Most commentators point to quantitative easing – monetary policies involving central bank buybacks of government bonds or other debt securities to inject liquidity into the economy – as the cause of negative bond yields.

Source: Deutsche Bank

While this is true, it’s not the root cause. We believe the main culprit is in fact a global economy with low demand, and therefore excess supply capacity, that’s persisting despite low interest rates and quantitative easing policies enacted to remedy these problems. Demand to use these low interest rates to fund productive investment cheaply is lacklustre, because demand for resulting products or services is considered to be too low. Firms are not investing in this type of environment – instead, they’re using part-time labour (or no labour) to allow their productive capacity to adjust according to underlying demand. Many workers are therefore underutilised (a problem the Reserve Bank of Australia is currently grappling with).

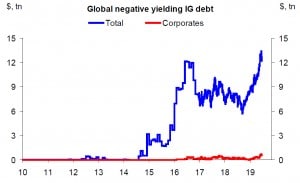

Change to this backdrop will require expansionary fiscal policies that governments globally show little sign of embracing. So negative yields will persist, and there will be investors who will lend a borrower $102 (say), receive no interest for a period of 10 years or longer, and receive only $100 back at maturity. Why would investors do this? Some are forced to by regulation. Others are willing to pay for “safe” government debt regardless. Others still are buying solely because they believe yields can move even further negative.

What should long-term investors do against this backdrop that slowly erodes wealth? There are three main issues to consider.

Active management

Active investment management is key. Many fixed income benchmarks (and therefore index bond funds) are heavily weighted to negative-yielding bonds and have become more sensitive to the impact of short-term backups in bond yields. Active managers can choose to avoid this volatility very easily, particularly because negative yields are at this stage concentrated on only a few jurisdictions, such as European countries and Japan).

Diversification

Fixed income capital markets are more than $100 trillion in size. This means there are plenty of investments to choose from without needing to take on particularly low or negative yields or undue risk. For example, highly rated corporate debt offers a quality alternative to government bonds – many well-known Australian and global companies raise funds in the bond market, instead of or in addition to using banks or issuing shares. A diversified and very high-quality bond portfolio can be built providing a good income stream while remaining defensive.

Risk mitigation

Fixed income investments should not have too much exposure to one risk factor. For example, many bond funds are overexposed to interest rate risk, which seems questionable with interest rates already so low. Portfolios generating returns from a range of sources are preferable for investors seeking sustainable income. It’s still possible to find portfolios offering sustainable income without taking undue risk. Investors need to look for actively managed products generating returns in a range of different ways to successfully navigate this “lower for longer” world.

Justin Tyler is director, portfolio manager – interest rates and currency at Daintree Capital.