Much of the Brexit commentary has focused on the negatives, but every cloud has a silver lining. Amid the political turmoil, where do the investment opportunities lie?

European shares

European equities were initially caught up in the turmoil, falling 9 per cent in the first two trading days after the referendum.

The rationale for the large impact is the fact that the UK referendum could precipitate further exits and, reflecting this, stocks of peripheral European countries have been dumped.

While such a scenario cannot be discounted, BT Investment Solutions does not think it should be the baseline, and any further breakaways could be years away. In fact, the aftermath of the UK referendum could act as a deterrent; the turmoil created could scare euro-sceptics into being more accepting of the status quo.

This seems to have been the reaction by the Spanish at their election, which was held post-Brexit.

Aside from the exaggerated break-up fears, we see European shares as an opportunity and would look to take advantage of any future weakness for a few reasons:

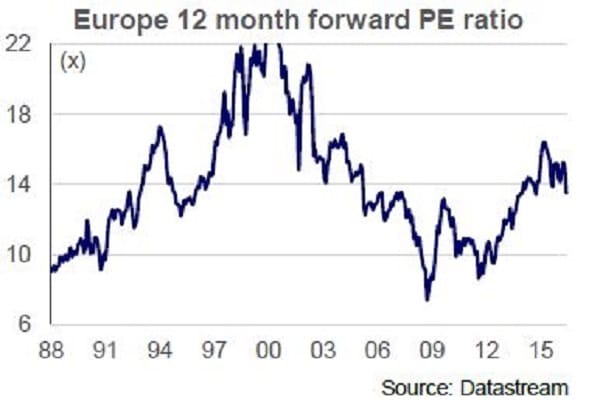

- European stocks are now cheap. The price-earnings (PE) ratio has fallen to around 13.5x, significantly below Australia and the US, which are around 16x, as shown in chart 1 (above).

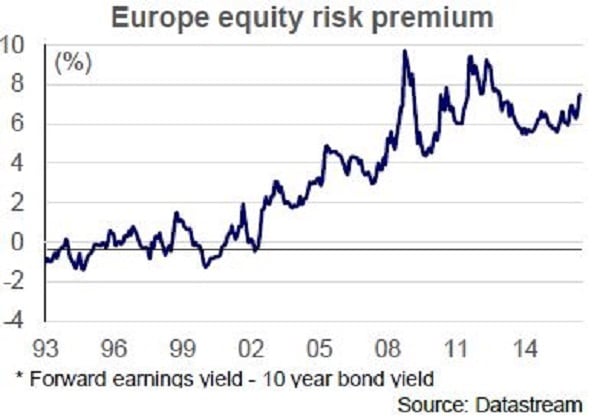

- European stocks are even cheaper relative to bonds. The German 10-year bond yield is now negative, so valuations on a risk premium basis are extreme, as shown in chart 2 (below).

- Earnings are unlikely to be affected too much. Private sector forecasters have revised down European GDP growth forecasts by around 0.5 per cent, which is not enough to have a meaningful impact on the earnings outlook.

- European growth has been reasonably solid over the past year, assisted by solid consumption and higher government spending. It took Europe much longer than the US to recover from the financial crisis due to the subsequent sovereign debt crisis and the damage done to banking sectors across the continent. However, significant progress has been made over the past couple of years and this provides a solid backdrop for further improvement.

Australian government bonds

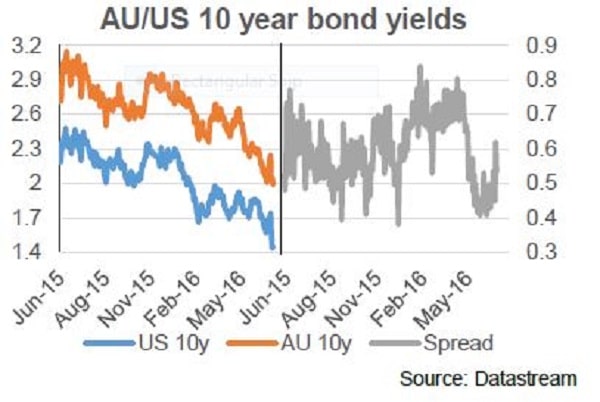

The spread between Australian and US bonds has risen as a flight to quality led to a sharp fall in US yields. The spread for 5-year bonds initially jumped from 40 to 68 basis points and remains elevated.

Our fair value estimate of the spread is around 30 basis points and we expect compression to resume based on a few factors:

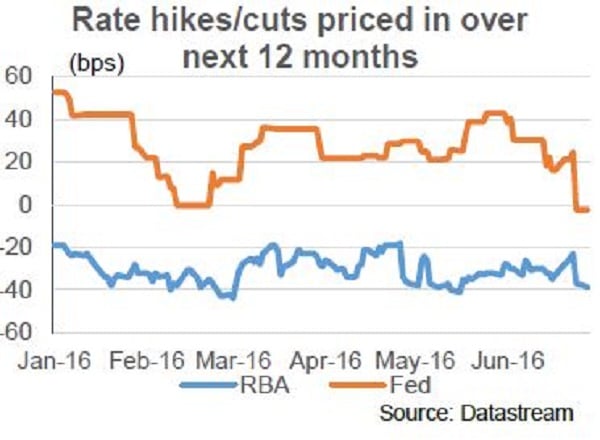

- Interest rate markets have now exaggerated the likely US Federal Reserve (Fed) response to the crisis. Markets are now priced for an interest rate cut by the Fed. This seems unlikely. They are also pricing slightly more than one rate cut by the Reserve Bank of Australia (RBA) but this is a realistic possibility. There is a strong chance that the RBA will cut rates further at its July or August meeting.

- There is a weaker inflation outlook for Australia than the US. Inflation is low in both countries but there is a greater prospect for a bounce in the US, given its tighter labour market.

Given the very low level of yields, it is unlikely that bond returns will be high from here, but this analysis suggests that Australian bonds should perform better than US bonds in the period ahead.

Watching the pound, euro and yen

There have been some substantial moves in currencies that are likely to at least partially unwind in the coming months as fear subsides.

Unlike with equities, many of the initial reactions to the Brexit vote have not yet reversed in currency markets. Some interesting currencies are:

- The pound and the euro, which appear cheap and could rise on reversal of the over-reaction to the referendum.

- The yen, which appears expensive. The yen has risen sharply as it has been considered a safe haven during the turmoil. But given the poor economic and inflation backdrop, the Bank of Japan can have little tolerance for a stronger yen. We expect this move to force an aggressive policy response resulting in a reversal in this yen move in the coming months.

Financials are potentially oversold

Financials have been sold off aggressively as investors have begun to price in some prospect of a financial crisis precipitated either by a broader recession or a Euro break-up. This appears to be an over-reaction for a few reasons.

- A European recession is unlikely. In fact, European activity appeared to be strengthening this year, reflecting a pick-up in government spending and acceleration in bank lending.

- A Euro-zone break-up should not be a baseline assumption, certainly not in the short term.

- The financial system is on a much stronger footing than before the financial crisis. Regulatory actions have strengthened capital and liquidity rules, and lending standards have been very conservative in recent years.

- A key issue that made the last financial crisis so much worse was the role of derivatives. Actions since the financial crisis have reduced the likelihood of derivatives exacerbating any future crisis.

Financials have become cheaper across the board and now represent an opportunity. In Australia, wealth managers have seen the largest impact, particularly those with UK exposure.

Investors and the media typically over-react to incremental information, particularly when the circumstances are complicated. But economies are complex systems with counterbalances and reactions that tend to dampen the effect of most shocks.

While it’s easy to get caught up in the negative impacts of the Brexit, what’s important for investors is identifying the opportunities that arise from the initial uncertainty.

Tim Rocks is the head of market research and strategy at BT Investment Solutions.