By Australian standards, government bond yields are extremely low at the moment.

Compare, for example, today’s 2.41 per cent yield on a 10-year government bond to a yield of more than 4 per cent offered at the end of 2014.

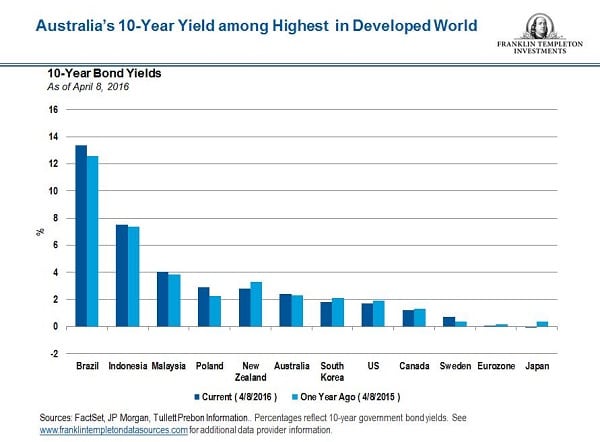

The current 2.41 per cent yield, however, looks quite attractive when stacked against many other developed countries’ 10-year government bonds, as you can see in the chart below.

Extremely accommodative monetary policy has driven 10-year yields down to 0.10 per cent in the eurozone and -0.09 per cent in Japan.

And in the United States, where the US Federal Reserve is still abiding by what we feel to be excessively accommodative policy given the country’s generally positive economic circumstances, the 10-year Treasury yield stands at 1.72 per cent.

Relatively higher yields have lured bond buyers to the Australian market, but we believe it’s important to remember that the Australian dollar historically has been a fairly volatile currency, and global investors have understandably looked for a premium to compensate them for this risk.

These forces have conspired to keep the Australian bond market at the higher end of valuations relative to what we think long-term value should be.

If the global search for yield continues to lead investors to Australia, the country’s bonds could remain somewhat expensive.

We believe global yields will likely move higher, and are not persuaded by arguments that yields will stay at these very low levels, or even lower, for any sustained period.

We acknowledge that yields may not move as high as they may have in previous cycles, but we think global economic risks are more skewed towards a move higher than lower in the near term.

Seeking value

Opportunities can still be found even in the current low-yield environment.

We believe high-quality corporate bonds still offer good value, particularly in utilities, high-quality commercial real estate and some segments of the banking sector, which we consider to be strong defensive sectors that offer compelling yields.

We also are looking at the attractiveness of some government bond yields in a relative sense to other government bond yields.

Rather than just buying government bonds as a long-only strategy, we are looking at the relative difference between markets. We believe this is still a compelling opportunity, particularly in an environment where there is global divergence in monetary policies.

In our view, strategies that track an index may face considerable challenges in the period ahead. With interest rates at very low levels, and with the sensitivity of interest rates – what we call duration – being at near-record high levels, there are risks to those strategies.

If we move to a period where interest rates are moving higher, passive investors and those bond funds taking a more benchmark aware investment approach could incur significant capital losses; however, there are different ways of investing in bonds.

Taking an absolute return approach to investing means we favour being very highly selective in the choice of securities.

We also believe managing interest-rate risk is important and we focus carefully on yield securities that we believe can offer appropriate potential returns for the risk incurred.

Andrew Canobi is director of Australian fixed income at Franklin Templeton Investments