Covenant documents form the legal rights for bondholders to protect and ensure that a company’s cash flow is targeted appropriately towards the interest payments (coupons), and the ultimate redemption of its bonds.

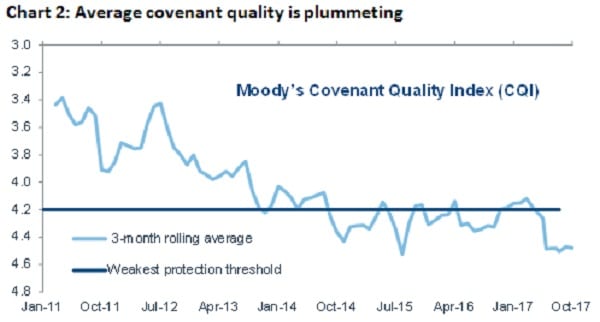

Bond covenant quality is closely related to the market cycle and we can often pinpoint where we are in the cycle by following the trend of covenants.

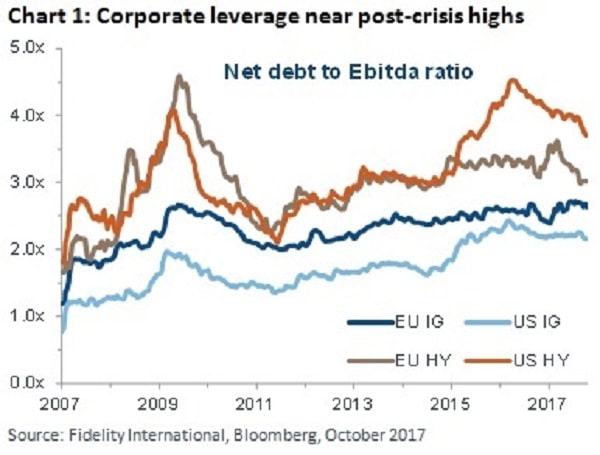

Low default rates, tight spreads, rising and high leverage, longer bond maturities – these are all clues that we are in a late cycle stage.

At this point, investors become increasingly impatient in their search for yield, and relative power begins to shift towards issuers, who in turn start relaxing covenants.

Source: Fidelity International, Bloomberg, October 2017

Covenant packages as a whole have been deteriorating for some time. Moody’s index of covenant quality recently measured close to its worst reading ever, even as coupons, which are intended to compensate for risk, have continued to fall.

Note: CQI includes all high-yield bonds, including high-yield lite. High-yield lite bonds lack a debt incurrence and/or a restricted payments covenant and automatically receive the weakest possible CQ score of 5.0. Source: Moody’s high-yield covenant database, October 2017

It’s crucial for investors to know how covenants, which are designed to protect against overly risky behaviour by companies, are changing so that they are aware of the risks they are taking.

A combined approach of picking the bonds with the strongest fundamentals, and understanding and monitoring covenants, will place investors in the best position as this cycle matures.

While the balance of power in covenant agreements swings away from bondholders towards issuers, there are certain actions that investors can pursue to protect themselves.

Expert interpretation and collaboration

Bond offering memoranda can run into hundreds of pages and are filled with legalese. These documents establish the legal rights for bondholders and investors need to be clear on how they will be treated under different scenarios, and their avenues of recourse.

It is important to pay close attention to a company’s limitation on indebtedness, particularly which corporate assets are provided as security for bondholders, and whether companies can incur indebtedness at operating companies to structurally subordinate the bonds.

This time-consuming work requires skilled, experienced and dedicated legal resources who can fully understand, interpret and communicate the technical language contained in the bond documents.

No one individual is going to be able to master all the diverse skills required to effectively invest in bonds throughout the market cycle. It needs teams working across divisions who can interact seamlessly.

Credit analysts are the central figures but they need ready access to expert legal opinions, and the opportunity to work with equity analysts to build a more comprehensive understanding of a company.

Portfolio managers have to be able to lean on all these skillsets, sometimes at very short notice, to make informed decisions under time constraints.

Push back

It’s often necessary to engage issuers and sometimes push back on terms. This is not easy, and requires credibility with the issuer and the capacity to engage in resource-intensive negotiations.

Investors must commit to lengthy, ongoing, time-consuming discussions, and be strategic in their dealings with the issuers.

Investors must also engage with other investors to discover points of mutual interest and ways to combine efforts effectively.

Investors can participate in industry groups and standards boards, and by liaising with market regulators it is possible to promote bondholder interests more generally and establish a strong voice over time.

One good example is the recent Diversey high-yield bond issuance. Here we, along with investors across the buy side, pushed back against the inclusion of a permitted investment basket that created a potentially unlimited capacity to make investments outside the credit group.

The result was the removal of the offending permitted investment basket in the final documentation.

Abstain

There are times when investors are unable to convince issuers to remove egregious terms from their covenant packages. In these situations, the only option is to refrain from making the investment, either entirely or to wait until the price declines to a point where the yield on the bond is high enough to compensate for the risk created by the loose covenant package.

A case in point is the recent HEMA bond issue. We chose to refrain from investing in HEMA due to several factors, including the flexibility granted to the company to calculate its financial ratios, and the lack of transparency for investors in how those calculations are made.

Conclusion

Bond covenants are an essential line of defence for credit investors. The gradual erosion we are seeing in their standards not only signals the maturity of the cycle, but also indicates that investors need to adapt their approach to bond investing.

Much of the trend in watered-down bond covenants is being driven by private equity, which has large pools of capital deployed in the market.

Dry powder is approaching $1 trillion, the highest it has ever been. As this money starts entering the market, covenants could corrode even further.

Despite the pressures on covenant quality, we are still seeing good opportunities for investment in the bond market, but those opportunities require more due diligence and discretion.

More now than ever in this cycle, fundamental analysis should be complemented with a thorough review of covenant agreements to target adequate returns without overly compromising protection.

Martin Dropkin is head of fixed income research at Fidelity International.