The number of LICs and listed investment trusts (LITs) on ASX has risen in the past year, with 113 products listed as at the end of March 2019, up from 107 a year earlier. The market capitalisation of the sector jumped 11.6 per cent to $42.3 billion.

LICs are often compared to Exchange Traded Funds (ETFs). They both offer a good opportunity to buy a diversified portfolio of assets. But LICs are different investment vehicles with different risks, including ‘NAV risk’. The NAV is the ‘Net Asset Value’ per share of the underlying portfolio. You want the share price of your investment to be as close as possible to NAV. The risk that it goes below that can negatively impact an investor’s returns. Investors in an LIC have more exposure to NAV risk than investors in an ETF.

There are three reasons for this:

- An LIC is closed-ended;

- An ETF has a market maker; and

- Passive ETFs are fully transparent, publishing their holdings daily.

LICs are closed-ended

A closed-end fund issues a fixed number of shares. Just like a listed company, an LIC’s fixed number of shares is determined via its initial public offering (IPO). After the IPO a LIC trades just like normal shares with market demand determining its share price. Increased demand means the share price goes up and the rise may be independent of the value of the LIC’s underlying investments. Most LICs therefore usually trade at a premium or discount to the value of their portfolio. The difference between the LIC’s share price and its underlying value can impact an investor’s returns. This is NAV risk.

When an LIC trades at a 20 per cent discount, investors in theory are buying $1 of assets for 80 cents. A discounted LIC share price has been perceived as a good thing for a prospective investor. Unfortunately it is not that simple.

Sometimes an LIC trades at a discount for good reason. Some LICs trade at big discounts because they have poor underlying performance, or the market has concerns about the manager. The LIC may have a patchy dividend record or it invests in an out-of-favour sector.

Low liquidity in LICs is another factor that increases NAV risk. As with other thinly traded stocks, lack of regular buying and selling creates pricing anomalies. You do not want to be holding a discounted LIC nobody wants to buy.

Poor investor relations programs from smaller LICs, usually because of their tight cost structures, can also hinder their share turnover.

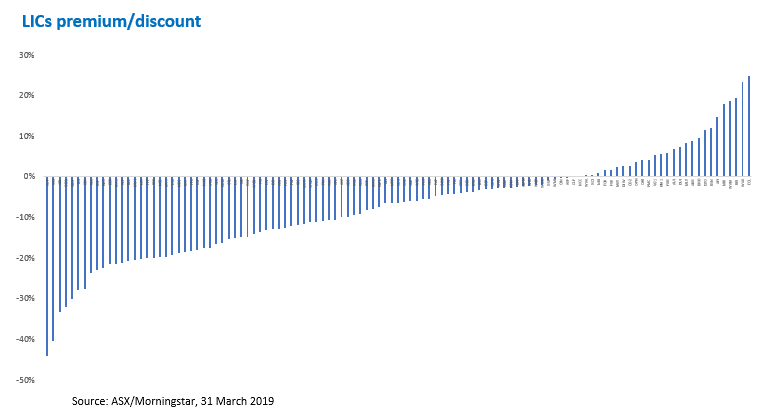

Some LICs trade at a big discount, a phenomenon that has been common on the ASX in recent times, with most LICs trading at discounts, as the chart below shows.

ETFs, on the other hand, are open-ended, meaning the fund manager can create (or redeem) units in the fund to match demand. This is one of the reasons ETFs’ prices remain close to the fair value of the underlying investments. The other reason is the involvement of a Market Maker.

Market Makers’ key role

Market Makers make markets by matching buy and sell orders for investors that want to trade on ASX. This means, as an investor, you are not dependent on there being other investors wanting to sell when you want to buy or other investors wanting to buy when you want to sell. The Market Maker will trade with you.

Market Makers stand in the market during ASX trading hours offering to buy or sell at prices either side of the NAV of the ETF shares. The ‘spread’, also called the “buy/sell spread” is to reward them for the service they are providing.

Market Makers can calculate the true NAV of an ETF because the ETF publishes its full portfolio holdings daily. During ASX trading hours an ‘indicative NAV’ or ‘iNAV’ is updated every 30 seconds. The iNAV allows investors to track the fair value of an ETF’s shares during the trading day.

This is good for investors. ETF investors can buy when they want and sell when they need, at a price very close to the true value of the portfolio of securities the ETF holds, avoiding significant premiums and discounts no matter the market conditions.

LICs, on the other hand, do not have Market Makers. They rely on random buyers and sellers for liquidity. If you want to sell your LIC you are dependent on there being another buyer who wants to buy it at the price you are offering.

As the ASX chart above shows, for many LICs there are no such buyers. Instead investors are being forced to sell at significant discounts to the NAV.

Transparency

The other issue with LICs is transparency. ETFs are fully transparent and the Market Marker can independently value the ETF. This is not the case with LICs. Buyers and sellers can’t see the underlying portfolio because a LIC, unlike an ETF, is not required to publish its holdings daily, making them difficult to value during the trading day. This lack of transparency increases the NAV risk of an LIC. The accurate pricing of an ETF with its transparency is something that an LIC can’t offer.

Arian Neiron, VanEck managing director Australia and head of Asia-Pacific