European investors have gotten used to paying for the privilege of parking their cash in government bonds. Many of the region’s government bond yields have been wallowing well below zero ever since the European Central Bank (ECB) began buying up government debt as part of its quantitative easing (QE) program last spring.

This rush of ECB money has driven the yields on more than 50 per cent of European government bonds down into firmly negative territory.

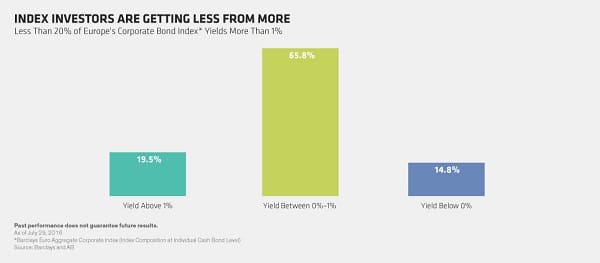

A newer phenomenon is the cratering of European corporate bond yields. The ECB brought fresh impetus to sub-zero yields when it opted to include top-level corporate bonds in its QE program in early June.

Europe’s credit universe is neither huge nor particularly liquid, so ECB buying has had a big impact on prices.

Investing in regional bonds by tracking Europe’s main investment-grade corporate bond index guarantees exposure to securities bringing baked-in losses if they’re held to maturity – and earning precious little income on the rest.

Negative-yielding bonds can deliver positive returns in the form of capital gains if they can be sold on at an even higher price before they mature.

Because European bond prices have rallied almost relentlessly in recent months, many investors seem to be betting that they can move only in one direction—higher still.

But this could be a highly shaky investment strategy.

Remember what happened last May? Bund prices abruptly tanked when numerous investors began to worry that the ECB might be about to rein in QE.

When they tried to cash in their Bunds simultaneously, months of price gains got wiped out in a few days.

The power of positive thinking

How can investors rise above Europe’s sinking bond yields? Think twice about the government and top-quality corporate bonds that dominate regional indexes and whose return potential relies almost entirely on the prospect of price gains.

Focus instead on higher-yielding assets whose income cushions offer a buffer against any hits to capital returns when turbulence strikes.

Additionally, don’t keep all your bond eggs in one basket. ECB bond-buying is proving a massive mover of regional bond prices, but it’s not the only game in town.

Broadening the search across the bond universe could open up valuable diversification from QE-driven dynamics.

Pockets of positivity

The good news is there are plenty of pockets of positivity outside Europe’s most expensive bonds.

A lot of the longer-dated sovereign debt issued by countries in Europe’s southern periphery (including Spain, Italy, and also Portugal) is offering much more attractive yields than many of the region’s higher-rated corporate bonds.

Some investors may be tempted to bypass both sovereign and investment-grade corporate bonds and reach further down the credit spectrum by investing in European high yield.

Bear in mind that the downside risks of investing in the highest-yielding bonds could outweigh the potential gains.

It’s never been cheaper for companies to borrow in euros than it is today, so only the very weakest credits need to offer supersized yields to compensate for their higher default risks.

We favour BB-rated and select single-B high-yield bonds. In our view, weaker credits simply don’t offer enough compensation for their higher default risks.

Meanwhile, we expect to see attractive new buying opportunities opening up as more and more US and other global companies start taking advantage of Europe’s bargain borrowing costs and issuing euro-denominated bonds.

This trend could extend to emerging-market companies and even emerging-market sovereigns that have traditionally relied on borrowing via US dollar-denominated bonds.

Most of these bonds won’t be eligible for ECB QE buying, so they’ll likely avoid some of the lurch lower in regional bond yields.

Likewise, looking outside the boundaries of Europe’s bond markets could prove rewarding.

While the Bank of England has begun ECB-style bond buying to counter the UK’s Brexit-related economic challenges, it says it’s not going to move into negative rates territory.

This should keep a solid floor under the still-positive yields on offer from British government bonds (gilts) and sterling-denominated credit.

In yield-parched bond markets, there’s still plenty of scope for active investors to accentuate the positive—and eliminate the negative.