Volatility is an inherent feature of public markets – recent rapid swings in asset prices have reinforced this fundamental truth. Trump’s trade policies saw markets swing wildly in April and with ongoing tariff uncertainty and rising geopolitical tensions, volatility in markets seems unrelenting.

Today, US stocks account for over 70 per cent of the MSCI World Index and Australia is no exception to this, with US equities making up an increasing proportion of investor portfolios. In recent times, this overexposure to the US has delivered outperformance – driven largely by the Magnificent 7 tech darlings. However, heightened volatility and softening performance is reminding investors why we shouldn’t have our nest eggs in one basket.

In buoyant times, it’s easy to overlook the role of the steady and stable parts of a portfolio – the conservative income-generators that don’t make headlines. But these are exactly the assets that provide stability when everything else is in flux.

Yet the traditional 60/40 portfolio is no longer proving a robust stronghold among record volatility. Traditionally, multi-asset portfolios have relied on the negative correlation between bonds and equities for diversification. However, increasingly, we are seeing a positive correlation in public markets. The year 2022 was an extreme example, where we saw significant correlated dips in both bonds and equities, and it is what we have again seen repeated in the most recent bout of market volatility.

Uncorrelated, alternative, unlisted assets that provide true diversification have risen to the occasion and surged in popularity. Private credit, for example, now accounts for 17 per cent of Australia’s commercial real estate debt market and the global private credit market is set to double to US$2.8 trillion by 2028. With bonds no longer providing the stand-alone hedge investors need, investors are seeking an alternative to stabilise portfolios and generate consistent returns across market cycles.

25/25/25/25 – the new 60/40

As traditional 60/40 portfolios come under pressure, investors are embracing a more diversified model – 25 per cent across equities, fixed income, alternatives and private markets – to balance risk, enhance returns and build resilience in a structurally different market environment.

Private credit fits this mandate as returns are typically linked to interest rates, not market sentiment – offering stability even amid shifting government policies or macroeconomic uncertainty. Introducing an overlay, like property, provides further uncorrelated diversification.

In real estate private credit, loans are commonly structured with floating interest rates, meaning returns move in line with the prevailing cash rate. While total returns may fluctuate with rate movements, when rates fall, as we are expecting to see in Australia, the margin above the benchmark remains consistent. For example, at Zagga, we target a return of 400 to 500 basis points above the RBA cash rate, regardless of where we are in the interest rate cycle.

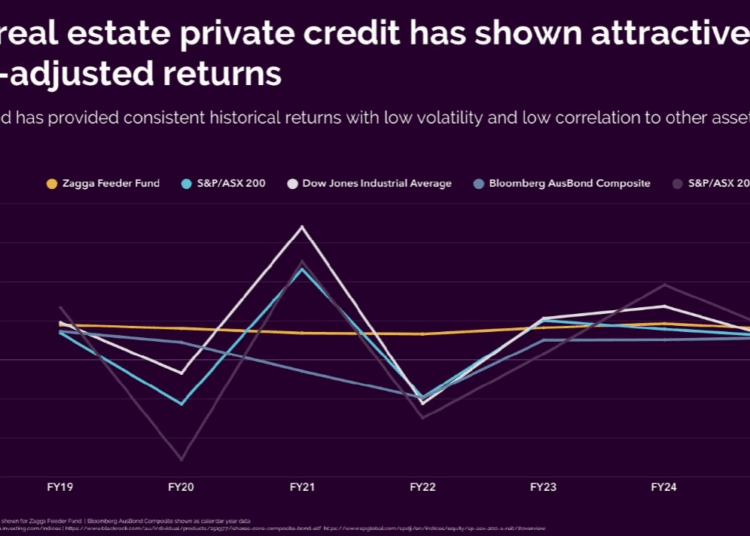

This alignment to interest rates provides a built-in hedge that is absent in traditional fixed income securities like government bonds, which typically lose value when interest rates increase. It also helps smooth returns over time when compared to the volatility experienced across other asset classes.

These fundamental distinctions have seen investors who are seeking predictable income and capital preservation, especially in uncertain times, turn to private credit.

Australia set for strong tailwinds

Australia’s private credit market remains nascent but is gaining rapid traction and starting to lure investor attention away from larger markets, like the US and the UK. This scale presents investors with compelling opportunities. Amid persistent market uncertainty and rising concerns around a US recession, Australia’s robust economic fundamentals provide a number of strong tailwinds for the continued growth of real estate private credit, with demand rising from both local and offshore investors.

First, Australia is battling a structural shortage of residential housing. Recent estimates indicate that Australia is building approximately 167,000 to 180,000 new dwellings per year, while underlying demand – fuelled by population growth and smaller household sizes – requires around 240,000 homes annually. This results in a yearly shortfall of 60,000 to 70,000 homes. Combined with high construction costs and labour shortages, the situation has created the perfect storm for the housing sector.

In short, demand outstrips supply, and this shows no sign of slowing down. If current trends persist, the cumulative housing shortfall could reach 300,000 to 400,000 dwellings by 2029, particularly concentrated in capital cities. This imbalance is further compounded by reduced bank appetite for construction lending influenced by higher capital requirements, tighter regulatory constraints and increased risk sensitivity, all of which is opening up institutional grade private credit opportunities for investors.

In response to this nationwide crisis, both sides of politics are promoting plans to increase housing supply, yet we would need to double the housing delivered over the next three years to meet future demand.

Further, in a falling interest rate environment, we would expect to see a higher level of commercial property transactions, as lower borrowing costs and improved sentiment support buyer activity and capital flows into real assets. As a result, there is an increase in institutional money flowing back towards property. In times of uncertainty, investors view real assets – particularly segments of commercial property – as defensive due to their income-generating characteristics. Sectors such as industrial, logistics, healthcare and essential services-based retail have remained buoyant, supported by stable demand and long-term leases. Meanwhile, Australia’s housing market, underpinned by structural undersupply and population growth, is well positioned to demonstrate resilience across the economic cycle.

Amid Trump, tariffs and sharemarket turmoil, investors are reassessing traditional portfolio strategies. As fixed income increasingly correlates with equities, the classic 60/40 model is losing its defensive appeal. Forward-looking investors are responding by adopting a more diversified framework – 25/25/25/25 – an equal allocation across equities, fixed income, alternatives and private markets.

At Zagga, we believe this approach better aligns portfolios with today’s market realities, offering a path to more stable, risk-adjusted returns. By incorporating private credit, investors can capture the benefits of uncorrelated income streams, building resilience in an uncertain environment.

Tom Cranfield, executive director, risk and execution, Zagga