The typical balanced fund is comprised of allocations to cash, equities and bonds as well as potentially some additional asset classes such as real estate investment trusts (REITs) and infrastructure (the more common alternative exposures).

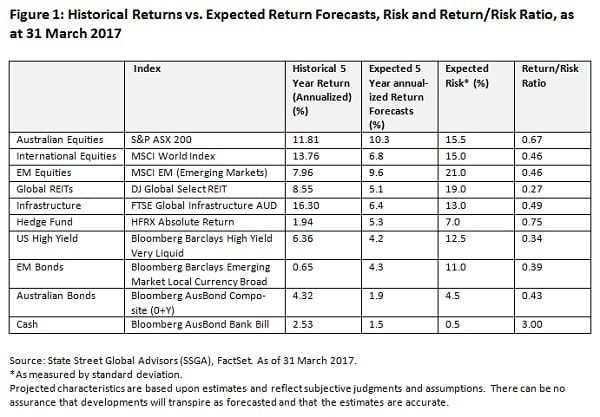

The past five years have provided good returns across most traditional asset classes, as can be seen in the table below with returns in excess of most expectations.

However, as the annualised forecast five-year returns show, expectations going forward are for more muted returns across asset classes. This is driving the search for yield beyond the traditional asset classes and into the alternative asset class space.

Alternative investments can provide attractive risk adjusted returns as an individual asset class (just look at the hedge funds in Figure 1) but with careful consideration to the type of strategy, can also be complementary to a broader asset allocation.

The term alternative investment is often used in a broad brush fashion to describe anything that isn’t covered by the traditional asset classes.

The asset class can encompass a broad range of strategies within it, not all of which are created equal.

As an asset class, alternatives can include more familiar asset classes such as REITs and infrastructure to more complex strategies such as hedge funds, managed futures, long-short equity, market neutral, private equity, merger arbitrage, opportunistic strategies, etc.

Within the balanced fund context, the key to any investment within the alternative space is careful consideration of how the exposure blends with the rest of the portfolio.

Understanding how it affects the total portfolio and ensuring at the total portfolio level, the portfolio is still targeting the desired characteristics.

There are many hurdles that can impede an investor’s foray into alternatives, from higher fees, accessibility, minimum investment sizes, illiquidity, but moreover, the breadth of the complex can make it confusing and time consuming to assess and carry out the required due diligence.

While broadening out the investment universe is important, especially taking into account the lower expected returns across asset classes going forward, careful consideration is required to understand exactly what is being obtained and how it interacts with the broader allocation.

Typically investors look to alternatives for the following characteristics:

- Exploit an alternative risk premia;

- Provide an additional source of return;

- Low correlated source of return to equity and bonds; and

- Provides diversification through market downturns.

While all are important, in the context of a broader asset allocation, the third and fourth points are key points to be examined.

This is where understanding exactly what the alternative strategy is attempting to achieve and how it will interact with existing assets is paramount.

Also, understanding how the allocation between traditional assets and alternative assets is managed is vital.

For instance, identifying an alternative asset with the last two characteristics can then be used in an asset allocation having a framework to switch out of equity assets, when the market environment becomes riskier for equities, into the alternative.

Rafiq Choudhury is a senior investment strategist in the Investment Solutions Group at State Street Global Advisors.