Looking back over the last three years, our view on the outlook for real estate markets did not change too much.

We were confident in their continued strong performance, we discussed the imperative to focus on income, and we flagged some key risks to monitor in the shape of weight of capital and politics.

Most of these same themes persist, however I hesitate to emphasise these messages too much this year.

Being in an extended cycle means we are one year closer to the peak, so the focus for investors should be on preparing for the next phase of the cycle, locking in sustainable sources of income and de-risking.

Real estate still plays a compelling role in any multi asset portfolio and is one of the last asset classes where attractive and high-quality yields are still obtainable; but 2018 is the year to be counter-intuitive.

Where to look for sustainable yields and safety

The extended cycle does not just apply to real estate markets of course. As the same economic factors continue to impact all asset classes (low interest rates, continued easy monetary policy) it is unsurprising that the theme of income investing persists so strongly.

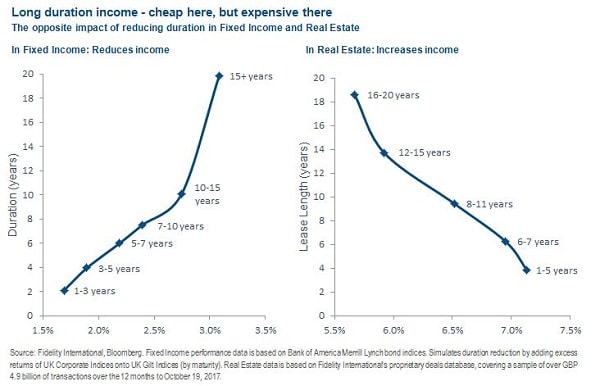

But as the cycle advances, some anomalies are emerging, and one such anomaly is the different investor behaviour in fixed income and real estate markets when paying for income duration.

As the chart below shows, the shorter the duration in fixed income, the less income you can expect – but the opposite is true in real estate markets. There is some intuitive logic to this – a long lease in a prime property is a valuable prize.

Similarly, property may have bond-type characteristics, but there are key differences, including depreciation and obsolescence.

And of course, a short duration bond results in a quick return of capital, whereas a short lease results in a potentially empty property that can be re-let. So yes, there is a rationale for the seemingly different pricing in the two markets.

However, everything is relative. As prime property (especially assets with long leases) is bid up to historically high pricing levels, this means prime yields are being bid down to historic lows – 3 per cent or even less.

This doesn’t leave much room to pay for ongoing costs, depreciation and obsolescence, or even to cover transactions costs, so it raises the question of whether investors are simply paying too much for the security of income, and misinterpreting it as safety of capital.

As and when interest rates start to increase, property priced at such low yields is likely to be vulnerable to interest rate increases.

So it may seem counter-intuitive to take the risk of shorter leases at an advanced stage of the cycle, but when 200-300 basis point premia over prime yields are available, it is certainly worth considering.

The rule for this stage of the cycle may well be to avoid both extremes of the property market – the ‘pumped-up prime’ assets, and the ‘terrible tertiary’ assets.

Instead, get rewarded for risk and capture additional yield by focusing on ‘investment grade’ properties outside the super-prime areas.

Counter-intuitive strategies for 2018

- Avoid the ‘best’ property – sure, prime property let to great tenants will always be high quality, but if you overpay for it, it doesn’t make a good investment. Many European prime property markets are now in bubble territory. Better risk-adjusted exposure is available outside prime.

- Reduce leverage – although debt for commercial property is close to the cheapest it has ever been, it is now time to do less of it, not more. Previous cycles have shown that the most vulnerable time to ramp up leverage is late in the cycle.

- Brexit will produce opportunities as well as risks – when one looks at historic structural events impacting UK property, such as financial deregulation (‘big bang’) in the ’80s, the ensuing years threw up several anomalies. For example, during the decade after the big bang (1990-99), London office property delivered significantly worse returns than Midlands industrial (less than 8 per cent annualised returns versus more than 11 per cent, respectively) – this, despite the fact that manufacturing was in decline and financial services was booming. Brexit looks like it will be a slow-motion event, so time is on the investor’s side and in the meantime, UK property is surprising on the upside in terms of returns.

- Don’t diversify too much – while diversification is good, too much of it in an illiquid asset class like property could be a bad thing. ‘Flags in the map’ may give the impression of a well-diversified portfolio, but exposure to less liquid markets, especially if mixing currency exposures, could be unnecessarily damaging.

In conclusion, 2017 surprised on the upside and in 2018 it looks like the extended cycle will continue. Real estate, and its highly attractive income, remains a compelling investment. It is, however, time to exercise some counter-intuitive caution.

Neil Cable, is head of European real estate at Fidelity International.