Equity markets similarly require the same agility to adjust for different market cycles and macro implications to deliver consistent returns for clients. The last (almost) two years of COVID-related repercussions have certainly tested even the best skippers’ navigation skills and having the flexibility in your process to adjust when necessary has been invaluable. As we head into 2022 with concerns around economic growth and monetary stimulus likely peaking, the earnings cycle potentially maturing, and equity market valuations optically high, investment risks appear to be rising. At Alphinity we continue to let earnings leadership, on a stock-by-stock basis, guide us through the next phase in the cycle, wherever earnings upgrades may lead us (rather than being tied to a specific style or macro outcome).

2021 – A normal, abnormal year

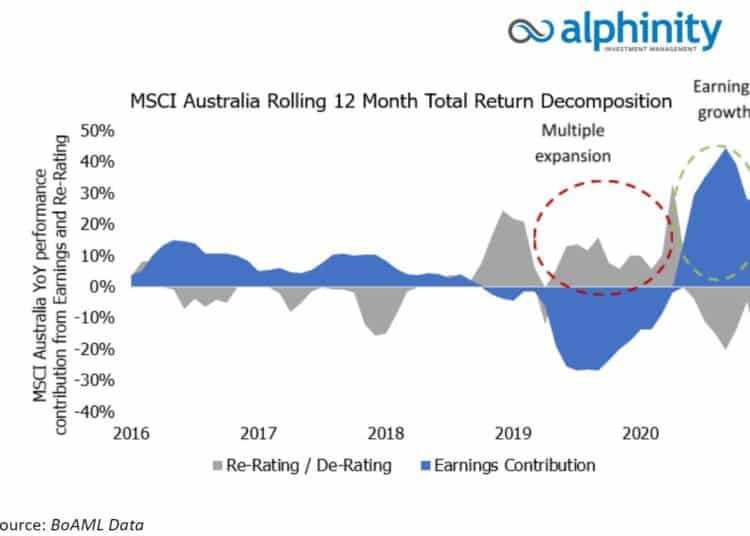

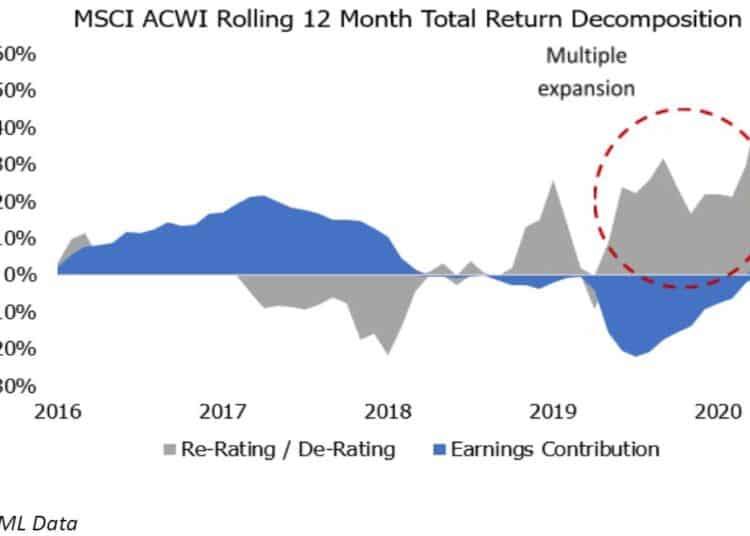

Nothing about the last 24 months since the COVID pandemic started has felt normal. Global equity markets (and Australia no exception) have however followed a surprisingly normal recession and recovery pattern, albeit faster and more aggressive than usual. Consistent with historical patterns, the first stage of the market recovery in 2020 was driven by valuation multiples expanding, with the market pricing in future earnings growth, which did not disappoint and drove the second stage of the recovery into 2021. The two charts below illustrate the similar return drivers of the MSCI Australia- and MSCI World Indices, with the former enjoying stronger earnings growth, but also a larger multiple contraction at the index level over the last year. The key question from here is the expectation for each of these drivers (earnings and multiples) as we head into a new year.

MSCI Australia following a normal post-recession market pattern – up c60 per cent since the trough with the PE expanding from 14.5x to 20x, currently back down to 18x.

MSCI World has added c97 per cent since the trough in March 2020 with the PE expanding from 12x to 20x, currently back at 18x.

Different points in the earnings cycle heading into 2022

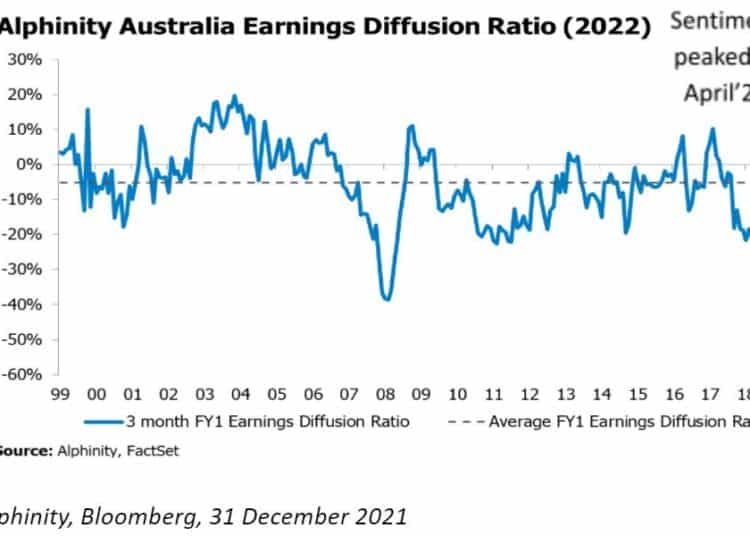

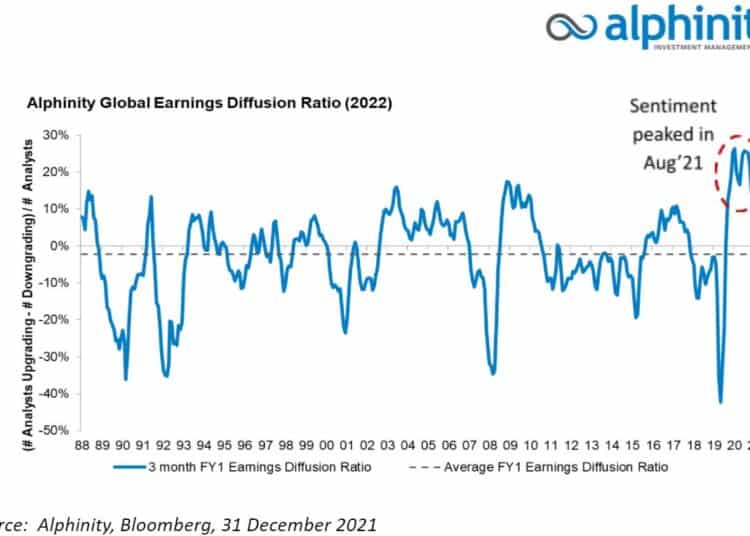

Global earnings revision breadth (or earnings sentiment as measured by the Alphinity Diffusion index, being the number of companies getting earnings upgrades vs downgrades) expanded to 30-year highs as analysts started pricing in the strong demand recovery and unprecedented corporate pricing power. Similarly, in Australia, earnings sentiment soared to highs last seen in 2003, peaking in April 2021 driven by the early cycle commodity pullback, dropped into negative territory during lockdowns and finally stabilised in November 2021. Generally, these small upgrades still favour pro-cyclical earnings, but we are seeing some selective defensive positive earnings revisions coming through.

Australian earnings cycle – Less clouding, but not yet clear

Globally, earnings upgrades are still dominating, but the trend is narrowing to fewer stocks. In terms of relative sector earnings revisions, the picture is getting more mixed compared to the clear cyclical and growth leadership we have seen over the last 12 months with some defensive sectors slowly creeping into positive territory.

Global earnings cycle – Still positive but losing momentum

High valuations offer less support and high dispersions increase vulnerabilities

Despite the recent multiple contractions seen during 2021, most global equity markets are still trading above their long-term averages driven in part by low interest rates and excess liquidity. Strong performance in the last 18 months has seen pockets of the market becoming particularly stretched and therefore vulnerable to material changes in earnings and interest rate expectations, real or perceived. The valuation dispersion between the highest (80th percentile) and lowest (20th percentile) rated stocks is at a record high for the ASX200 and the MSCI World Index, with unprofitable tech a particular standout. Factor and style dispersion were also extremely high during 2020, which makes sense for a year marked by very high uncertainty or a recession and extreme volatility. This dispersion has reduced a bit during 2021 but remains at unusually high levels across several styles, such as value vs growth, given the strong recovery in the economy.

Global equity markets still trading above their long-term average valuations

Adjusting the sails for the winds of change

Add to this peaking, but still robust, global economic growth, stubborn inflation data, likely less central bank support and ongoing uncertainty around new COVID variants such as Omicron, is probably going to make navigating macro influences on markets more challenging this year. The increasing points of uncertainty suggest a more diversified, balanced approach will be required, focused on individual company stories rather than large thematic biases, with flexibility to react to material changes in the investment environment. Introducing some defensive characteristics also seems prudent, as long as you can identify the relative earnings story.

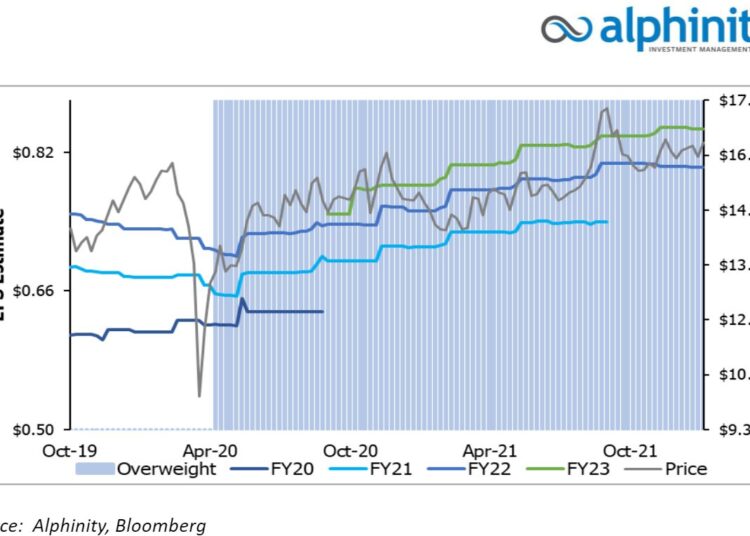

Across our Australian funds we continue to follow the individual company earnings and where upgrades are coming from. Along those lines we have added to some more defensive positions such as Sonic, Amcor, Medibank and Treasury Wineries in the last few months. Global packaging company Amcor for example, offers a defensive earnings stream with strong cashflow generation and a solid balance sheet, which allow management the flexibility to do recurring buybacks and potential bolt-on acquisitions. Amcor has beaten earnings and upgraded its outlook at the last six quarterly reports, primarily driven by better-than-expected synergies with Bemis, but also better than feared passthrough of higher resin prices. Amcor’s defensive qualities should see it deliver a steady return over the next 12 months and outperform the market on any potential correction.

Amcor – offering a defensive earnings stream and strong cashflow generation

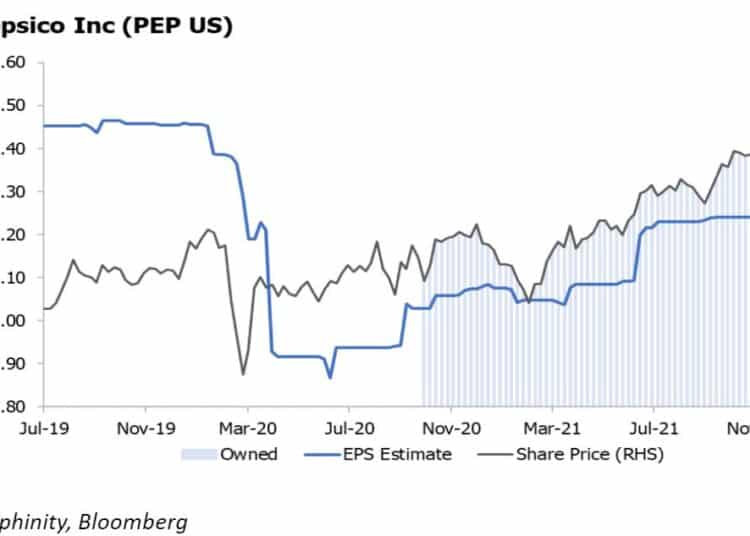

On the global side, we have continued to incrementally reduce our cyclical and higher PE growth exposure in favour of high-quality defensives such as Pepsico, Nextera and Nestle. Pepsi is a high quality, defensive consumer stock with strong pricing power and under-appreciated long-term revenue growth driven by strategic reinvestment under a new CEO, a mix shift to the higher growth snacks segment, targeted M&A and market share gains in beverages. Recent third quarter results displayed broad-based strength across the business, with management committed to offsetting rising inflationary pressures by leveraging strong brand investment and innovation to drive price increases and revenue management.

Pepsi – driving earnings growth through strong pricing power and innovation

It seems likely that 2022 will be a more challenging year for markets, especially given the higher valuation starting point. It is through choppy waters like the present that we rely on our agile, style agnostic process to get us to our destination. As Thomas S. Monson once said, we cannot direct the wind, but we can adjust our sails.

Elfreda Jonker is a client portfolio manager at Alphinity Investment Management.