The existence of the value premium (ie, the greater long-term return of value over growth stocks) in equity markets is a long established academic conclusion.

A library could be filled with papers detailing the extent and breadth of the value premium across most world markets, in both large and small companies.

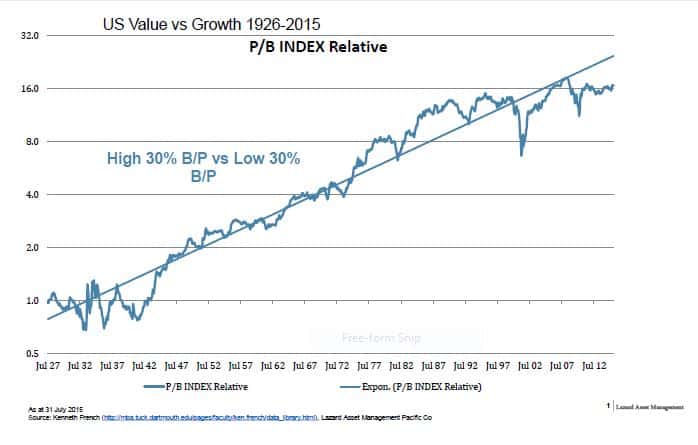

Practical observation supports the academics. US equity market data shows that historically, over the long term, buying companies based on cheap valuations has indeed led to better returns.

Since 1927, the cumulative returns of the lowest 30 per cent price/book (P/B) US stocks (a common measure to assess the cheapest stocks) have been 16 times higher than those with the highest valuations (see Graph 1).

Graph 1 – Over the long run, cheap valuations can deliver better returns

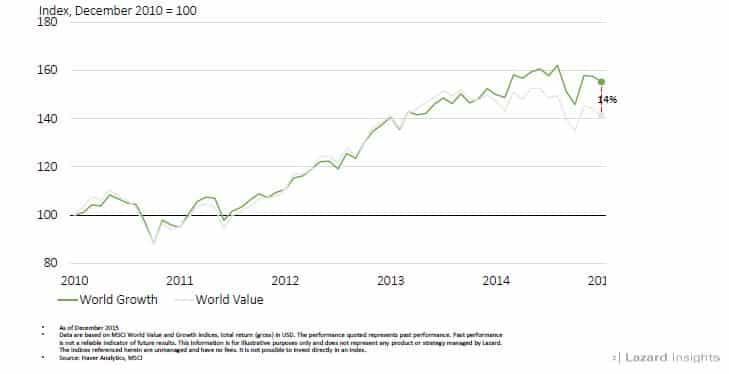

However, value has now underperformed growth for nearly a decade.

During this extended economic cycle, investors have favoured quality, growth, and low volatility stocks, which has driven strong performance from momentum strategies.

Compared to history, the duration of the recent underperformance of value is stunning and it certainly speaks to the difficulty of market timing, with few investors conceiving that the underperformance of value could go on for so long.

This underperformance is clearly evident when comparing the cumulative five-year returns of value and growth indices (see Graph 2).

Graph 2 – Globally, growth has recently outpaced value

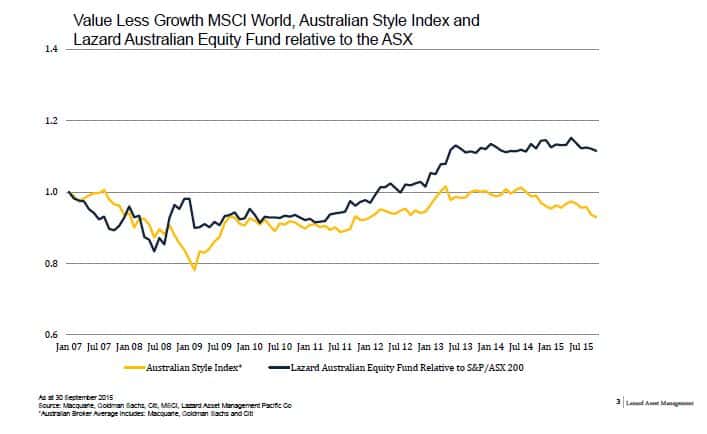

This five-year period has also highlighted the importance of active management. Not all active ‘value’ managers have underperformed over this period.

The underperformance of mechanical value factors has strengthened our belief that active portfolios can offer better investment outcomes both over the long and medium term than single factor “smart beta” portfolios.

This is supported by our own performance during this challenging ‘value’ period, with the Lazard Australian Equity Fund outperforming the S&P/ASX 200 Index and dramatically outperforming value indices (see Graph 3).

Graph 3 – ‘Passive’ value vs ‘Lazard’ value

While mean reversion often prevails, at times companies and sectors undergo structural changes with permanent consequences for levels of profitability, and it is in those cases that fundamental analysis and active management is essential.

The key for an active manager is avoiding the value traps that can destroy performance and also being diversified so the portfolio is not over exposed to one sector or industry bet.

This helps investors to “ride out the storm” relying on other parts of their investment process to add value until the value/growth cycle turns, once again, providing an opportunity to reward investors who choose to focus on intrinsic long-term valuations.

Bouncing back

The good news is that long-term data shows that historically, the best time for the value approach has been after a period of underperformance. This data accords with our local experience.

The best periods for our style of disciplined value investing were in the years following poor value returns. In the recession year of 1990, the market sold down cyclical stocks to very low levels, which led to a long period of high value returns during the recovery.

From 1998 to March 2000, the market inflated the prices of tech stocks and sold down so-called “old economy” stocks to low levels, setting up dramatic outperformance for valuation-driven investors over the next four to five years.

While the timing of the resurgence of the value premium is difficult to forecast, in the end, we believe valuations always matter and will once again be relevant during this cycle.

In our view we are well positioned to take advantage of the low valuations in specific companies, as we expect that the global and local underperformance of value will end, as all other such episodes have ended in the past. We look forward to the market returning its focus on the fact that what one pays in price ultimately determines what one should receive in return.

Those investors who have found that having exposure to value stocks was a headwind to their ability to achieve strong and consistent alpha may ultimately find that headwind turning into a tailwind.

Dr Philipp Hofflin is a portfolio manager/analyst in the Lazard Asset Management Australian equity team.