Unpredictable market currents may have exposed the vulnerabilities of strategies that are meant to transcend volatile return patterns within stock markets.

Global equity market patterns shifted dramatically during 2016 (see chart, below). Consider the returns of different equity factors – features of stocks such as attractive valuations, strong momentum or profitability.

In the first half of the year, stocks that were considered to be safer, with lower-volatility characteristics or higher dividend yields, outperformed the MSCI All Country World Index (ACWI) by a wide margin. But they underperformed sharply in the third quarter.

Momentum and value stocks changed direction

High-momentum stocks were also unpredictable. They surged in the second quarter, only to underperform in the third. And value stocks were just as fickle, staging a strong rally after the US presidential election in the fourth quarter.

These were challenging times for many equity managers. In particular, portfolios that are rooted in an investing style, which lean on equity factors in stock-selection processes, had a rough ride.

For example, minimum-volatility and growth managers struggled to deliver annual outperformance in the rapidly changing environment.

Squeezing the Core

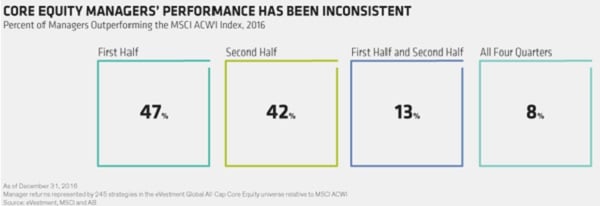

Core equity portfolios were also under pressure. Less than 50 per cent of global core equity strategies outperformed the MSCI ACWI in either the first or second half of 2016.

Only 13 per cent outperformed in both the first and second half of 2016, and only 8 per cent beat their benchmarks in all four quarters.

Why the challenged performance? We think that many core equity managers have biases to different equity factors. While these equity factors can be good guides to sources of long-term returns, their performance can be very volatile over short periods, as we saw last year.

Of course, style-oriented portfolios are susceptible to factor-return volatility, but these hazards can be addressed through careful stock selection and diligent risk control.

By definition, core equity portfolios aren’t meant to be heavily weighted toward specific style factors.

Yet in practice, core managers may not be aware of how the group of stocks they have chosen has inadvertently created a bias towards a particular factor or style that can lead to unintended performance swings.

Irregular return patterns to continue

Last year’s volatile return patterns may not be an anomaly. With more market uncertainty on the horizon, driven by political risk or changing monetary policy, we expect more irregular return patterns as the year unfolds.

This could dilute or augment the effectiveness of stockpicking. Indeed, in the first quarter of 2017, growth, quality and momentum stocks were top performers, while value stocks decelerated.

In this environment, it’s especially important for portfolio managers to focus on fundamentals.

This means ensuring that the fundamental characteristics of the companies they research – such as cash-flow trends and business dynamics – will drive long-term stock returns.

And portfolios must be constantly monitored to avoid unintended skews towards equity factors, in our view.

By applying these two principles to core portfolios, investors can neutralise the impact of sharp shifts in factor performance and enjoy more consistent long-term return patterns in erratic equity markets.

Klaus Ingemann is a portfolio manager and senior research analyst, global core equity, at AllianceBernstein.