Continued low yields and the risk of rising interest rates mean fixed income investors are having to broaden their search for income and total return.

But global bond markets continue to offer plenty of opportunities for flexible, unconstrained investors. Here are five ideas for the next 12 months.

Still riding high: US high yield

US companies are in good health, and we expect them to remain that way, with higher global growth driving acceleration in earnings.

Revenues and debt coverage ratios are picking up, while leverage is ticking down – all good news for bond investors. Default rates, at 1.1 per cent over the 12 months to September 2017, remain well below their long-term average of 3.7 per cent.

Spreads have enjoyed strong tightening momentum for the past 18 months, and while we don’t expect this to continue at the same pace, there is still room for them to come in further in a gradually rising or stable interest rate environment.

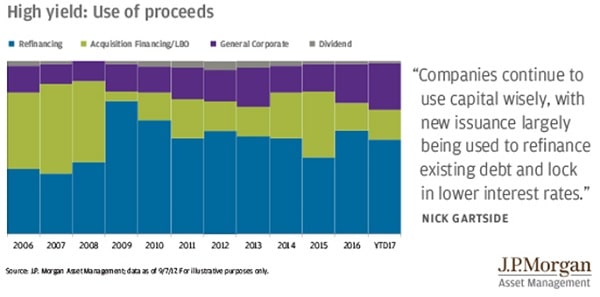

On the technical front, we aren’t seeing companies being too aggressive in issuing debt, and proceeds are largely being used for refinancing at lower interest rates.

Credit where it’s due: US investment grade credit

The strength of the US corporate sector means we’re also positive on US investment grade credit. At above 3 per cent, yields are attractive relative to similarly-rated sovereigns.

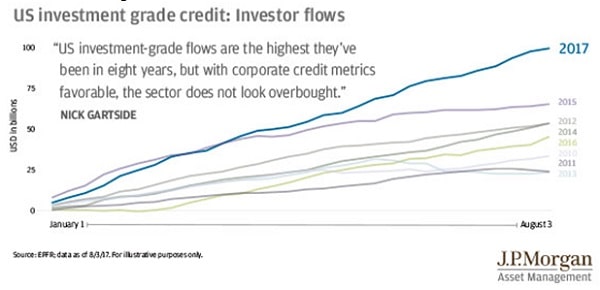

This is also a strong demand story: flows into US investment grade credit are the highest in eight years, with demand coming from both domestic retail investors and overseas institutions.

We expect 2017 supply to be in line with last year’s new issuance level, though companies have front-loaded much of this issuance given expectations of further interest rate hikes, suggesting that fourth-quarter technicals could be very supportive.

Banking on banks: European subordinated bank capital

European banks continue to build up their capital buffers, with core equity Tier 1 capital and leverage ratios now well above regulatory minimums.

Banks had suffered from fears of even lower interest rates – which would add to the pressure on earnings – but these worries have receded, and earnings revisions in the sector have been positive so far this year.

With spreads just below 400 basis points, valuations are attractive on an absolute basis, while issuance levels are manageable.

However, this is an area of the market where it’s vital to be selective. Some banks, particularly in the peripheral eurozone, still have issues with non-performing loans, so it’s important to look closely at the fundamentals of individual issuers.

Going local: Local currency emerging market debt

Emerging markets are benefiting from supportive conditions in the developed world, including still-benign monetary policy and muted US dollar strength.

Meanwhile, emerging market fundamentals are also improving, with growth trending higher, debt low relative to GDP, current account balances improving and larger reserve balances providing a cushion against future shocks.

Emerging market local currency debt is arguably the fixed income sector offering the most value at present. Yields have come down, but still look attractive, and currencies are cheap relative to historical averages – hence our preference for unhedged local bond exposure (which does mean we need to keep a close eye on FX volatility).

The broad emerging market debt sector has been supported by strong inflows this year, but local currency positioning is still not overstretched.

Steering clear: Short European government bonds

Although European government bonds are currently supported by central bank buying, we are wary of the sector.

While inflation in the eurozone is low enough to keep the European Central Bank from tapering its quantitative easing program too aggressively, it is still well above bond yields, at over 1 per cent versus yields close to zero, meaning investors are locking in losses in real terms.

Yields are also unattractive in absolute terms, with the 10-year German Bund at 0.5 per cent and almost 30 per cent of the regional market still in negative yield territory.

Nick Gartside is international chief investment officer of fixed income at JP Morgan Asset Management and portfolio manager for the JPMorgan Global Strategic Bond Fund.