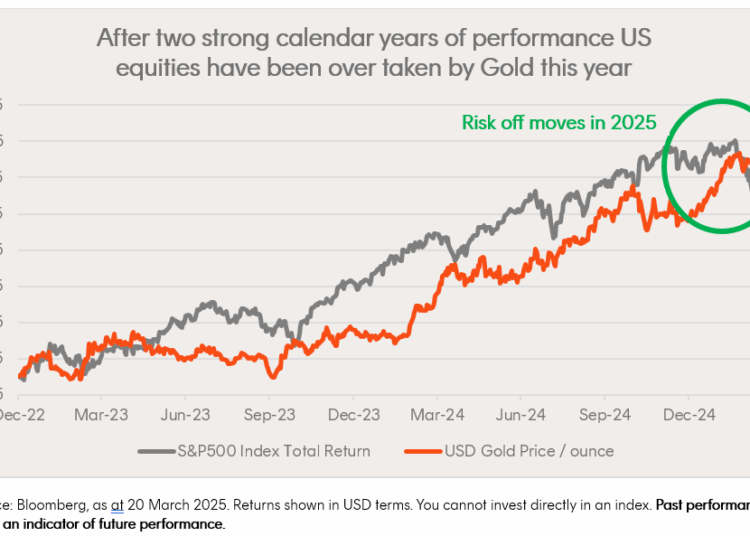

The initial exuberance at Donald Trump’s election victory has been replaced with fears over policy uncertainty, DOGE cuts and deteriorating international relations. Last week’s projections of lower growth and higher inflation from the Federal Reserve reflect the mood of the market since the S&P 500 peaked in mid-February.

Put together, it’s little wonder that stocks have fallen and investors have sought safe havens, driving the gold price higher in 2025.

However, what some investors may not appreciate is how well gold had performed while equities were running hot in 2023 and 2024. In fact, gold is not just a rainy day investment. Since the turn of the century, the S&P 500 Index has beaten major European, Japanese and emerging market indices (in US dollar terms). But gold has been even more exceptional over that period. An investor with US$10,000 in 31 December 1999 might have turned that figure into US$54,700 today by investing in the S&P 500 Index (assuming dividends were reinvested), or a remarkable US$89,200 had they indeed chosen to buy gold.

It’s important to recognise that past performance comes with a disclaimer, and we are not suggesting that investors sell all their equities and switch to holding 100 per cent in gold. But gold has demonstrated its ability as a store of value over the long term and deliver solid returns in a range of environments. Given the twin risks of high inflation and lower growth right now, we believe gold is uniquely positioned for the current risk off environment.

In this piece, we’ll explain our case for why we think this trend can continue and unpack the various drivers that matter right now.

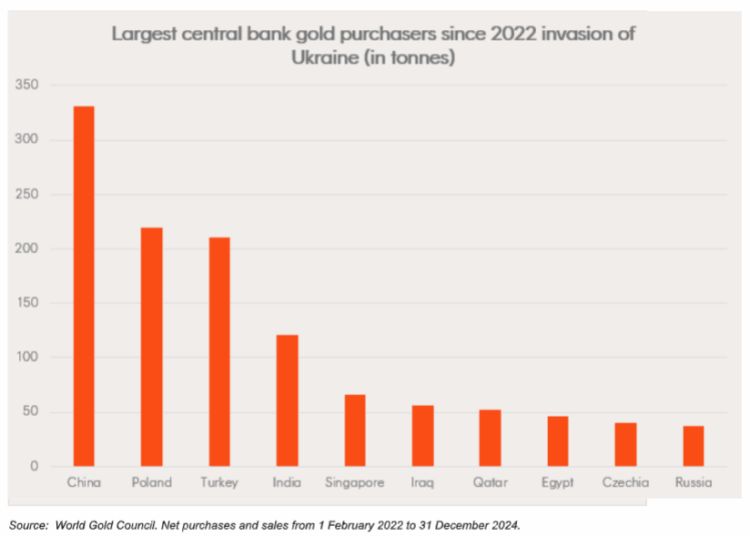

Reason 1: Central banks have been buying

The escalation in geopolitical tensions has caused central banks to buy a lot of gold. Central banks see gold as a stable way to diversify their reserves beyond foreign currencies like the USD and US Treasuries. In the wake of the Russian invasion of Ukraine, the US showed they were not afraid to “weaponise” the dollar-centric global financial system by imposing crippling sanctions on another nation state.

In response, some non-US aligned central banks have turned to gold. Since February 2022, total reported central bank buying has jumped significantly. Demand has been driven by such countries as China, India, Poland, Turkey and Egypt.

Reason 2: Cyclical support from consumers and investors

China and India are currently the world’s largest gold markets. Asia makes up more than 60 per cent of annual demand, so these consumers and investors provide significant support for higher gold prices. China has seen a boom in demand for gold jewellery with Millennials and Gen Z consumers driving this demand. In the second half of 2024, Indian demand jumped, thanks to strong economic growth and the reduction of customs duty on gold imports.

Investors are also buying gold and gold exchange-traded funds (ETF). Last month, US investors bought US$5 billion in gold-backed ETFs in one week. In the first two months of 2025, our Gold Bullion ETF (QAU) has seen over $60 million in net inflows. This only adds to the argument that investor interest for the yellow metal has rarely been stronger.

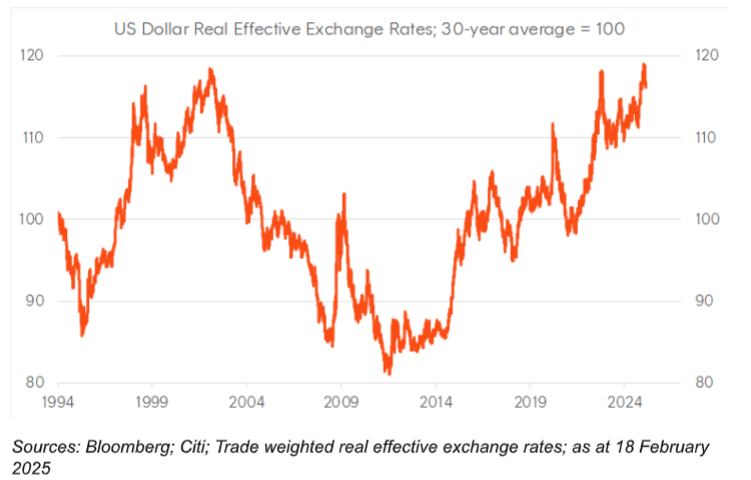

Reason 3: Gold’s main rival as a safe haven is expensive

At the outset, the US dollar surged following Trump’s second election. But those gains have started to fade away because of the potential implications of the administration’s tariff policy on inflation and growth. When investors are questioning whether inflation or growth is the bigger problem, it brings into doubt the US exceptionalism thesis. This concern is starting to weigh on the US dollar and conversely increase gold’s attractiveness as a safe haven asset.

Despite some weakness over the last month, the US dollar remains almost as expensive as it has ever been over the last 30 years, on a purchasing power parity basis. Given this, the US dollar could decline significantly from its current level. Add in the heightened volatility seen in currency markets and it may not take much for gold to rally even further in US dollar terms.

Other sparks for a gold rally (in US dollar terms) include the possibility of meaningful Chinese stimulus measures announced in the wake of Trump’s heightened trade war and whether America’s fiscal position comes under meaningful threat.

Hedge your gold exposure

Put together, adding some exposure to the US dollar gold price could be an intelligent move. This means you will get “purer” exposure to the US dollar gold price rather than the Australian dollar price of gold. Gold has broken through the psychologically important US$3,000/oz level, if it continues to rise then holding this ETF could be a strong core addition to your portfolio.

Cameron Gleeson, senior investment strategist, Betashares