Sequencing risk sounds complex but it really can be summed up in two words: bad timing. It’s the risk of having bad timing at the start of an investment period such as retirement. This also happens to be when the portfolio amount is at its highest level, so more can be lost for any percentage decline.

Why understanding sequencing risk is important is because it helps frame the way portfolios are constructed for retirees. A poor sequencing risk event like a severe market decline can have a devastating impact on the amount, and longevity of a retirement nest egg. Generally, the level of sequencing risk should play an active role in the choice of investments in a retiree’s portfolio, especially if it needs to last a long time on a relatively small balance.

Take equities for example. A traditional equity fund may be able to generate high long-term capital growth, but it may also include high sequencing risk, which stems from its high volatility.

However, there are a smaller number of equity funds that are designed for lower sequencing risk. These may be categorised as low-risk equity funds, and they may focus on reducing volatility, generating income, or often a combination of both.

Why sequencing risk matters can be clearly shown by comparing the differences in a retiree’s nest egg depending on when they retired, and what happened in the subsequent months.

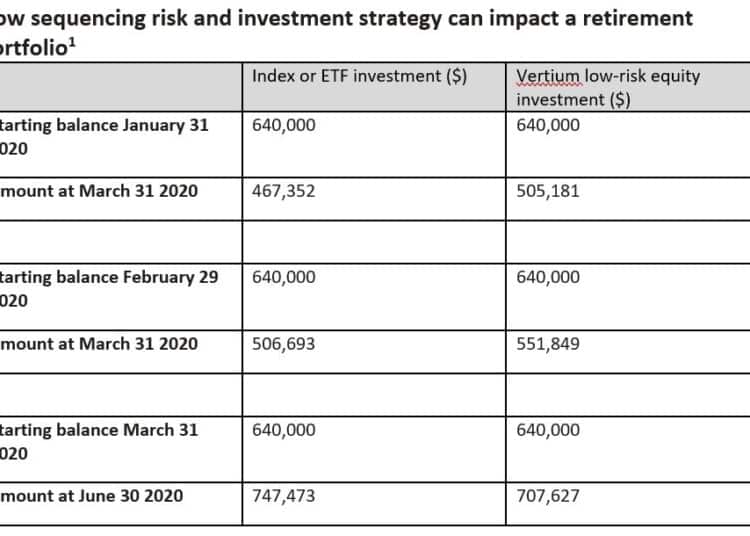

The table below shows that if a retiree couple retired with the average $640,000 balance on 31 January this year, and invested all of it in an Australian shares index fund of similar ETF, their balance would have fallen to $467,352 by the end of March.

If instead of investing in the index or ETF fund, they invested in a low-risk equity income fund such as the Vertium Equity Income Fund, they would have fared much better, with a balance of $505,181. That’s a $38,000 difference simply by choosing an equity fund that can better manage sequencing risk.

Now, let’s change the scenario and assume they held off retiring for one month.

If they invested in an index fund or ETF on 29 February (instead of 31 January), their end of March balance amounted to $506,693. So they saved over $39,000 by simply delaying investment by one month. And if instead they chose the more sequencing risk-friendly Vertium Equity Income Fund instead of the indexed or EFT fund, they would be further ahead with a balance of $551,849.

In this scenario, based on actual investment returns, the difference between the poorest timing and choice, and the best timing and choice, amounts to a whopping $84,000. And that’s largely the impact of sequencing risk over just one month.

See why it’s so important?

As you’ve probably worked out, the selection of months can have a big impact on the result and even if you assume these months are very selective and unlikely in the future, they can and do happen.

If the same couple held off investing until 31 March, their balance at the end of June would be $747,473 in the index or ETF option, while the Vertium Equity Income Fund would have delivered a lower amount of $707,627. So in these months, when markets recovered, loosening the sequencing-risk safety harness would have helped deliver a higher result.

This time it’s good timing. But why risk your retirement based on chance?

It’s very difficult to time markets and the level of sequencing risk insurance that needs to be employed in a retiree portfolio. But that’s probably beside the point anyway.

Hoping for the market to rise in retirement is not a strategy. Planning for adverse market conditions is a prudent strategy for retirement.

The counterpoint is that you can construe different results using different time periods and show advice clients a range of scenarios.

However, the fact remains that outcomes are variable, and sequencing risk can devastate portfolio balances in a worst-case scenario, as shown in the recent example.

Perhaps a more stable portfolio strategy is to blend low-risk funds with higher risk strategies to match the risk profile of an investor. In the Australian equities space, that may mean blending a capital growth equity fund with a low-risk equity income strategy, such as Vertium.

Jason Teh, chief investment officer, Vertium Asset Management