The argument for these so-called passive funds has been well-articulated by this year’s Berkshire Hathaway shareholder letter from the legendary Warren Buffett.

“A lot of very smart people set out to do better than average in securities markets. Call them active investors. Their opposites, passive investors, will by definition do about average. In aggregate their positions will more or less approximate those of an index fund. Therefore, the balance of the universe – the active investors – must do about average as well. However, these investors will incur far greater costs. So, on balance, their aggregate results after these costs will be worse than those of the passive investors.”’

Perhaps the most interesting element of this letter is that Mr Buffett is the very model of an active investor, becoming the legend he is today by investing big sums in quality companies.

In the US, the shift from active to passive funds is now at a crescendo. In the last two years alone there has been US$923 billion inflow into passive funds and US$570 billion outflow from active funds.

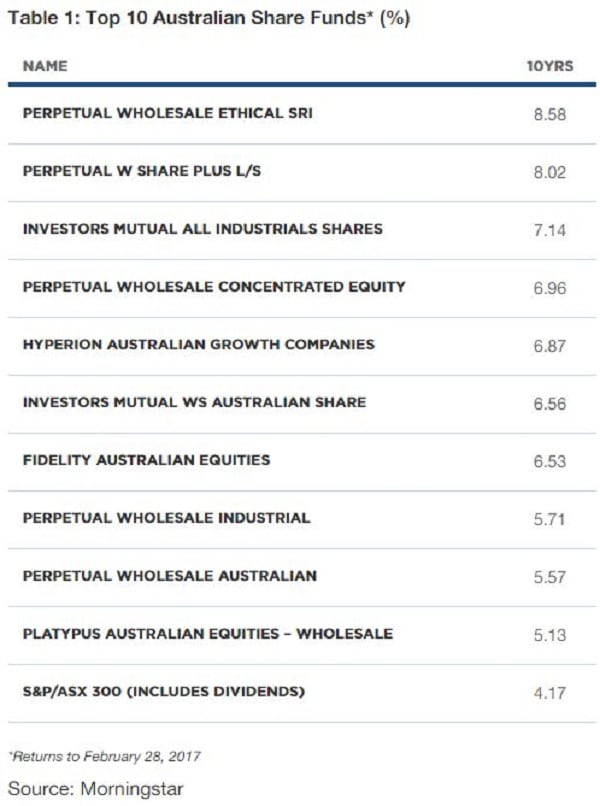

However, this does not mean that investors should not choose active management. As can be seen in the Morningstar table below, over the past 10 years in Australia some funds have significantly outperformed the index after fees.

There is no doubt that index fund investing is an option for many investors. But it’s not as simple as it looks. What follows are some observations about the trend to indexing and some of its implications.

Buying high, selling low

Generally speaking, the first rule of investing is to buy low and sell high. However, in passive or index investing, over the longer term the opposite occurs.

To replicate the performance of an index, passive funds need to create a portfolio that mirrors the index.

Typically, companies which are candidates for inclusion in an index are companies which have had strong share performance (i.e. a medium-sized company getting to the point where it is big enough to enter the ASX 300).

Companies which are candidates for removal from an index are generally companies with poor performing shares.

So on the day that one company replaces another one in an index, passive funds will sell the stock which has been removed from the index (the one with the weak share price) and buy the stock which has been included into the index (the one with the strong share price).

Once a stock is in an index, its weighting is generally a function of the company’s market capitalisation which in turn is driven by the share price. As a share price strengthens, its index weighting will increase and passive funds will need to buy the stock.

On the other hand as a share price falls and the index weighting decreases, passive funds will be forced to sell the stock to mirror the weighting of the index.

It’s called passive investing because that’s what you’re doing – buying a basket of companies and lying back and watching what happens to them.

From my point of view as a value investor, the key point here is that the investment decision is driven purely by size and price movement – not by changes in the value and quality of the underlying business – or how it is positioned to deal with the challenges of the future.

Dangerous ebbs and flows

One attractive feature of ETFs is that at a very low cost they can give investors exposure to shares in a very specific sector. The funds under management (FUM) of the ETF will increase and decrease as the popularity of a specific sector/style ebbs and flows.

This is all very well if you’re on the up tide. As investors chase what is hot, they will invest in the ETF which is flavour of the month. The ETF manager must then spend this cash on the underlying securities/assets that ETF is supposed to hold.

The problem is that if these ETFs become too big relative to the value of the underlying securities, inflows into the ETF will themselves place upward pressure on the asset price.

This is fine until the tide turns and investors are asking the ETF for their money back and it’s forced to sell into a falling market, accentuating the share price drop.

Let’s look at an example: a recent Wall Street Journal article discussed an ETF specialising in junior (small) gold miners.

The ETF had enjoyed US$1.4 billion of inflow since September 2016. Thanks to that flow the ETF is now the largest shareholder in two-thirds of these smaller gold companies and the inflows from the ETF have arguably pushed the companies’ valuations beyond their intrinsic values.

Now imagine if there were to be a bear market in gold and the ETF fell out of favour. As investors sell, the ETF manager will need to sell the shares which back the ETF. One thing I know about bear markets is that liquidity is much lower than expected.

When a large shareholder is being forced to sell into a bear market, it will exacerbate the share price fall well beyond intrinsic valuation (just as it did during the share price rise).

The point here is that the rise of ETFs may actually increase volatility and market inefficiencies. This may not be as obvious now given we are almost 10 years into an equity bull market, but when we start to see some volatility, it will be exacerbated by the amount of money flowing into and out of ETFs.

Stock pickers versus index huggers

What I have tried to demonstrate is that passive investing has drawbacks as well as advantages. Right now the market is swinging away from active towards passive funds management.

We believe fund managers that continuously underperform in their respective indexes will fall by the wayside. So will supposedly active managers – those which “hug” the index.

However, there will be an equilibrium point, where, almost via natural selection, the more skilled stock pickers survive and thrive.

A world where sentiment and weight of money drive price is a nirvana for stock pickers – because it creates all sorts of mispricing opportunities and pockets of hidden value for us to exploit for our clients. Interestingly, this is what Warren Buffett has always done.

The active funds which survive will have to earn their fees from long, detailed due diligence, thorough analysis and good judgement. Which is as it should be.

Anthony Aboud is a portfolio manager at Perpetual Investments.