Portfolios no longer consist of just a simple mix of bonds and stocks and the same is true for managed accounts. It is no longer enough to rely on just two asset classes to do the heavy lifting for you.

The quest for alpha

An appropriately diversified portfolio that takes into account different forms of diversification can and should be able to weather different types of volatility, like the volatility that equity markets started to experience in January.

As an example, many alternative strategies delivered positive results in January as equity markets fell, smoothing returns across portfolios.

Even prior to January, there was a lot of attention being paid to the fact that we were unlikely to see the types of equity market returns experienced in recent years. Super funds have been reporting the best returns they’ve had for 10 to 15 years in 2021, and the current correction is not entirely unexpected. But it has created a reminder of the importance of being risk aware.

Equity markets do, over time, recover but it is important to set realistic expectations. As much as we’d like it to, the S&P/ASX 200 will not deliver the 17 per cent per annum it delivered last year, every year.

Last year it was defensive assets that were delivering lacklustre returns. And while the return on the 10-year bond is still just around 2 per cent, these are looking much more attractive than they did and would also be helping smoothen returns across a resilient portfolio that had sensibly invested in bonds as part of its diversification strategy.

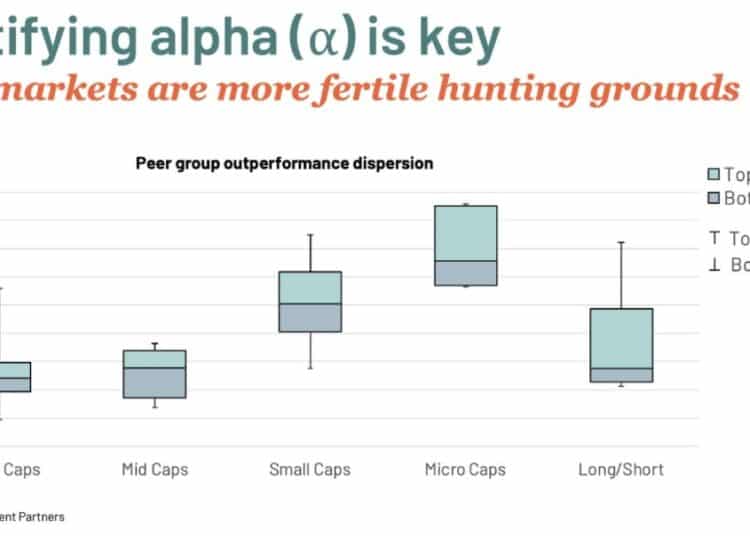

We believe that you can find alpha in all parts of the market, but we recognise that there are parts where it’s certainly easier to do so and where historically it’s been possible to deliver far greater alpha.

For instance, while some might avoid small caps and micro caps because these are more volatile and potentially riskier, as the above chart highlights, active managers in that space have historically been rewarded quite well. The peer group outperformance dispersion is much higher in small and micro caps than large- and mid-caps.

And from our perspective, it is that outperformance that outweighs the potential risk and volatility, especially when it is included as part of a well-diversified portfolio.

Diversification not de-worsification

While no one can forecast market returns with certainty, what you can do is build an investment portfolio that is risk aware and provides exposure to multiple sources of uncorrelated return drivers.

When it comes to managed accounts, this involves diversifying both your growth and defensive asset allocations and not, for example, viewing fixed income as one homogenous asset class. Today, there’s a whole gamut of investments that fall into fixed income that are very different from government bonds. Obviously, corporate credit will have a higher risk return profile than government or semi-government bonds, but that doesn’t mean there isn’t a place for it in your defensive allocation in your managed account.

Too often, people get caught up in the short term. Portfolios will always move around in the short term, like we’ve just seen in January, but you need to keep your eye on the longer-term prize and not be too swayed by short-term moves.

Steven Tang, head of consulting at Zenith Investment Partners.