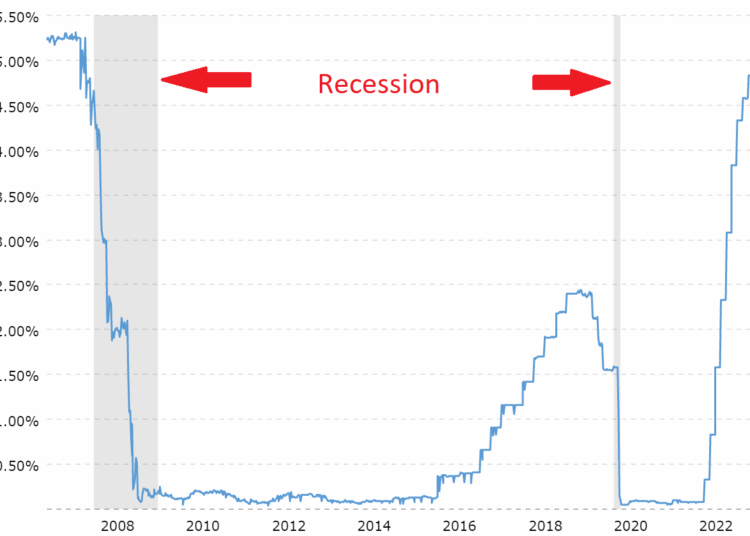

Needless to say, we have lived in an unprecedented period whereby interest rates have remained below 1 per cent since 2009 (except for a brief period preceding COVID-19).

Source: Fed Fund Rates

In other words, we have had a 13-year runway of varying degrees of capital allocation that paid little attention to fundamentals and valuation. Today, the Federal Reserve (“Fed”) fund rate is 4.83 per cent. In essence, there has been a rapid interest rate hike — 4.75 per cent since March 2022 — which has exposed risk in financial markets.

While the Silicon Valley Bank (SVB), US regional banks, and Credit Suisse stories don’t require further explanation — their failures are arguably the first domino to fall in what will likely be a volatile period in markets. Leverage is everywhere in financial markets and capital markets are particularly fragile in what has become an increasingly difficult inflation battle.

Central bankers are very fearful of inflation “setting in” and they therefore collectively seem more likely to keep interest rates higher for longer. One unfortunate reality is that labour markets are structurally tighter than they have been for 20 years, hence the risk that central banks overreach with rate hikes remains elevated.

What does this mean for equity markets?

We would argue that certain macro conditions will heavily influence style performance.

While the “Growth” and “Value” approaches arguably have larger footholds in most institutional portfolios — we believe “Quality” is perfectly aligned for a sustained period of outperformance.

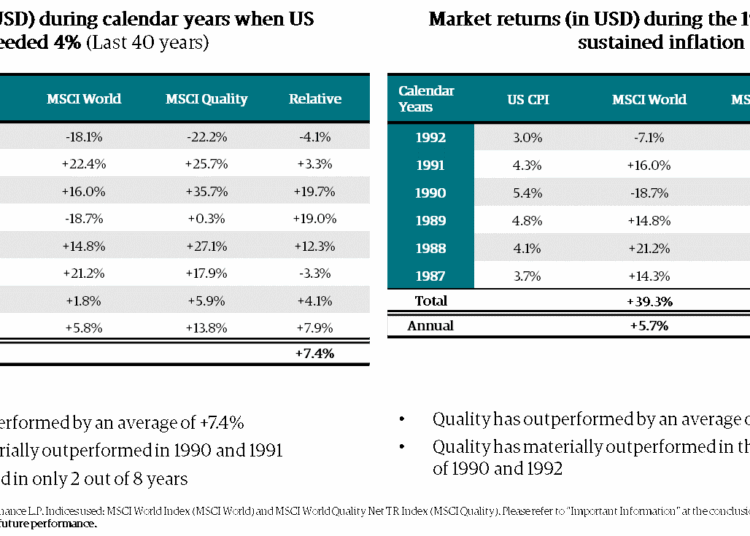

Over the last 40 years, there has been a very close correlation with the “Quality”-investment style performing well during periods of inflation. Since 1982, there have been eight calendar years where US CPI has exceeded 4 per cent. The MSCI World Quality Index (“Quality”) has outperformed the MSCI World Index (“World”) by an average of 7.4 per cent in those years. The only two instances where the “Quality – Inflation” rule has failed were in 2022 and 1988 when “Quality” lagged by 3.3 per cent. What was interesting about that time period was the magnitude of the subsequent mean reversion. In the following three years, “Quality” outperformed by an average of 17 per cent.

We feel strongly that markets are poised to reward “Quality” for the next few years.

Against a backdrop of higher interest rates for longer and stubbornly higher inflation, we would expect to see quite material earnings divergence at the style level. “Quality” companies by definition have better pricing power and moderate levels of leverage — making them far more likely to continue delivering strong earnings, and therefore, performance.

Typically, value-companies are more vulnerable to sustained earnings weakness as they tend to exhibit a combination of leverage, poor pricing power, and economic sensitivity.

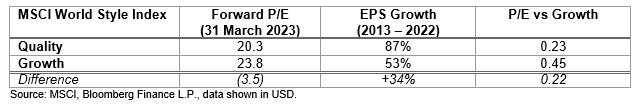

While growth-companies have clearly dominated in recent times, except for 2022, we would argue that they are more susceptible to earnings multiple compression. As at the end of March 2023, the MSCI World Growth Index (“Growth”) was trading on a forward P/E of 23.8x which represents a 45 per cent premium to the broader market. We would also argue that the large cap growth stocks which have dominated equity market returns in recent years are far less likely to repeat their recent earnings growth performance.

In recent years, the lines between “Quality” and “Growth” have become increasingly blurred. In the five-year period to December 2021, they were highly correlated and delivered almost identical returns (Growth +21.3 per cent p.a., and Quality +20.0 per cent p.a.).

The year 2022 was interesting in that “‘Growth” lagged “Quality” by 6.8 per cent in a weak market environment. We feel this albeit short-term dispersion in returns highlights the superior downside capture characteristics of “Quality” as a style.

One interesting observation we would highlight is that the recent historical earnings growth of “Quality” is superior to that of “Growth”. From 2013–22, the “Growth” EPS growth stood at 53 per cent versus “Quality” EPS growth of 87 per cent. The reason for this apparent anomaly is that “forecast growth” is a key metric that MSCI use to categorise growth stocks. Quality stocks on the other hand are selected based on high ROE, stable year-on-year EPS growth, and low leverage.

Another way to think about the respective metrics of “Growth” and “Quality” at this point in the cycle is to compare the current valuations with actual EPS growth:

In short, our view is that paying a discount for premium growth, low leverage, and superior profitability is a very compelling argument for investors to upweight their “Quality” exposure now for strong long-term alpha generation for our investors.

Ned Bell, chief investment officer, Bell Asset Management