debt. Up until recently, Australia’s financial institutions had issued only modest amounts of tier 2 capital.

That’s good news for investors. With the RBA cutting rates third time this year, term deposits and Australian corporate and government bonds no longer provide enough yield. Subordinated debt provides a new way to fill the income gap.

The yield to maturity on the benchmark iBoxx AUD Investment Grade Subordinated Debt Index was 2.4 per cent as at 30 September, much higher than the 1.3 per cent average interest rate on 12-month bank term deposits at the same date.

Tier 2 capital to rise in importance

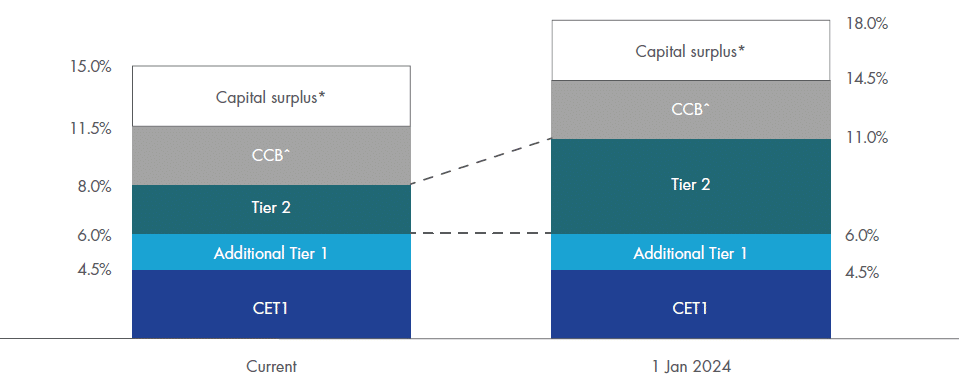

Tier 2 capital will become more important as APRA is now requiring Australia’s big four “domestic systematically important banks” (D-SIBs) to hold a lot more of it. Based on APRA’s new rules, the chart below shows the expected increase in subordinated debt from the big four D-SIBs to 11 per cent from 8 per cent of risk-weighted assets (RWA) over four years to 1 January 2024.

Figure 1. Changes to major banks’ capital structures

Source: ANZ. Capital conservation buffer. *Capital surplus of 3.5 per cent is generally higher than the level D-SIBs may normally maintain, as they have acted in anticipation of changes to the capital adequacy framework as a result of the “unquestionably strong” capital benchmarks. APRA expects the D-SIBs to continue to maintain a normal capital surplus in excess of regulatory capital requirements once such changes are implemented. No increase in common equity tier 1 capital (CET1) or Additional tier 1 capital is expected during the period.

The attraction of subordinated debt

With so much more subordinated debt to hit the market, it’s important to understand what it is. The debt has similar characteristics to traditional bonds in that it delivers reliable income and an investor’s capital is relatively safe because it is predominantly issued by the big four banks.

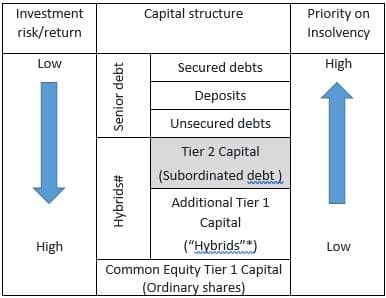

The following chart provides a simplified example of the capital structure in a financial institution to illustrate how different securities issued by banks rank in priority of payment in the event of insolvency.

Figure 2. Simplified capital structure of a financial institution

As the chart shows, priority is given to holders of deposits and other senior debt, while subordinated debt holders rank above ordinary shareholders and investors in additional tier 1 capital – more commonly known as “hybrids”. For this reason, subordinated bonds are considered riskier than deposits or senior debt but are less risky than shares and other hybrids. Reflecting their subordination, subordinated bonds generally offer a higher interest rate than senior debt or traditional bonds.

Subordinated debt is more debt-like than hybrids and generally interest payments must be met and funds repaid at maturity while the issuing financial institution is solvent. However, in times of financial stress, interest payments on subordinated debt securities may be stopped indefinitely and they can be converted to equity or written off without the bank becoming insolvent or failing. This is because the purpose of tier 2 capital is that it can be absorbed to prevent the failure of a bank to avoid costly taxpayer-funded bail-outs.

The opportunity for investors

Until now, subordinated debt has primarily only been accessible by large institutions. Now investors of all sizes can access an investment-grade subordinated debt portfolio.

With estimates that the big four collectively need to raise $50 billion in subordinated debt to meet APRA’s new tier 2 capital TLAC requirements by 2024, the subordinated bond market is poised for significant growth.

VanEck has launched the VanEck Vectors Australian Subordinated Debt ETF (ASX: SUBD). The only one of its kind in Australia, SUBD gives investors access to a portfolio of investment grade subordinated bonds via a single trade on ASX.

SUBD tracks the iBoxx AUD Investment Grade Subordinated Debt Index (SUBD Index) which only includes investment-grade Australian dollar-denominated, floating rate bonds issued by financial institutions that qualify as tier 2 capital under APRA’s rules. The index had a yield of around 2.4 per cent p.a. as at 30 September 2019.

Arian Neiron, managing director – head of Asia Pacific, VanEck

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (“VanEck”) as the responsible entity and issuer of units in the VanEck Vectors Australian Subordinated Debt ETF ARSN 635 881 533 ASX Code: SUBD (“SUBD”). This information is general advice only about financial products and is not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision investors should read the product disclosure statement and with the assistance of a financial adviser consider if SUBD is appropriate for their circumstances. A copy of the PDS is available by calling 1300 68 38 37. SUBD is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from SUBD. SUBD is based on the iBoxx AUD Investment Grade Subordinated Debt Index (“the index”). The index is the property of Markit Indices Limited (“Markit”) and iBoxx® and Markit® are trademarks of Markit or its affiliates. The index and trademarks have been licensed for use by VanEck. SUBD is not sponsored, endorsed, or promoted by Markit. VanEck® and VanEck Vectors® are trademarks of Van Eck Associates Corporation.