Overhyped positivity on stock markets and negativity on real estate have historically set the stage for REIT investors to enjoy multi-year periods of improvement and outperformance and a “golden era” of investment. We expect returns will compare well to global equities.

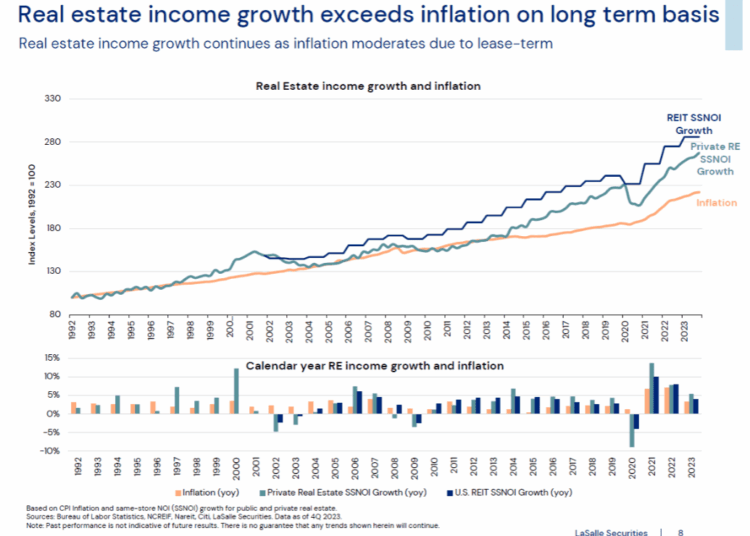

REITs too are an important diversifier for portfolios. They deliver attractive levels of growing income, which is important for investors, as real estate income growth tends to exceed inflation on a long-term basis, supported by long lease terms, as the chart below shows. Inflation is moderating, too, and interest rates are falling, which are tailwinds for REITs.

We see the potential for a golden era for REITs this year and beyond, driven by easing interest rates and inflation and strong demand for commercial property against short supply. Given strong financial positions, access to capital markets and increased investor confidence, REITs are positioned to deliver outperformance compared to stocks.

The convergence of several factors, including a dislocation in bank lending, negative market sentiment, REIT underperformance and an easing of financial conditions, mirrors the circumstances that have preceded previous periods of exceptional growth in the REIT market.

Our base case projection for REITs is for total returns of 9 per cent per annum over the next three years, with 4 per cent from income. If financial conditions ease further, those return expectations could he higher. Over the past 25 years, REITs have produced total returns of 8 per cent per annum, with around half that return coming from income.

If financial conditions ease further, such as by 50 basis points or 100 basis points, we expect returns to increase to between 13 per cent and 18 per cent, respectively, setting the stage for the next “golden era” in REITs.

Importantly too, as interest rates fall, so will borrowing costs for REITs. The majority of REIT borrowing is from the unsecured loan market, at interest rates that are almost 100 basis points lower than a traditional mortgage. Lower interest rates would reduce these borrowing costs more.

Positive outlook for several sectors

The REIT sector is so much more than office space. We are seeing some great opportunities in sectors that took a big hit in the fourth quarter, particularly interest rate sensitive sectors that have higher longer-term growth potential or are more yield orientated, such as cell towers.

While real estate fundamentals are broadly healthy, we think the strongest growth is expected from data centres and healthcare. Strong demand is tailwind for both sectors, while low supply will especially support office, retail, industrial and residential sectors into 2026.

Concerns gripping the office sector are now fading. We now see high-quality offices are in high demand and in short supply in many markets around the world, with rents increasing in some locations for office space.

In terms of geographic opportunities, we favour Europe and the UK given low prices. UK REITs are about as cheap compared to US REITs as they have ever been, and there is also less upside pressure on interest rates in Europe as there is in the US. Japanese REITs, too, have been hit but valuations are very low and investors have opportunity to buy real estate fairly cheap. China’s market is more difficult and at some point, it will turn, and we are watching for that very closely, but we aren’t buying there yet.

This supervision and identification of opportunities requires active management. REIT managers are able to leverage expertise to identify and seize mispricing between fair value and share prices. It is important to seek a specialist REIT manager to achieve the most optimal long-term opportunities and returns.

Matthew Sgrizzi, chief investment officer, LaSalle Investment Management