Investors are unlikely to need reminding about recent events in global equity markets. Risk has risen, equities have fallen and commentators have had a field day.

From the top of the market on 27 April this year, to the trough on 29 September, the S&P/ASX 300 Index has dropped 17.6 per cent.

Market volatility (as measured by the S&P/ASX 200 VIX Index) doubled during August alone. A larger market drawdown hasn’t been seen since the Euro crisis in the middle of 2011.

Many investors and market observers would not have been surprised to see such moves given the state of the local and global economies, coupled with full equity valuations.

But even if we expect risk to increase, knowing the exact time, trigger, or shock that creates it is notoriously difficult to get right.

What we do know is that such increased uncertainty and market dislocations invoke fear in many market participants.

The natural instinct is to react to this fear, often without duly considering all the options and possible outcomes, and this may lead to poor decisions.

As investors, what can we do to protect ourselves against such market vagaries, while still allowing participation in equity returns over the long term?

There are two things we would like to share about our approach to protecting investors from the whims of the market: how to prepare, and how to take care while being defensive.

Firstly, we believe the key is being prepared for, rather than responding to, increases in market risk, and building a portfolio that aligns with your own investment objectives over an appropriate horizon. For most, those key objectives are basically a wish to grow their assets and not lose their money.

Converting those objectives into a disciplined investment process means three things:

1. Only hold investments that meet the portfolio return and risk objectives.

- For example, if the Australian banks are unattractive, don’t hold them. If a particular company doesn’t meet your risk and return objective, it doesn’t need to be in the portfolio. If another securities company provides a secular growth opportunity at reasonable valuations and the risks are acceptable, then put them in the portfolio instead.

2. Avoid concentrated exposures.

- If the banks are attractive, do they have to be 30 per cent of your portfolio? No. Exposure to the banks can be balanced with other attractive market segments.

- Does 50 per cent of your Australian equity portfolio need to be dominated by the six largest companies in the market just because the benchmark index is? Of course not.

3. Estimate total portfolio risk rather than tracking error, and manage it.

- Rather than being concerned about the tracking error contribution of securities NOT held in the portfolio, worry about the TOTAL risks of the securities that are IN the portfolio.

The second area of interest is about defensive portfolio characteristics.

Investors have recently gravitated to perceived safer stocks to protect themselves within their equity portfolios, and we can examine this shift more closely.

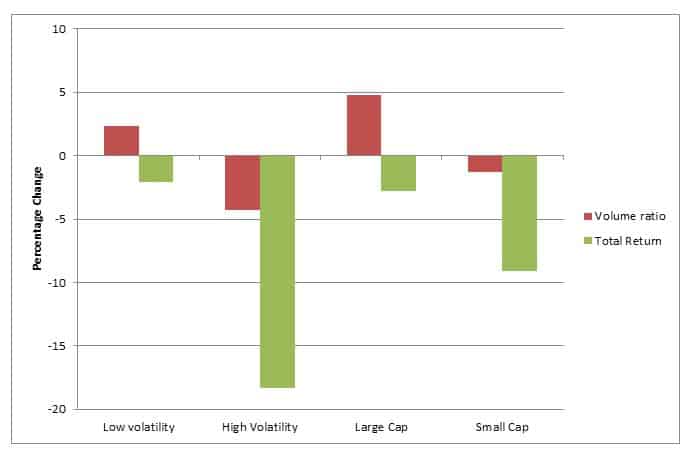

We divided the market from two perspectives typically associated with risk: historic volatility and market capitalisation. Figure 1 shows averages for the highest and lowest quartiles.

Low volatility and large-cap groupings have seen an increase in trading volume and a strong total return, indicating stronger investor preference for them. Higher risk and smaller cap names have, in contrast, been shunned.

Figure 1: Volume and return of quartiles of volatility and capitalisation S&P/ASX 300 Index. Six months ending 31 August 2015

We have long been advocates of incorporating risk into our equity portfolio construction process. All else being equal we would rather buy a stock with lower risk than one with higher, and by risk we mean total volatility not benchmark-relative risk.

But low historic volatility in itself does not equal safe. We strongly believe you need to consider return potential as well as expectations of future volatility to make an informed investment decision.

Fundamentals matter — and if your historically low-risk investment exhibits, for example, poor quality of earnings, a deteriorating growth outlook or weak sentiment, the past may not be a reliable guide to the future.

Perhaps most importantly is the price you pay for this perceived ‘safety’. If you overpay, you are unlikely to reap a substantial return on your investment – no matter how safe it has been.

When protecting from market volatility within an equity investment portfolio, it is important to prepare for the volatility, and also to beware of the fundamentals of perceived safety stocks.

Oliva Engel is the head of active quantitative equity, Asia Pacific, at State Street Global Advisors.