In times of market turmoil, fixed income has historically demonstrated its value as a defensive asset, offering stability and income when equities falter. In an increasingly uncertain environment, those favourable qualities are once again proving their resilience and will likely persist throughout what appears to be a “shallow” rate-cutting cycle.

However, not all credit is created equal, nor is the market perfectly efficient.

By actively managing differing credit exposures effectively through a multisector approach, investors can focus on the more attractive risk reward credit investment ideas and position their portfolios appropriately.

The case for multisector credit

Successful investing in credit markets requires both flexibility and a clear understanding of how different credit segments and security types contribute to portfolio resilience.

Being overly reliant on a single-sector focus in credit brings concentration risks. By investing in a multisector credit portfolio, investors will have access to a larger pool of credit securities offering daily liquidity. More importantly, a larger pool of credit securities, provides for a much better prognosis for maximising returns for an investor. Even amid varied economic scenarios in an increasingly uncertain world, the income generated within a multisector credit portfolio should remain relatively stable with downside risk actively managed.

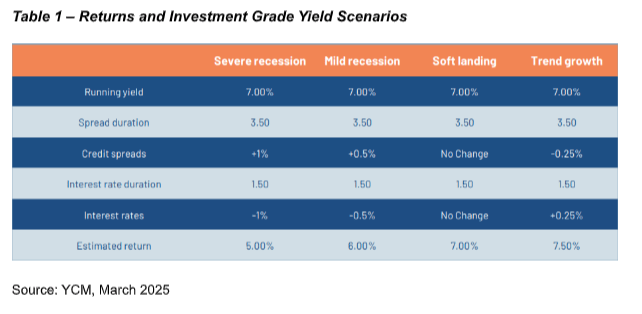

The value of this approach is supported when considering a number of differing economic scenarios as “stress-tests”. Whether it is a mild recession or “soft-landing” scenario, the ability for a multisector portfolio to continue generating positive returns remains a resilient feature of this type of credit investing.

For instance, a multisector portfolio in Australian credit, backed by a weighted average investment grade rated portfolio and highly diversified, returns a running yield currently of ~7 per cent. When taking into account a hypothetical severe recessionary scenario, such a portfolio we estimate could still generate returns of ~5 per cent, or closer to equity-like returns of 7.5-8 per cent in a trend growth scenario.

Remarkably, multisector credit in the current environment not only offers attractive returns but is also defensive – offering little prospect of negative returns over the next 12 months.

The case for Australian multisector credit portfolios

With bond yields remaining elevated, investment-grade credit offers a compelling opportunity for those looking to mitigate risk while still capturing higher income. Again, not all credit is created equal. But for the investor comparing fixed income portfolios across global markets, there is a distinct advantage in an Australian credit focus.

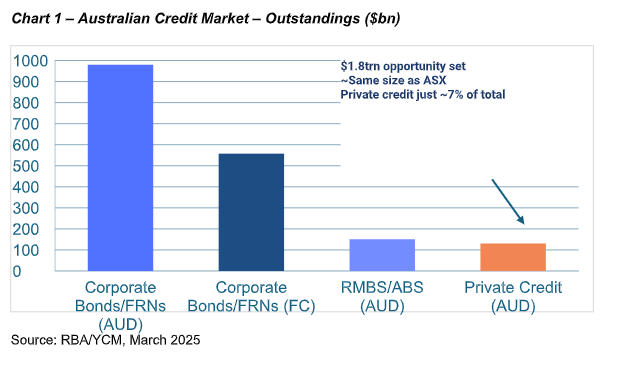

Firstly, the opportunity set available in Australian multisector credit is large and valued at around $1.8 trillion – comparable to the total market capitalisation of the ASX 200.

In addition, the investment-grade space in Australia is more stable and transparent. Unlike some international markets, where complexity in products like collateralised loan obligations (CLOs) have proliferated, Australia’s approach generally remains more focused on high-quality issuers. On offer is a solid base of high-quality, investment-grade issuers, and although the domestic corporate bond market is naturally smaller than the US and Europe, it’s dominated by large, financially stable entities with predictable cash flows.

This quality focus is but one more reason Australian multisector credit is an appealing option for investors seeking defensive returns through market cycles.

Private credit: A ‘bit player’ in a diversified credit portfolio

While investment-grade credit offers stability, the same cannot be said for all corners of the credit market. Private credit (i.e. non-investment grade), which constitutes just 7 per cent of the multisector Australian credit universe (refer to chart), is in the midst of a cycle shift and there are now clear signs of stress emerging. The rapid expansion of private debt over the past three to four years has led to lower reward and increased impairment risk, particularly as higher-for-longer interest rates begin to bite. The lack of transparency, in particular with valuations in this segment, only compounds investor uncertainty, making it difficult to assess underlying risks.

Furthermore, liquidity mismatches – where funds offer monthly redemptions despite holding illiquid assets – are becoming a growing concern. As investors reassess their asset allocations, private credit’s role must be carefully weighed against the potential for credit losses and other constraints such as limited exit options.

Australian multisector credit: A stable haven amid global uncertainty

Far from the stresses showing elsewhere in the market, investment-grade credit occupies an entirely different risk-return profile. In the current higher for longer rates environment, Australian multisector credit offers investors an optimal environment to maximise risk adjusted returns across a very large opportunity set. In 2025, investors retain the ability to earn average equity-like returns from IG quality multisector credit portfolios without the volatility associated with equities or the default risk associated with large sections of the private credit market. For investors looking to derisk their portfolios while still capturing higher yields, look no further than Australian multisector credit.

Phil Strano, senior investment manager, Yarra Capital Management