At this stage, we see no imminent cause for concern and we have identified some new trading opportunities in short-dated paper.

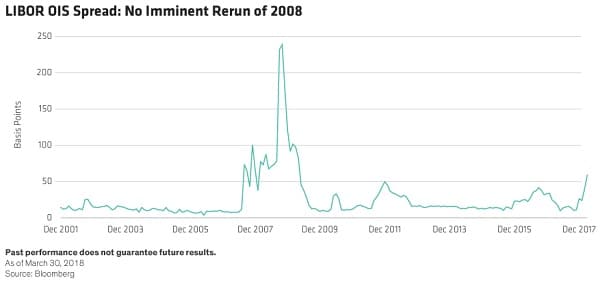

In recent weeks, the spread between US LIBOR and overnight indexed swaps (OIS) has spiked (see below).

The widening OIS spread is a potential sign of financial stress and was one of the harbingers of the 2008 global financial crisis.

A calmer look

In our view, an immediate comparison with 2008 is overblown. The credit cycle is well advanced, corporate leverage is rising, and investors should stay alert for signs of distress.

However, the spike in the spread this year can be explained by other factors – notably, the pattern of Treasury-bill (T-bill) issuance, together with the repatriation of corporate cash piles following recent US tax reforms.

Overnight indexed swaps are reckoned to be a good indicator of the short-term interbank credit markets. A narrow OIS spread over LIBOR indicates a well-functioning market where the benchmark interest rate for banks (as represented by LIBOR) is closely aligned with the market rate for short-term corporate borrowers (as represented by the yield on commercial paper or CP).

When the OIS spread spikes, it may indicate that companies are having trouble raising finance and that banks are reluctant to lend to them.

However, recent conditions have been exceptional. Investor demand for CP has waned as large US corporates like Apple, Oracle and Microsoft have started to bring their offshore cash piles home and are no longer big buyers of CP.

Instead, they have refocused on M&A, special dividends/buybacks, and capex. And borrower supply has risen because of the US Treasury’s seasonal increase in net bill issuance by over $110 billion in February to fund the budget deficit.

Although this issuance was mostly absorbed by money market funds, it further reduced the demand for CP. Consequently, CP prices fell, yields rose and the LIBOR OIS spread widened.

Little sign of distress for borrowers

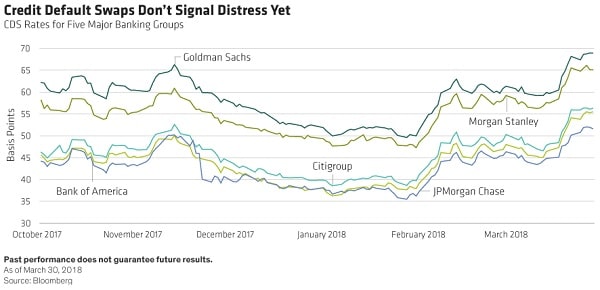

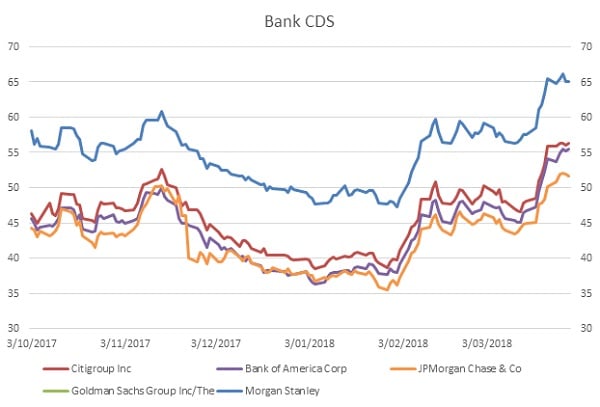

Are there any other signs of distress for corporate borrowers? Not immediately. The bank credit default swap (CDS) markets aren’t pointing to funding stress (see below). Current CDS rates are not much different from the levels of last November.

Similarly, outside the US, the equivalent versions of LIBOR OIS in other currencies (EUR/GBP/JPY) do not suggest that the recent widening in the US spread is a systemic issue.

We have only seen spillover effects in places like Saudi Arabia, Hong Kong and Australia, where wholesale funding-dependent banks need to tap US dollars. European or Japanese banks are less dependent on USD funding.

That’s why we think the recent US LIBOR OIS spread widening was not a sign of actual funding stress, just a symptom of USD liquidity moving from offshore to onshore, and CP to T-bills.

Opportunities for alert investors

But there have been some other knock-on effects of the widening US LIBOR OIS spread, particularly in shorter-dated bonds.

Investment grade credit spreads for front-end USD-denominated bonds have widened, making them more attractive relative to longer-dated issues.

Investors can currently buy two- to three-year maturity single-A-rated corporate bonds at double the credit spread of two months ago and with a yield over 3 per cent – more than 25 basis points higher than 10-year US Treasuries. That is an attractive proposition in today’s environment.

Currency is another important consideration. It is becoming increasingly expensive for EUR- and JPY-based investors to hedge USD securities back into their home currencies. As an alternative, investors can buy GBP and EUR credit on a currency-hedged basis.

For example, adding GBP credit in five- to 10-year domestic utilities or in global issuers can help investors reduce potential damage from Brexit. These issues offer attractive spreads versus securities with similar risk denominated in EUR and USD.

And the all-in GBP yield is more appealing, now that the market is expecting additional interest-rate rises from the Bank of England this year.

Shorter-dated EUR credit, with duration risk hedged by German interest-rate futures, is another opportunity, in our view. This strategy provides an attractive all-in yield.

It also helps protect against two risks: an increase in German yields when quantitative easing (QE) ends and the European Central Bank raises interest rates, and a negative impact on EUR investment-grade longer maturity credit spreads when QE corporate bond purchases taper away.

Wider spreads may persist. US tax reforms will have an enduring impact. With less demand from corporates, we expect, on average, that LIBOR OIS spreads will stay wider than six months ago.

However, nimble investors will likely recognize the value opportunity and will step in to mitigate the widening effect.

Staying mindful of downside risk is crucial at this stage in the cycle – but so is focusing on the right variables. When the market gets edgy without good reason, there are often good opportunities for investors who stay alert.

John Taylor is a fixed income portfolio manager at AllianceBernstein.